[ad_1]

Bitcoin (BTC), the biggest cryptocurrency available in the market, has skilled a pointy drop beneath the $41,000 mark as exchange-traded funds (ETFs) for Bitcoin went reside on January 12.

The next profit-taking, promoting stress, and outflows from Grayscale’s Bitcoin Belief ETF (GBTC) performed a major position within the downward development.

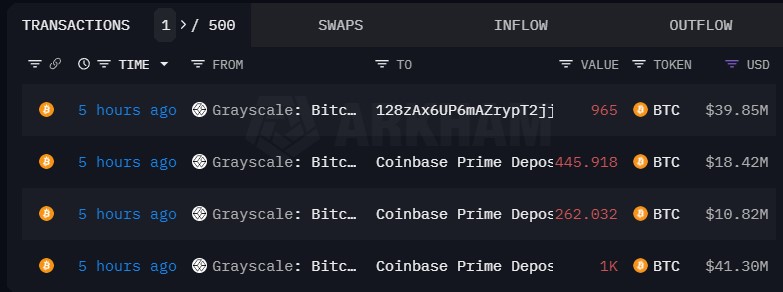

Grayscale’s Bitcoin Transfers To Coinbase Intensify

On Tuesday, NewsBTC reported that six days in the past, Grayscale initiated the primary batch of BTC outflows from their holdings to a Coinbase, totaling 4,000 BTC (roughly $183 million) over six days.

Nevertheless, the asset supervisor resumed outflows from the Belief to the alternate on Tuesday, sending an extra 11,700 BTC (equal to $491.4 million) to Coinbase.

Moreover, on Friday, knowledge from Arkham Intelligence revealed that 12,865 BTC ($529 million) have been transferred from the Grayscale Belief deal with to Coinbase Prime.

In whole, the Grayscale Belief deal with has transferred 54,343 BTC ($2.313 billion) to Coinbase Prime through the opening hours of the US inventory market over 5 consecutive buying and selling days since January 12, which has undoubtedly contributed to the downtrend in Bitcoin’s worth.

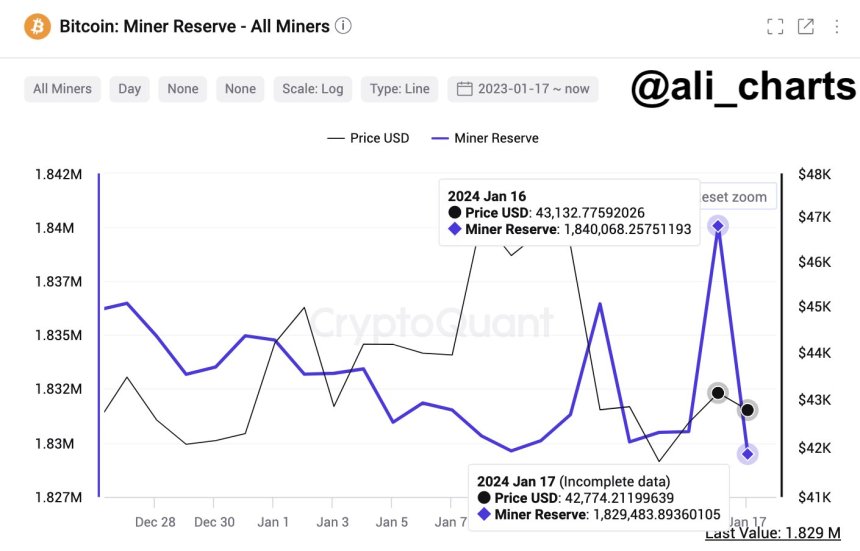

Promoting Frenzy Amongst BTC Miners

Along with Grayscale’s promoting spree, there was elevated promoting exercise by Bitcoin miners forward of the upcoming Bitcoin halving.

Crypto analyst Ali Martinez highlights that on-chain knowledge from CryptoQuant signifies a considerable enhance in promoting exercise by BTC miners. Up to now 24 hours, miners offloaded practically 10,600 BTC, with a worth of roughly $455.8 million.

The persistent promoting stress has brought about BTC to commerce at $40,900, reflecting a slight 0.2% lower over the previous 24 hours.

The downtrend has been evident throughout numerous time frames, with declines of 5%, 6%, and seven% over the seven, fourteen, and thirty-day durations, respectively. Nevertheless, regardless of these latest setbacks, Bitcoin stays remarkably constructive year-to-date, with a formidable 98% achieve.

Total, the mixed influence of Grayscale’s Bitcoin Belief ETF outflows and elevated promoting exercise by miners has intensified the downward stress on Bitcoin’s worth, breaching the crucial assist stage of $41,000.

The main target now turns to how Bitcoin bulls will defend the essential $40,000 assist stage, which stands because the final line of protection earlier than a possible dip towards the $37,700 mark.

Ought to this assist stage fail to carry, the Bitcoin market might witness additional worth declines, doubtlessly pushing the worth right down to the $35,800 mark. Nevertheless, with the Bitcoin halving scheduled for April, bullish traders are hopeful that this occasion will catalyze a major bull run.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site solely at your personal threat.

[ad_2]

Source link