[ad_1]

Whereas the latest Bitcoin and crypto momentum is cooling off, Ethereum (ETH) rejects decrease lows, particularly towards Bitcoin (BTC). Taking to X on December 8, decentralized finance (DeFi) researcher DefiIgnas shared insights that counsel ETH might be on the verge of a rally that might probably see the second most dear coin usurp BTC’s present place because the best-performing asset.

Causes That May Drive Ethereum Bulls

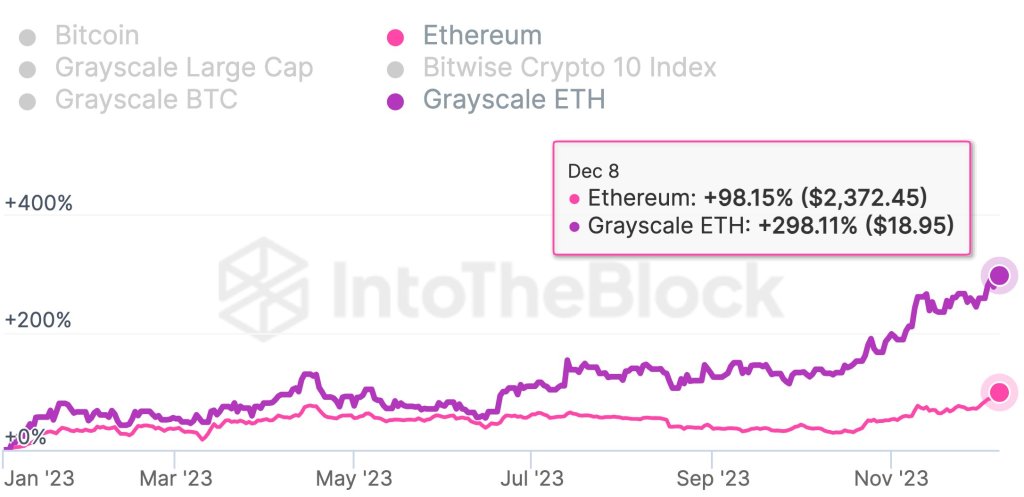

The researcher noticed that ETH is down 24% versus BTC in 2023. Nonetheless, a number of elementary indicators present that that is about to vary. First, DefiIgnas famous that crypto traders are more and more drawn to discounted Grayscale Ethereum Belief (GETH), which has been rallying over the previous few months, outperforming Ethereum spot costs.

GETH surged by 298% up to now few months, whereas ETH solely rose by round 100% in the identical interval. As GETH share costs elevated, its low cost with spot ETH decreased. This implies extra capital not directly flowed into ETH, resulting in larger demand.

Moreover GETH rising, the researcher stays bullish on Ethereum due to the latest developments surrounding the approval of the primary spot Bitcoin ETF. The crypto group expects the Securities and Alternate Fee (SEC) to authorize a number of merchandise, together with these proposed by Constancy and BlackRock.

In DefiIgnas’ evaluation, as soon as the spot Bitcoin ETF goes stay, possible in early 2024, all “consideration, narrative, and hypothesis” will shift towards the company approving the primary spot Ethereum ETF. BlackRock, the world’s largest asset supervisor, has already utilized with the SEC to situation the primary spot Ethereum ETF.

The anticipated activation of the Cancun improve in H1 2024 may also possible assist Ethereum costs. Over time, Ethereum has built-in a number of upgrades. This consists of shifting to proof-of-stake (PoS) from proof-of-work (PoW) and overhauling their payment public sale mechanism, introducing ETH burning.

Nonetheless, with Cancun, the aim is to straight improve the primary internet’s capabilities by activating a number of proposals, together with EIP-4844 proto-dank sharding, which goals to cut back fuel charges related to rollups. This replace will additional cement Ethereum’s quest to considerably improve on-chain scalability and scale back fuel charges through the years.

ETH Appears to be like Agency, Resistance At November Highs

At spot charges, ETH is agency versus BTC, wanting on the candlestick association within the day by day chart. How costs react within the days forward stays to be seen.

Even so, if there’s affirmation of the December 7 features, ETH may lengthen features. In that case, it might probably break above the present consolidation as bulls goal to interrupt above November 2023 highs of round 0.058 BTC.

Characteristic picture from Canva, chart from TradingView

[ad_2]

Source link