[ad_1]

The Bitcoin and crypto house is poised for a doubtlessly transformative week, with a number of key occasions that would have far-reaching implications for the market. Let’s delve into the specifics of every occasion:

#1 Spot Bitcoin ETF Approval – Friday

As Bitcoinist reported earlier as we speak, a essential window is presently open for the SEC to doubtlessly approve all 12 spot Bitcoin ETFs. The deadline ends on November 17, after which newer filings will enter a public remark interval. That is particularly fascinating as a result of it’s assumed that the SEC goals to keep away from favoritism in a extremely aggressive market, as highlighted by business consultants. Remarkably, the SEC must decide on two spot Bitcoin ETFs by Franklin Templeton and Hashdex by November 17!

#2 US CPI Report – Tuesday

The Shopper Worth Index (CPI) report is ready to be launched on November 14, 8:30 am ET. The main inflation metric within the US is anticipated to indicate a lower on a year-over-year (YoY) foundation to three.3% in October from September’s 3.7%, influenced primarily by decrease gasoline prices. Month-over-month (MoM) inflation is anticipated to come back in at 0.1%, decrease than the earlier 0.4%.

Nevertheless, core inflation charges, which exclude risky meals and power costs, are more likely to stay comparatively secure. Just like September, the forecast for the core inflation fee (CPI MoM) in October is 0.3%. The year-on-year US core inflation fee is anticipated to fall barely from 4.1% to 4.0%.

The Federal Reserve’s response to those figures shall be essential, as chair Jerome Powell has indicated a willingness to proceed rate of interest hikes if inflation pressures don’t ease. This knowledge is essential for buyers and will have instant implications for the Bitcoin and crypto market.

#3 US PPI Report – Wednesday

The Producer Worth Index (PPI) for October, scheduled for launch on November 15, 8:30 am ET, provides insights into the inflation on the producer stage. The forecast signifies a marginal improve within the YoY PPI from 2.2% to 2.3%. The PPI may present a complementary perspective to the CPI and is important for understanding inflationary traits from the manufacturing facet of the financial system.

#4 Potential US Authorities Shutdown – Friday

The danger of a US authorities shutdown looms (once more), with November 17 as a essential date. This comes within the wake of Moody’s downgrade of the US credit standing outlook to ‘unfavourable,’ citing considerations over massive fiscal deficits and debt affordability.

Proposals for momentary measures have been put ahead as soon as once more in an effort to stop a authorities shutdown. Nevertheless, numerous US authorities businesses are already initiating preparations to brace their employees for a potential partial shutdown, following their established protocols.

This might have a number of implications for Bitcoin and crypto. On the one hand, Bitcoin and crypto have traditionally reacted positively to the US authorities shutdown, and the market rally may very well be additional strengthened. However, as was the case final time, a call by the SEC on the Spot Bitcoin ETFs may come as early as Friday.

#5 Polygon’s Main Announcement – Tuesday

Polygon has been producing appreciable pleasure in current days, according to its development in the direction of the two.0 roadmap. A heightened sense of anticipation has been stirred by Sandeep Nailwal, Polygon Labs Government Chairman. On November 7, he hinted at vital bulletins slated for November 14.

Are you prepared?

ninth November

14th November

Keep tuned!

— Sandeep Nailwal | sandeep. polygon 💜 (@sandeepnailwal) November 7, 2023

Hypothesis throughout the neighborhood is rife, with dominant theories suggesting the opportunity of an airdrop and the revelation of a big partnership. This conjecture is partly fueled by Nailwal’s earlier remarks a few potential airdrop to customers of Polygon’s Ethereum Layer 2 resolution, Polygon zkEVM. Moreover, the continued transition of the community’s native token from MATIC to POL has sparked additional discussions and theories.

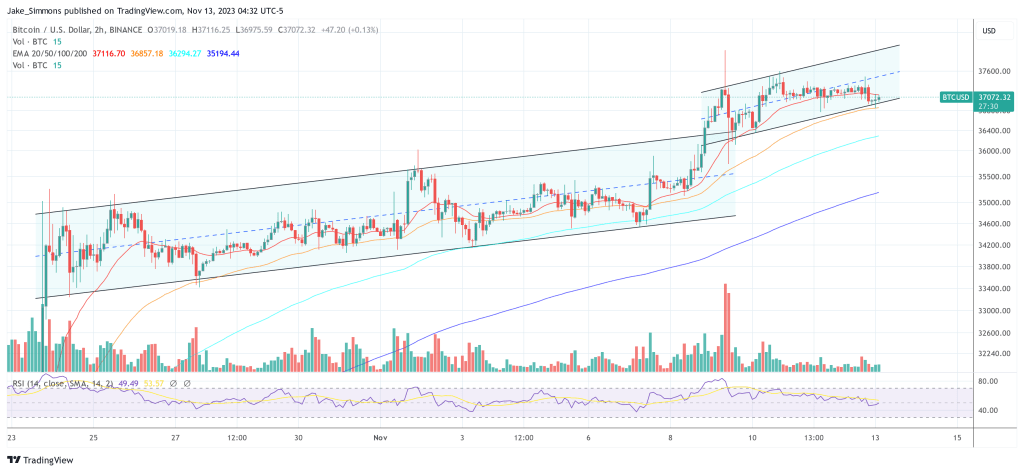

At press time, Bitcoin traded at $37,072.

Featured picture from Jeremy Yap / Unsplash, chart from TradingView.com

[ad_2]

Source link