[ad_1]

In a surprising flip of occasions, Binance CEO Changpeng Zhao has agreed to step down from the crypto change and has plead responsible to “violating US anti-money laundering necessities.”

The information is presently being priced into the crypto market, resulting in excessive volatility in Bitcoin and altcoins, plus numerous chatter on social media. Let’s take a more in-depth have a look at how the market and speculators are reacting thus far.

CZ To Step Down, Pleads Responsible, Firm Charged $4B In Fines

Earlier right this moment, the US Division of Justice revealed it might be asserting motion towards a cryptocurrency firm. Probably the most dominant cryptocurrency change, Binance, was the goal of the enforcement motion, and was ordered to pay $4.3 billion in fines.

Binance CEO Changpeng “CZ” Zhao stepped down in consequence, and plead guilt to US anti-money laundering expenses. The crypto market sank within the earlier hours right this moment in anticipation of the information.

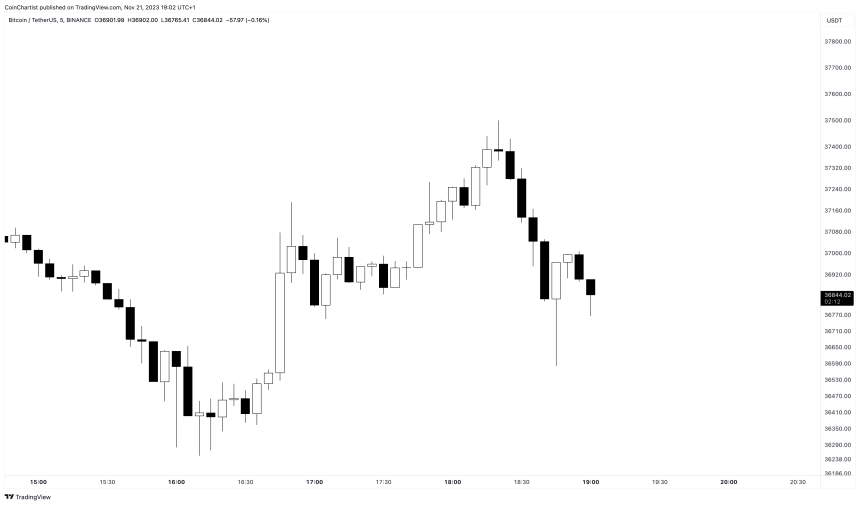

Nonetheless, as quickly because the Wall Avenue Journal revealed the knowledge publicly, Bitcoin worth bounced again and so did the altcoin market. Moments later, a lot of the upside worth motion was worn out. Value as traded inside roughly a 4% vary right this moment, however has traded throughout that a number of instances because the information broke, highlighting highly effective intraday volatility.

Bitcoin worth is additional unstable on the information | BTCUSD on TradingView.com

The Crypto Market Reacts To The Binance Information

Whereas the market tries to cost in what simply occurred, volatility will proceed to ensue within the close to time period. On X (previously Twitter), notable figures are talking out with regard to CZ’s departure from Binance.

On-chain analyst and market commentator Will Clemente factors out it’s “only a matter of weeks till Bitcoin ETF approval now” with Binance out of the way in which. The corporate has lengthy been cited as a key cause for the SEC remaining hesitant to tug the set off on a spot BTC ETF utility approval.

Messari Crypto CEO Ryan Selkis calls it one of many “greatest catalysts we might have in crypto” between ETFs, crypto-friendly laws, and this $4 billion settlement serving to crypto be seen as a “actual trade.”

Economist Alex Kruger reveals that the settlement is ranked the seventh in monetary compliance historical past, subsequent to names like JP Morgan, Financial institution of America, Goldman Sachs, Wells Fargo, and a number of other others.

[ad_2]

Source link