[ad_1]

The beneath is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

In a surprising improvement to the worldwide Bitcoin group, Binance founder and CEO Changpeng Zhao is stepping down from his function as a part of a responsible plea on felony and civil costs within the US.

Binance, the most important digital asset alternate on this planet by quantity, has seen its very future come into query as the results of a authorized battle with the US Division of Justice (DoJ). Founder and CEO Changpeng Zhao, also referred to as CZ, pled responsible on September 21 to cash laundering violations, and agreed to each resign from his publish and pay a $50M effective, which can be decreased. Binance can even pay a whopping $4.3 billion effective, and this penalty appears pretty set in stone. This settlement comes on the finish of a monthslong authorized battle by which the DoJ charged him of a number of critical violations: Not solely facilitating transactions with sanctioned teams equivalent to Russian mercenaries preventing in Ukraine, however even encouraging customers to cowl their tracks on potential violating money-laundering statutes.

Bitcoin Journal Professional is a reader-supported publication. To obtain new posts and help our work, contemplate turning into a free or paid subscriber.

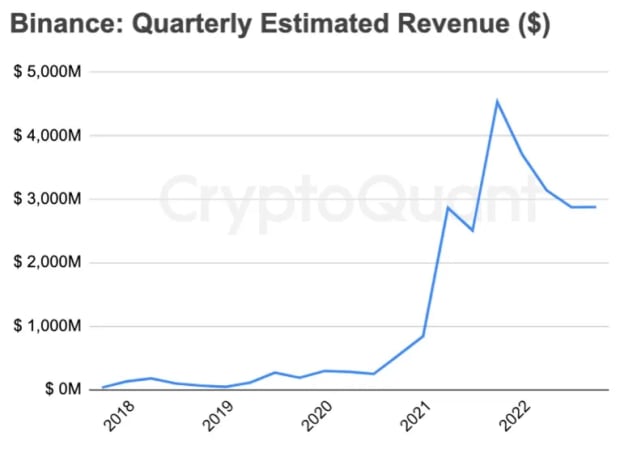

Since its founding in 2017, Binance has steadily grown through the years to change into the world’s hottest Bitcoin alternate. The agency was initially based in China, however has moved places a number of instances through the years, even to totally different continents, and presently doesn’t have an official headquarters. It has grown in notoriety regardless of requiring a special platform, Binance.US, to supply providers of any type inside america, however its largest windfalls got here because it absorbed FTX clients within the wake of that alternate’s apocalyptic collapse. CZ had lengthy been one of many business’s largest gamers, however particularly since FTX fell, Binance has indisputably been the most important within the area. And now, CZ’s deal looks like a last-ditch transfer to maintain the corporate operational.

In his resignation letter, printed someday after he pled responsible in Seattle, CZ claimed that “Binance will probably be effective. I must take care of some ache, however we’ll survive. We’ll get by way of, though with some adjustments in construction. It won’t be a foul factor once we look again in a number of years’ time,” including that he “wanted a break anyway.” Publicly, he tried to current an optimistic face, expressing confidence in his workers and inspiring a clean transition for the brand new head, Richard Teng. Regardless of this assured facade, there are nonetheless new difficulties brewing for CZ and his firm.

For one, since Binance wanted to spin off a subsidiary to function inside america, Binance.US shouldn’t be strictly coated by the preliminary plea settlement with the Division of Justice. Certainly, as of November 27, the Securities and Alternate Fee (SEC) is actively investigating the US department for misuse of shopper funds and a potential backdoor that CZ might use to proceed accessing Binance.US property. Binance lawyer Matthew Laroche claimed that the corporate “has withered below the stress and value of the SEC lawsuit. The typical month-to-month worth of Binance.US property is down virtually 90% and Binance.US has misplaced virtually half of its month-to-month customers because the SEC filed its case.”

Along with this continued try and restrict CZ’s potential assets, his actions are additionally being curtailed. Changpeng Zhao has established ties in a number of nations: Having been born in China, his household immigrated to Canada throughout his childhood and he has citizenship there. Moreover, he’s a citizen of the United Arab Emirates, and resides there together with his spouse and kids. Contemplating that the latter nation has no extradition treaty with the US, and that CZ has huge assets to attract on, Seattle District Courtroom Choose Richard Jones labeled him a flight threat. As a part of his bail settlement, CZ is briefly forbidden from leaving america, as the federal government claims {that a} multi-billionaire with overseas citizenship, a responsible plea and a potential jail sentence could be detained “within the overwhelming majority of circumstances.” In different phrases, the truth that he’s free from jail within the US is itself a stretch, not to mention leaving the nation.

Clearly, the presumption that the corporate’s founder and head would have interaction on this form of conduct doesn’t portend nicely for the enterprise. Already certainly one of its fundamental opponents is seeing a serious enhance in the identical method that Binance benefitted from FTX’s collapse: Since CZ introduced his resignation, the alternate Coinbase has seen a inventory worth progress of round 20% in 5 days. This enhance for Coinbase comes on high of a really worthwhile 12 months, as the corporate’s inventory valuation total has jumped practically 90% within the final six months. Coinbase is itself even engaged in a authorized battle with the federal authorities, however evidently it has been faring higher on this respect.

Nonetheless, regardless of all these setbacks, the corporate is trying ahead. New CEO Richard Teng instructed the press that he has a “strong timeline” for shifting ahead with firm compliance. Stressing that “Binance is a six 12 months outdated firm—it’s a comparatively younger firm by any measure,” he claimed that he intends to direct a change from the “disruptor” perspective of many tech startups and situate the agency into the world of conventional finance. A former banking regulator, Teng hopes to deliver this moderating expertise into the long run for Binance. Moreover, although different corporations could stand to learn from their opponents’ failure, a way of solidarity does exist: Former BitMEX CEO Arthur Hayes referred to as the therapy of CZ “absurd” in comparison with different money-laundering violators like former Goldman Sachs CEO Lloyd Blankfein, and questioned what these developments might imply for all digital asset exchanges.

Stepping away from Coinbase itself, one should have in mind how Bitcoin as an entire has been taking these developments. Which is to say, it’s been effective: The value rally that started in October has continued unabated. Evaluating this to the five-alarm hearth that came about when FTX collapsed, it’s simple to see how the business has matured: Commentators have taken discover of the overall confidence that Bitcoin is right here to remain. A number of of the most important crashes in Bitcoin’s historical past have coincided with the downfall of main exchanges, however headlines are filled with normal optimism and Bitcoin’s rally hasn’t even faltered. The state of issues in 2023 appears clear: Though particular person companies could rise and fall, Bitcoin has achieved sufficient adoption and notoriety that it’ll take multiple enterprise to significantly hurt it. Binance could very nicely bounce again from setbacks like this, and if it does, there will probably be a bustling business ready for it.

[ad_2]

Source link