[ad_1]

On-chain knowledge exhibits that demand for Bitcoin from HODLers is at the moment outpacing miner issuance for the primary time in historical past and by quite a bit.

Bitcoin Demand From Accumulation Addresses Is Larger Than Miner Issuance

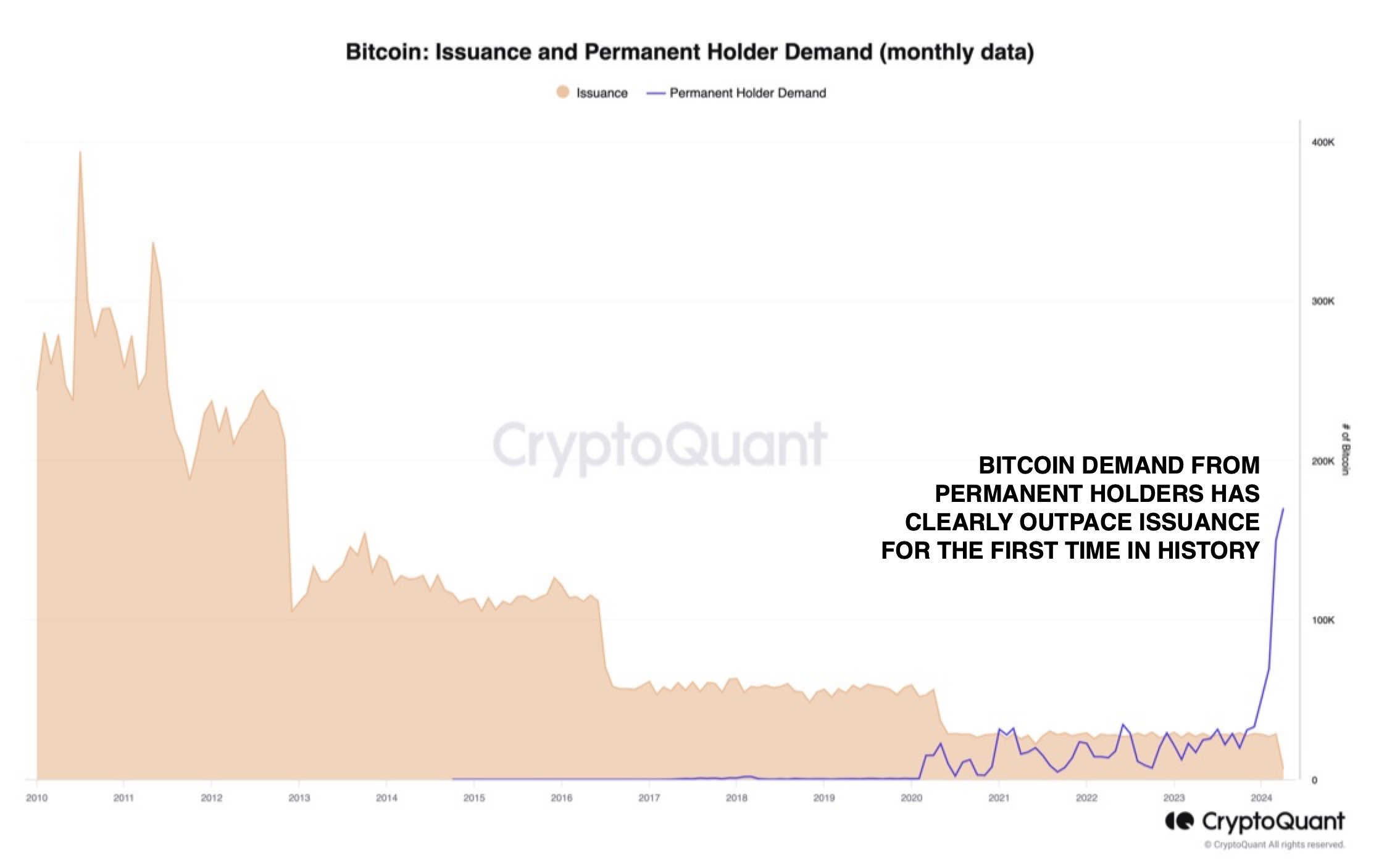

As CryptoQuant head of analysis Julio Moreno defined in a brand new publish on X, the demand for the asset has not too long ago been rising at an unprecedented charge. Under is the chart shared by the analyst exhibiting the demand from the “everlasting holders.”

The BTC miner issuance and everlasting holder demand, in contrast | Supply: @jjcmoreno on X

The “everlasting holders” right here confer with the homeowners of the “accumulation addresses,” that are outlined as wallets which have solely a historical past of shopping for BTC and by no means of promoting it.

Since these traders aren’t recognized to promote, it’s potential that the brand new provide that they accumulate would additionally change into equally illiquid sooner or later. As such, shopping for from these HODLers, specifically, generally is a bullish signal, because it suggests the accessible buying and selling provide of the asset is probably taking place.

Within the chart, the demand from these HODLers is gauged utilizing the expansion of their mixed stability. As is obvious, the buildup addresses considerably upped their shopping for again in 2020 and maintained these progress ranges for the following few years.

Moreno has additionally connected the Bitcoin “miner issuance” knowledge to the identical chart. This metric retains observe of the full quantity of Bitcoin that the miners are minting on the community.

Miners “produce” BTC once they clear up blocks and obtain block rewards. These rewards are handed out in BTC and are the one technique to improve the cryptocurrency’s circulating provide.

Because the graph exhibits, the issuance observes streaks of some years the place it stays kind of fixed. In between these streaks, its worth immediately plunges. The rationale for that is naturally the halving.

The halving is a periodic occasion on the Bitcoin community the place the block rewards are completely slashed in half. These occasions happen roughly each 4 years; the following one is scheduled in about ten days.

As displayed within the chart, whereas the demand from the buildup addresses was fairly excessive beginning in 2020, it by no means fairly exceeded the issuance of the miners.

Just lately, nevertheless, the expansion within the accumulation addresses has exploded, with the metric not solely sustaining above the community issuance but in addition far surpassing its worth.

This means that these HODLers are shopping for rather more than the miners have produced on the community. The CryptoQuant head notes that that is naturally solely a portion of the full demand of the community, as there are different purchaser entities, so it exhibits simply how robust the demand for BTC has been not too long ago.

A serious driver behind this demand could be the emergence of the Bitcoin spot exchange-traded funds (ETFs), which offer another technique to achieve publicity to the cryptocurrency in a mode that’s preferable for conventional traders.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $68,400, up greater than 4% over the previous week.

Appears like the worth of the asset has sharply gone down over the previous day | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, CryptoQuant.com, chart from TradingView.com

[ad_2]

Source link

Stumbling upon this website was such a delightful find. The layout is clean and inviting, making it a pleasure to explore the terrific content. I’m incredibly impressed by the level of effort and passion that clearly goes into maintaining such a valuable online space.