[ad_1]

Ethereum is beneath strain and has simply dropped under $1,600. Nonetheless, on-chain information reveals {that a} crypto whale, “0xb154”, has moved extra cash from Binance, a cryptocurrency alternate, to a non-custodial pockets.

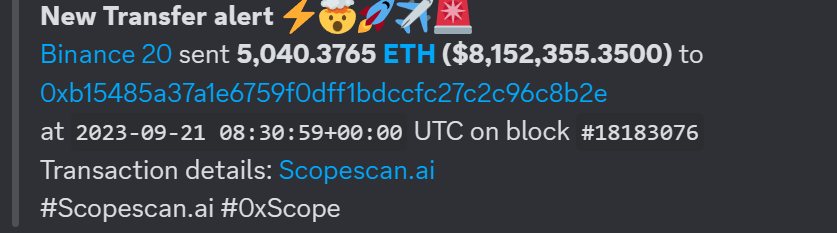

On September 21, the ETH whale transferred over $8.1 million of the coin.

Whale Strikes Extra Ethereum From Binance, Shopping for NFTs

When crypto costs contract, outflows from non-custodial wallets to centralized ramps, together with Binance and Coinbase, are likely to rise. It is because centralized exchanges supporting stablecoins or fiat, together with the Euro or JPY, supply an interface the place they will simply swap for the “security” of the much less unstable fiat currencies or tokens designed to reflect them, together with USDT.

That the holder is shifting tokens away from Binance whatever the heightened volatility can sign confidence for ETH and the broader Ethereum ecosystem. It isn’t instantly clear what might have motivated the whale to maneuver cash away from the alternate at this level.

Nonetheless, what’s evident is that ETH is down roughly 4% from September 21’s peak and shifting additional away from April 2023 highs when it rose to over $2,100.

Information present this isn’t the primary time the whale moved funds. On September 6, the investor withdrew 9,688 ETH value $15.8 million from Binance. Lower than two weeks earlier, the whale notably transferred 22,340 ETH, value $41.2 million, to Binance.

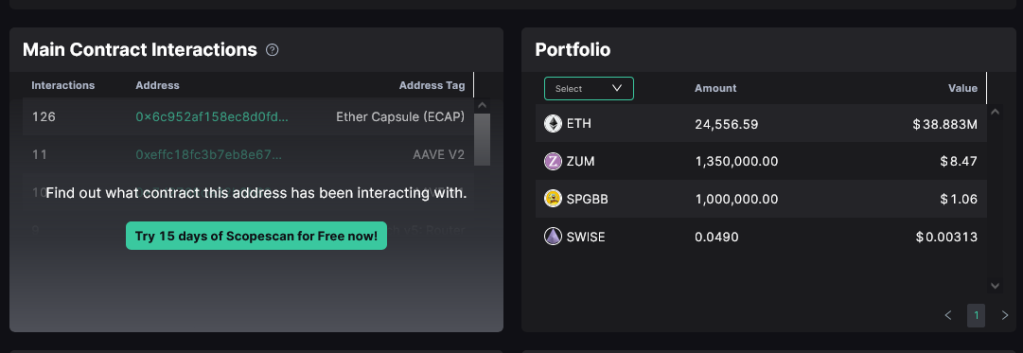

A more in-depth examination of the identical handle reveals it has 24,556.59 ETH value over $38.8 million at spot charges. Apart from ETH, the handle controls mud quantities of different periphery altcoins, together with ZUM and SWISE.

Aside from merely HODLing ETH, the whale has additionally been lively on the non-fungible token (NFT) scene, historic purchases. Over time, the investor has held over 100 NFTs the place, on common, spent 0.2641 ETH; the most recent buy was on September 21.

The investor has been actively accumulating NFTs since early April 2023 and has spent over 35 ETH.

ETH And NFTs Are Fragile

The whale has collected extra ETH and NFTs when the crypto market is fragile. For instance, NFT buying and selling quantity is over 90% down from 2021 peaks.

Presently, ETH costs are down 25% from April 2023 peaks. When writing, bears have efficiently compelled the coin under June 2023 lows because the coin strikes additional away from the psychological $2,000 degree. Candlestick association factors to weak spot, suggesting that ETH might dump even decrease to $1,400—or March 2023 lows, if sellers press on.

Characteristic picture from Canva, chart from TradingView

[ad_2]

Source link