[ad_1]

Fast Take

Bitcoin closed March on a robust word, attaining its highest month-to-month and quarterly closing costs above $70,000. The main digital asset by market cap has skilled important progress in 2024, with a year-to-date rally of over 57%, pushed by growing institutional adoption and investor curiosity.

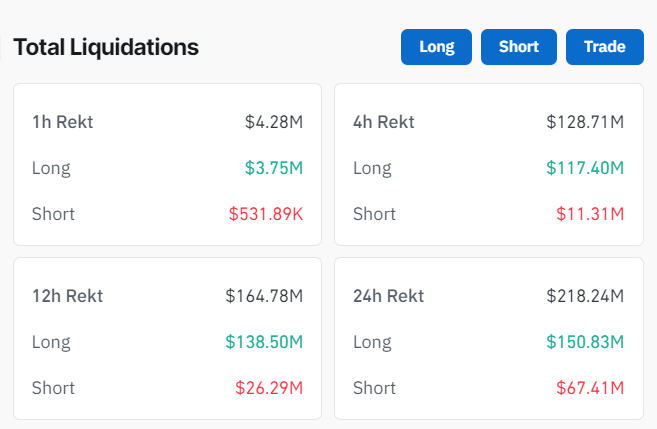

Nevertheless, the brand new quarter began with a sudden downturn as Bitcoin fell to $69,000 on Apr. 1, leading to over $218 million in liquidations throughout the digital asset market up to now 24 hours, as reported by Coinglass.

In accordance with Coinglass knowledge, out of the $218 million liquidated, $151 million was attributed to lengthy positions being worn out, whereas the remainder stemmed from quick positions being liquidated. Liquidations occur when an trade closes a dealer’s leveraged place attributable to both partial or complete lack of the dealer’s preliminary margin.

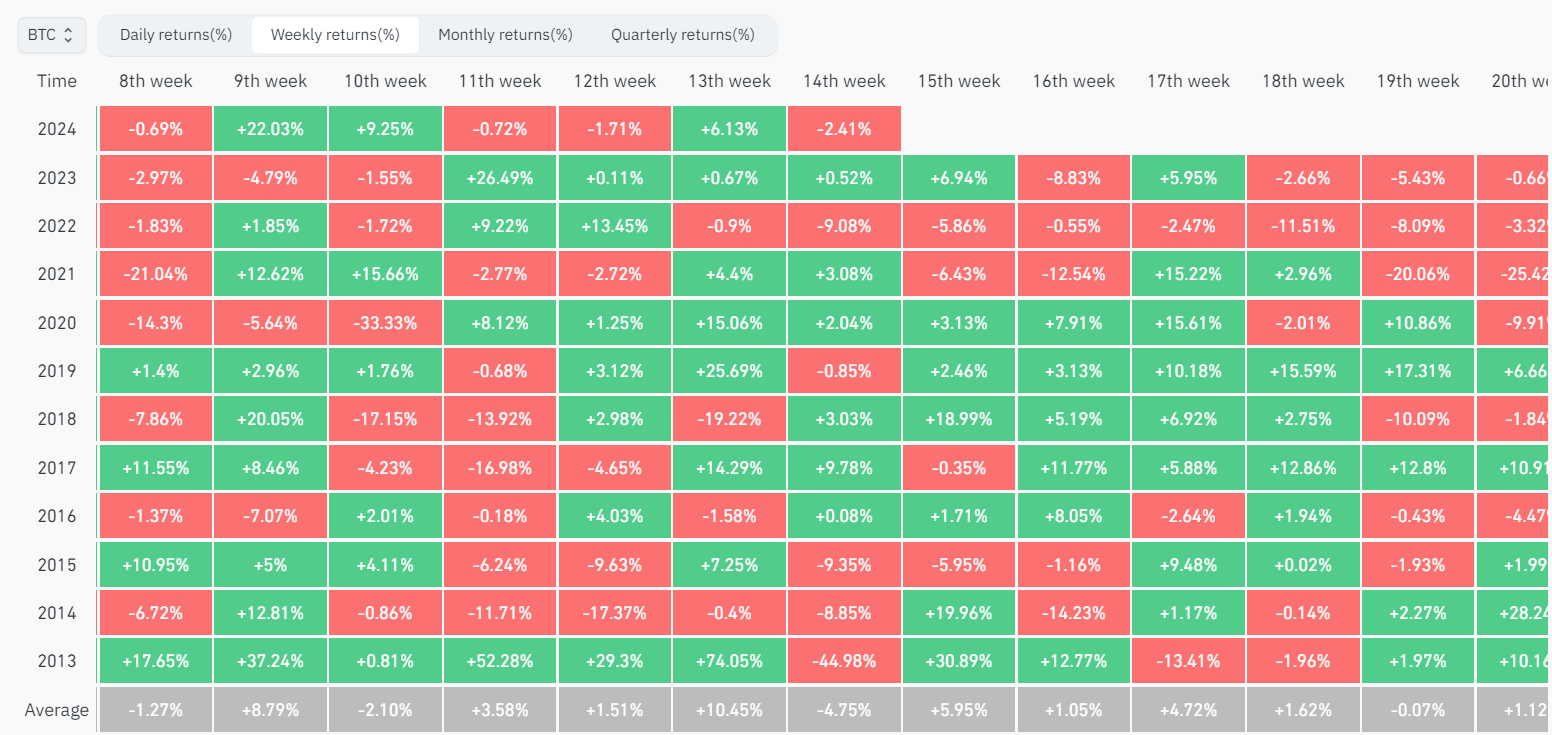

Coinglass knowledge exhibits that Bitcoin is presently down solely 2.4% up to now within the 14th week of 2024. Nevertheless, traditionally, this week has been the worst performing for Bitcoin in comparison with some other week on the calendar. Knowledge exhibits that since 2013, Bitcoin has averaged a 4.75% loss throughout the 14th week, making it constantly the least favorable week of the yr for the benchmark digital asset. The vast majority of these unfavorable returns had been concentrated within the years 2013-2015.

The publish Historic knowledge reveals April’s first week as Bitcoin’s Achilles’ heel appeared first on CryptoSlate.

[ad_2]

Source link