[ad_1]

Digital asset administration large Grayscale’s institutional crypto merchandise are hovering sky-high as spot markets proceed a significant bounce again.

Grayscale primarily gives institutional buyers with trusts that purpose to present publicity to digital property in a compliant, easier means than holding them immediately.

The value of the trusts doesn’t immediately monitor the value of the property, creating reductions and premiums relying on demand.

Amid a return in institutional curiosity, Grayscale’s merchandise have exploded, inflicting large premiums between the value of the trusts and the spot market.

At time of writing, Coinglass information exhibits Grayscale’s Chainlink Belief (GLINK) is buying and selling at $49, a 250% premium in comparison with the spot value of LINK.

The agency’s Solana Belief (GSOL) is priced at $202, an 869% premium on the value of SOL, whereas its Filecoin (FIL) product is buying and selling at a 901% premium and its Decentraland (MANA) product is at a 308% premium.

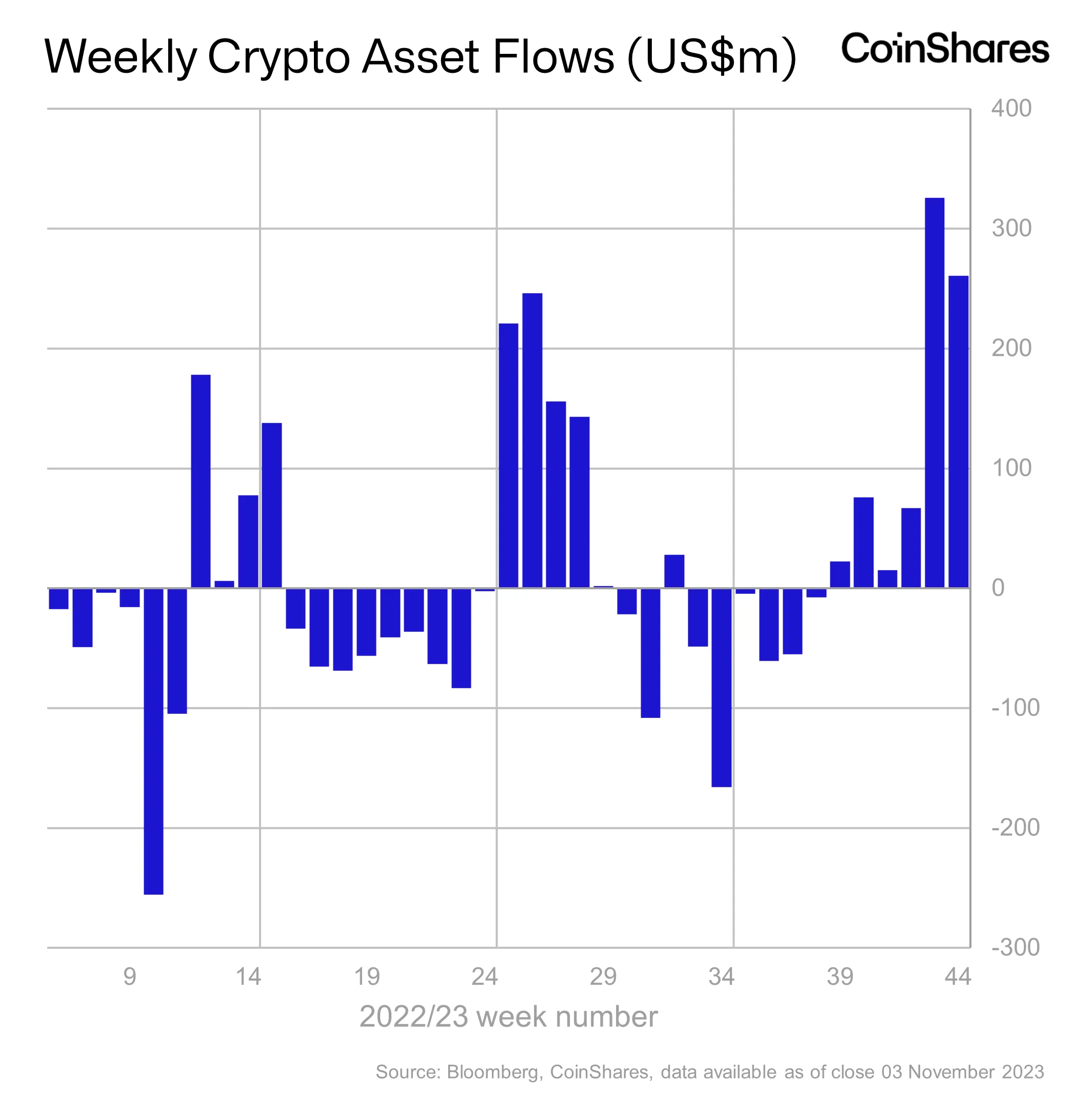

The massive premiums on Grayscale’s merchandise come following a number of constructive stories from Coinshares that counsel institutional demand for crypto property is choosing again as much as ranges that have been final seen within the bull market of 2021.

In its newest Digital Asset Fund Flows report, CoinShares discovered that institutional buyers are persevering with to allocate to crypto because the asset class enjoys its sixth consecutive week of institutional inflows.

“Digital asset funding merchandise noticed inflows totaling US $261 million, representing the sixth week of consecutive inflows that now totals US $767 million, surpassing the whole inflows of US $736 million seen in 2022. This run of inflows now matches the July 2023 run of inflows and is the most important because the finish of the bull market in December 2021.”

Verify Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Verify Newest Information Headlines

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses you might incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/IM_VISUALS

[ad_2]

Source link