[ad_1]

Cosmo Jiang, a portfolio supervisor at digital assets-focused hedge fund Pantera Capital, is highlighting one crypto undertaking that would witness an explosion in exercise this 12 months.

Stacks (STX) goals to allow sensible contracts and decentralized finance (DeFi) functions on Bitcoin (BTC). The undertaking’s native token, STX, is up practically 95% prior to now month.

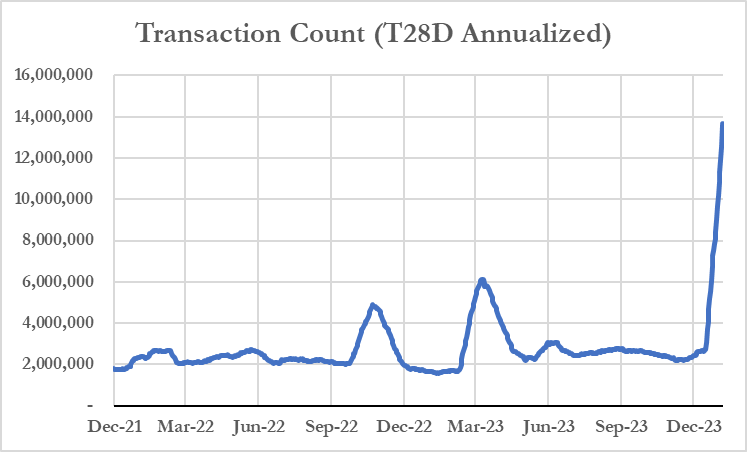

Jiang notes Stacks’ transaction exercise has additionally been skyrocketing.

“On the eve of the Bitcoin ETF (exchange-traded fund), consumer exercise already offers us a inform – they need to do extra. Transaction exercise on Stacks continues to pattern upward. What does this seem like in April, when the Nakamoto improve will increase transaction speeds >100x?

Networks are flywheel companies. Flywheel has begun spinning quicker.”

The Stacks Basis says the Nakamoto improve is presently scheduled for launch earlier than the Bitcoin halving, which is presently estimated to occur on April seventeenth, in keeping with BuyBitcoinWorldwide.com.

The improve goals to cut back the time it takes for a user-submitted transaction to be mined and confirmed from round 10 minutes to some seconds, in keeping with Resh Singh, a enterprise growth supervisor at STX:LDN.

“Quick affirmation occasions are essential for constructing scalable decentralized functions on Stacks, particularly decentralized finance apps the place worth volatility is a serious danger. By confirming trades in seconds quite than minutes, DeFi on Stacks can attain efficiency corresponding to centralized exchanges.”

STX:LDN is a London-based, community-led group that facilitates Bitcoin and Stacks growth and academic occasions.

STX is buying and selling at $1.76 at time of writing. The Thirty ninth-ranked crypto asset by market cap is down greater than 11% prior to now 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Test Newest Information Headlines

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses chances are you’ll incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in affiliate marketing online.

Generated Picture: DALLE3

[ad_2]

Source link