[ad_1]

Following studies of BlackRock’s Spot Bitcoin ETF being listed on the Depository Belief & Clearing Company (DTCC) with the ticker IBTC, the BTC value had rallied above $35,000 primarily based on investor expectations alone. The fast nature of this surge noticed tens of 1000’s of crypto merchants caught within the crossfire as over $400 million was liquidated in someday.

Extra Than 95,000 Crypto Merchants Lose Their Positions

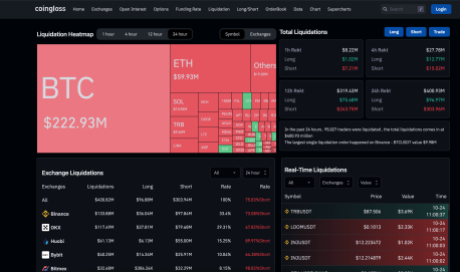

In line with information from Coinglass, the crypto liquidation volumes ramped up shortly following the Bitcoin value surge. The platform studies that just about 95,000 merchants had been liquidated, with quick merchants bearing the brunt of those liquidation traits.

Of the $400 million liquidated within the 24-hour interval, quick merchants accounted for 75.83 which got here out to $303 million. Lengthy merchants had been, nevertheless, not neglected of the onslaught as $96.88 million in liquidation volumes nonetheless got here from lengthy positions regardless of the course of the crypto market rally.

BTC liquidations cross $222 million | Supply: Coinglass

The only largest liquidation order happened on the BTCUSDT pair on the Binance crypto change. This dealer misplaced an eye-popping $9.98 million when their place was liquidated. In the identical vein, Binance has additionally seen the very best liquidation volumes of all crypto exchanges with $133.88 million.

Bitcoin accounts for the overwhelming majority of liquidation volumes at $222.93 million. Ethereum comes second with $59.93 million in liquidation volumes. Solana clinched the third place with $10.35 million. However apparently, Trellor (TRB), a low-cap altcoin that simply made it into the highest 200, snagged 4th place with $9.40 million in liquidations. The altcoin has been one of the vital spectacular performers by the market motion as nicely, rising from a spread of $50 to $96 earlier than retracing.

Bitcoin Reveals Power

Though Bitcoin has since retraced from its 2023 excessive of $35,000, the main cryptocurrency continues to indicate dominance. Every day buying and selling volumes have already risen above $46 billion, which implies that traders are coming again into the cryptocurrency en masse.

This implies a willingness to buy Bitcoin at larger costs and this may proceed to prop up its value. Since patrons presently outnumber sellers on this market, it’s extra possible that the Bitcoin retracement is simply short-term and a restart of the value surge can ship BTC above $36,000 subsequent.

Additionally, BlackRock’s ETF itemizing on the DTCC stays very contemporary and continues to be offering gasoline for the rally. This may possible proceed for an additional couple of hours earlier than exhaustion kicks in and leaves ample time for Bitcoin to regain its footing for an additional surge.

If Bitcoin crosses $36,000, then liquidation volumes are anticipated to rise much more. This might result in one of many worst liquidation traits in 2023.

BTC value nonetheless holds regular above $34,000 | Supply: BTCUSD on Tradingview.com

Featured picture from YouHolder, chart from Tradingview.com

[ad_2]

Source link