[ad_1]

The beneath is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Bitcoin has seen a slight reversal in its ongoing rally over the past months of 2023. This value fluctuation could nonetheless recommend an upcoming bull market because the asset finds new backers.

All through its whole historical past, Bitcoin has been a wildly fluctuating asset. Within the nearly 15 years for the reason that Genesis Block was mined, its biggest valuations have at all times come because of dramatic spikes, and the comedown from these highs has at all times been about as steep. However, it has at all times proven an uncanny tendency to finish up in a greater scenario after the mud settles. This unstable nature has even been taken as a constructive in lots of features, because it reinforces a central fact for Bitcoin: It’s in the end a forex, with a brand new imaginative and prescient for the way financial relationships ought to function in society. Bitcoin has gained an ideal deal from those that want to deal with it as a pure funding asset, however these individuals can’t kind the center of the neighborhood.

All that is to say, Bitcoin costs fell on December 11 after an prolonged bull market that lasted a number of months. Typically spurred on by the constructive buzz round a Bitcoin ETF profitable federal regulatory approval, the value continued to rise regardless of setbacks just like the change of CEO at Binance, the business’s largest alternate. Regardless of the looks that this new rally might stand up to shocks that may have been important even a 12 months prior, its invincibility couldn’t final as the value dropped almost 6% from midnight Sunday to the time of this writing. As the value hovers across the $41,000 vary, a noteworthy growth is the obvious lack of worry from all corners of the Bitcoin world.

Bitcoin Journal Professional is a reader-supported publication. To obtain new posts and help our work, contemplate changing into a free or paid subscriber.

Though it could appear pretty commonplace for probably the most die-hard Bitcoiners to view all value declines as a “wholesome correction” or a cooldown for an “overheated” market, much more conventional monetary media retailers like Barron’s have claimed that “the tea leaves in crypto derivatives nonetheless level to bullish animal spirits.” Talking primarily a few collection of potential catalysts, the esteemed weekly circulation appeared to level solely to causes that this setback is minor. Specifically, it quoted FxPro analyst Alex Kuptsikevich in stating: “A wave of profit-taking hit the cryptocurrency market on Monday morning…we noticed a large exit from lengthy positions in low liquidity… Robust demand for danger property in conventional markets means that the market will attempt to get again on its earlier progress observe.”

These lengthy positions specifically are on the crux of the current downturn. After months of success, oblique traders confirmed a selected curiosity in dangerous bets the place Bitcoin was involved: These traders had a higher abdomen for beginning futures contracts at closely leveraged positions. Though bets like this might be simpler to arrange and earn cash with out increased startup capital, they’d be liquidated routinely if bitcoin had been to fall immediately. A sudden drop in value was rapidly in a position to erase some $330 million in these bets, a determine that ballooned to $500 million the following day. These leveraged positions appear as of but to be the largest casualties from the value drop.

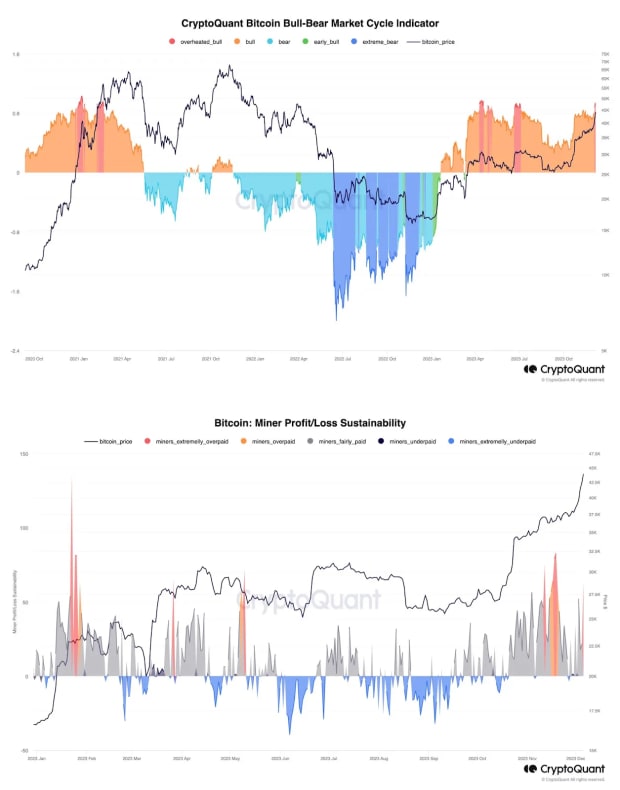

In different phrases, as analysts have been fast to level out, the market was simply too scorching. A collection of figures add weight to the declare that Bitcoin’s success has inspired these dangerous bets: Not solely was the bull market coming into traditionally unstable charges for the primary time since earlier than the bull market, however different components like mining problem function canary within the coal mine. With the following halving changing into more and more imminent, miners are in no place to anticipate a continued situation the place mining rewards enhance quicker than mining problem. However that’s precisely the situation that’s been taking part in out.

So, though some specialists have claimed that this cooling interval could proceed to persist so long as one month or longer, the overwhelming consensus is that the value of bitcoin will come again as arduous as ever within the very close to future. However why is that this? Positive, a tiny setback for bitcoin doesn’t appear to harm anyone however the overleveraged futures merchants, however what can justify the actual perception that, as CNBC put it, “there’s loads of momentum left within the present bitcoin uptrend?” The reply comes from the identical factor that created this momentum: an actual perception within the Spot Bitcoin ETF.

Final week’s rumors that the main ETF candidates had been nearing a breakthrough of their negotiations with the SEC have become new negotiations: BlackRock specifically has prolonged a brand new invitation for the most important banks on Wall Avenue to get in on the motion. BlackRock requested a change within the ETF protocol from their proposals, permitting sure approved contributors to make use of money as an alternative of bitcoin to speculate. Contemplating that some giant banks are prohibited from straight holding Bitcoin or different digital property, this variation straight opens the door for a number of the largest gamers within the business. A proposal like this appears to additional recommend that BlackRock’s talks with the SEC have stabilized to a brand new diploma.

Moreover, Google has additionally up to date its commercial insurance policies, quietly making adjustments to a platform that has traditionally had an ideal skepticism in direction of Bitcoin-related merchandise. With sure caveats, Google will now allow the commercial of “Cryptocurrency Coin Trusts” to customers in the US, particularly claiming that monetary property representing precise digital forex are truthful sport. On high of this, Google has even loosened its enforcement technique for violations of this sort, turning quick suspension right into a 7-day warning. Modifications like this absolutely appear to recommend that the search engine large can be anticipating a forthcoming approval.

This setback, in different phrases, is only a pure half within the life cycle of Bitcoin, and bitcoiners recognize that. Generally, the forex’s runaway success attracts newcomers that don’t absolutely perceive that bitcoin’s volatility cuts each methods. Merchants noticed overleveraged positions as an inexpensive option to doubtlessly win giant sums of money from bitcon’s value rally, and now a short lived setback has prompted a whole bunch of tens of millions to evaporate. However that is nothing new. Downturn phases like this hold the market from rising too unsustainably for too lengthy, and make sure that anybody who’s fascinated with Bitcoin for very lengthy will recognize greater than a fast likelihood for revenue. Bitcoin’s capability for meteoric rise is what brings individuals into the fold, and meteoric declines are what mood their expectations. Via all of those strikes, Bitcoin solely grows in power.

[ad_2]

Source link