[ad_1]

The Bitcoin value is buying and selling at $27,100 on the time of writing, marking a 60% decline from its all-time excessive of $69,000 in 2021. Because the anticipation for the subsequent bull market builds, questions come up relating to Bitcoin’s potential future costs.

Whereas most predictions are speculative, one analyst has devised a mannequin leveraging historic information to forecast potential tops and bottoms in Bitcoin’s value over time.

Bitcoin Value In Earlier Cycles

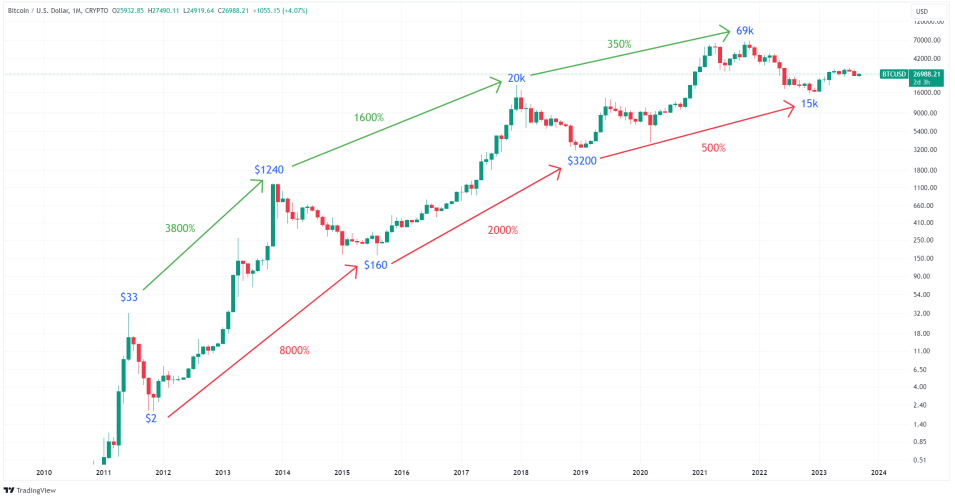

Bitcoin’s costs modifications since 2011. Supply: BTCUSDT on TradingView

Since its inception, Bitcoin has demonstrated exceptional development, rewarding early long-term buyers considerably. This value development is observable in measuring Bitcoin’s costs from the lows to the highs and between the highs of successive bull markets.

In 2011, the height was $33, adopted by a peak of $1240 in 2013, reflecting a 3800% improve between peaks. The following peaks in 2017 and 2021 have been $20,000 and $69,000, representing will increase of 1,600% and 350%, respectively. Comparable ranges of improve are additionally noticed when inspecting the lows of various cycles.

Notably, the relative development between cycles has diminished, presumably as a result of improve in Bitcoin’s market capitalization, requiring extra substantial capital to affect its value. This diminishing development aligns with a mathematical sample referred to as logarithmic regression.

Logarithmic Regression

An analyst has devised numerous logarithmic curves on the Bitcoin chart to forecast Bitcoin’s potential tops and bottoms, using time as the one enter. Such fashions will help buyers by providing an easy strategy to see potential market tendencies and make proactive plans within the unpredictable world of cryptocurrency.

Chart of Bitcoin’s value in a channel of logistic regression curves. Supply: @BawdyAnarchist_ on X

Bitcoin’s tops and bottoms sometimes manifest each 4 years, enabling the prediction of potential Bitcoin costs in upcoming cycles primarily based on the logarithmic regression mannequin.

Bitcoin Value Projections

2025-2026: Bitcoin value could peak within the third or fourth quarter of 2025 between $190,000-$200,000, earlier than bottoming out round $70,000 the next 12 months.

2029-2030: Bitcoin value could attain a prime of $420,000 to $440,000 and backside out the next 12 months at round $230,000.

2033-2034: Bitcoin value could peak between $750,000-$800,000 and backside out round $700,000 the next 12 months.

By the late 2030s, the mannequin begins to interrupt down as predicted tops begin falling under the anticipated bottoms, doubtlessly indicating a stabilization in Bitcoin’s value publish its peak of $750,000-$800,000

Last ideas

Whereas fashions like this supply insightful projections of Bitcoin’s potential future costs, it’s essential to acknowledge their limitations and the necessity for periodic updates with recent information factors. Quite a few exterior components, together with however not restricted to regulatory modifications, technological developments, and macroeconomic situations, might considerably impression the mannequin’s accuracy.

Furthermore, the unprecedented nature of Bitcoin’s trajectory, having by no means endured a recessionary surroundings, implies a possible susceptibility to extra substantial crashes than fashions would possibly predict. Predictions needs to be cautiously thought of with broader market analyses and tendencies as with all monetary mannequin.

Funding Disclaimer: The content material supplied on this article is for informational and academic functions solely. It shouldn’t be thought of funding recommendation. Please seek the advice of a monetary advisor earlier than making any funding selections. Buying and selling and investing contain substantial monetary threat. Previous efficiency isn’t indicative of future outcomes. No content material on this web site is a advice or solicitation to purchase or promote securities or cryptocurrencies.

Featured picture from ShutterStock, Charts from TradingView.com

[ad_2]

Source link