[ad_1]

Knowledge exhibits over $333 million cryptocurrency futures shorts have discovered liquidation previously day after Bitcoin registered a plunge in the direction of $42,000.

Cryptocurrency Market Sees Lengthy Squeeze Following Bitcoin Plunge

Bitcoin and the cryptocurrency sector as an entire have gone by means of some sharp volatility previously day and as is normally the case, this volatility has accompanied with it some shakeup for the futures facet of the market.

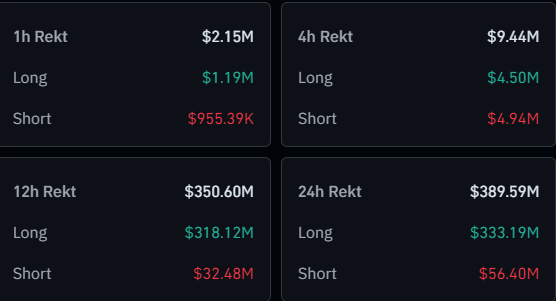

As information from CoinGlass under exhibits, the sector has noticed over $389 million in whole liquidations over the previous 24 hours.

The info for the cryptocurrency futures liquidations during the last day | Supply: CoinGlass

“Liquidation” right here naturally refers back to the pressured closure that any contract undergoes after it amasses losses of a particular diploma (the precise worth of which can be depending on the spinoff platform it’s open with).

The volatility inside this era has been in the direction of the draw back, with Bitcoin initially observing a drop to as little as $40,600 earlier than bouncing again to the present $42,000 ranges, so it’s not stunning that longs have taken the brunt of this liquidation squeeze.

The volatility that Bitcoin has noticed through the previous day | Supply: BTCUSD on TradingView

These bullish buyers have seen contracts price $333 million flushed down the drain on this mass liquidation occasion, which means that they’ve been accountable for greater than 85% of the full market liquidations.

Earlier within the month, the shorts had been those who took the beating, because the Bitcoin worth had quickly rallied up, however with this plunge, the dynamic has reversed, with the bears rising victorious.

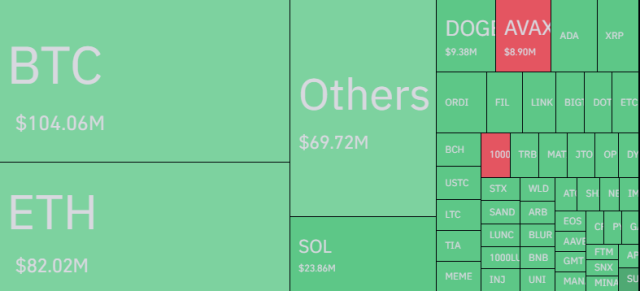

By way of particular person contributions in the direction of this liquidation squeeze by the assorted symbols, BTC unsurprisingly had the biggest share, because the under desk shows.

The breakdown of in the present day’s liquidations by way of the symbols | Supply: CoinGlass

Curiously, Ethereum noticed $82 million in liquidations, which isn’t removed from Bitcoin’s $104 million. Often, the hole is far bigger, as BTC observes extra curiosity from the merchants.

ETH registering such excessive liquidations this time round could also be a results of the truth that it has seen some uptrend lately, in a interval the place BTC had been consolidating sideways. This is able to have made speculators shift focus in the direction of the quantity two cryptocurrency as a substitute.

Binance & OKX Whales Misplaced In This Squeeze, Whereas BitMEX Whales Confirmed Sensible Conduct

An analyst has shared an attention-grabbing truth about this newest futures liquidation occasion in a CryptoQuant Quicktake submit and it’s that the BitMEX whales have behaved in a different way from these on Binance and OKX.

The pattern within the Bitcoin open curiosity on varied exchanges | Supply: CryptoQuant

Round when Bitcoin had damaged by means of the $44,000 barrier, the BitMEX whales had closed up their lengthy positions, one thing that’s mirrored within the Open Curiosity information of the change. The “Open Curiosity” right here refers back to the whole quantity of positions (each lengthy and quick) presently open on the platform.

Not like these good whales, those on Binance and OKX continued to carry their positions, and so, when this newest Bitcoin plunge occurred, they bought struck with liquidation, because the quant has highlighted within the chart.

Featured picture from Shutterstock.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link