[ad_1]

Amidst a renewed wave of optimism sweeping via the broader cryptocurrency panorama, the resurgence of Bitcoin (BTC) to the pivotal $37,500 value threshold has change into a catalyst for constructive shifts.

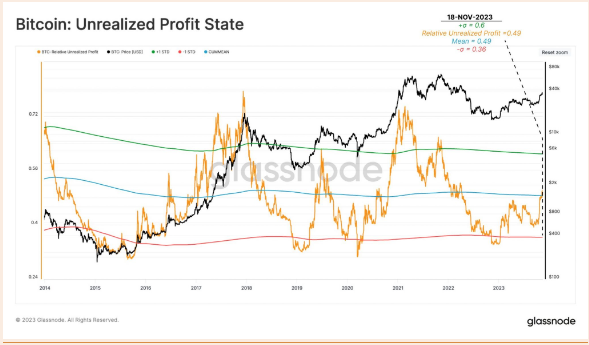

At current, a staggering 85% of Bitcoin holders discover themselves in a worthwhile place, a testomony to the resilience and potential of the main cryptocurrency. Encouragingly, key indicators trace on the chance of this proportion increasing in tandem with Bitcoin’s upward trajectory.

Making Cash With Bitcoin

Because the market plummeted from its all-time excessive in November 2021, the quantity of Bitcoin provide in revenue has reportedly hit ranges final noticed two years in the past, in response to Glassnode.

The analytics service additionally said that the quantity of unrealized revenue contained in these currencies continues to be very small.

Based mostly on the most recent figures from blockchain analytics web site IntoTheBlock, some 85% of Bitcoin holders are worthwhile on the present value of the primary cryptocurrency, 11% are shedding cash, and 5% are simply breaking even.

With #Bitcoin buying and selling at yearly highs above $37k final week, over 83% of the coin provide was pushed again into worthwhile territory.

Nevertheless, the magnitude of unrealized revenue stays modest, and isn’t but ample for long-term buyers to divest.https://t.co/IGJpglF20J

— glassnode (@glassnode) November 22, 2023

In response to the information supplied by Glassnode, it’s seen that the present circulating provide of BTC, standing at 83%, has exceeded historic norms. Furthermore, it’s approaching the higher threshold of +1 commonplace deviation, which is at 90%.

Bitcoin reached its peak for the 12 months, surging to $37,900 on November 16, signaling a major milestone in its efficiency. Nonetheless, a subsequent pullback has ensued, with the cryptocurrency retracing 4% from its latest excessive.

Bitcoin inches nearer to the $38K territory. Chart: TradingView.com

This retracement aligns with the continued market cooling, emphasizing the dynamic and responsive nature of cryptocurrency markets to prevailing circumstances.

Strong Accumulation Tendencies For Bitcoin

In response to the most recent statistics on November 23, Bitcoin was noticed to be traded at a value of 37,500. This worth signifies a 2.30% enhance inside the final 24 hours, a 0.39% acquire over the previous seven days, and a 9.93% development over the earlier month.

Glassnode said that this latest enhance has seen stronger accumulation patterns than others this 12 months, primarily based on an Accumulation Pattern Rating. Costs skilled two notable will increase in late January and late March, with will increase of 40% and 50%, respectively.

Supply: Glassnode

Supply: Glassnode

Glassnode’s analysis signifies that the present enhance in Bitcoin’s profitability has not incentivized its long-term holders to promote their holdings so as to notice beneficial properties.

A complete analysis of BTC’s Unrealized Revenue (see chart above) signifies that it continues to persist on the historic common degree of almost 50%.

The report characterizes this degree as notably decrease compared to the exceedingly excessive ranges of 60% or extra noticed in the course of the euphoric interval of earlier bull markets.

When mixed with extra encouraging components just like the hope for the approval of a possible spot exchange-traded fund (ETF) and the upcoming halving occasion, the aforementioned knowledge is certainly favorable for the flagship decentralized finance (DeFi) asset.

Featured picture from Freepik

[ad_2]

Source link