[ad_1]

Ethereum (ETH), the world’s second-largest cryptocurrency, is demonstrating strong momentum as its worth phases a resurgence, reclaiming ranges above $2,000.

This bullish development positive factors traction concurrently with important developments within the US Securities and Change Fee (SEC). The regulatory authority is participating in discussions concerning the potential approval of a spot Ethereum Change-Traded Fund (ETF).

This pivotal improvement has injected optimism into the Ethereum market, because the prospect of an ETF introduces new potentialities for mainstream adoption and funding, additional fueling the present upward trajectory of Ether’s worth.

Ethereum’s Ascending Triangle: Bullish Breakout Potential

Over the course of a number of months, the worth of Ethereum has been in a consolidation development that has resulted within the formation of an ascending triangle. Though the technical formation is bullish by nature, that is solely true following a worthwhile breakout.

Pattern strains join the equal highs and better lows of the ascending triangle configuration. This association signifies that traders are rising extra assured and shopping for the dips at a sooner tempo.

ETHUSD at the moment buying and selling at $2,066 on the day by day chart: TradingView.com

Apparently, right this moment’s charts present there are not any “dips” to purchase, as Ethereum broke previous the vaunted $2,000 degree to welcome December on a excessive observe.

Ethereum just isn’t solely maintaining, but in addition rising to unprecedented heights. The value of ETH is at the moment up 3% at $2,100, and traders and fans are enthusiastic about the opportunity of a rally to $3,000 and even increased.

Ether’s spectacular success towards Bitcoin, outperforming the alpha cryptocurrency by nearly 5%, is a serious indicator of this. Vital on-chain indicators indicate that ETH might proceed to outperform BTC this month.

Constancy Submitting Fuels Ethereum Optimism

The primary indication of a bullish transfer was a breakout over the psychological $2,000 barrier, though there was numerous see-saw movement round this degree. Extra particularly, ETH is buying and selling between the weekly assist degree at $1,930 and the excessive for the second quarter at $2,140. That is the fourth week in a row that this has been taking place.

#Ethereum Spot ETF submitting by Constancy!

Confirms my thesis that after #Bitcoin will get its shine, we’ll see Ethereum working to $3,500 in Q1 2024.

— Michaël van de Poppe (@CryptoMichNL) November 30, 2023

Crypto analyst Michael van de Poppe has voiced his optimism for Ethereum in gentle of the Constancy submitting. Given this submission, he affirms his conviction that after Bitcoin’s speedy improve, Ethereum is positioned to achieve $3,500 all through the preliminary quarter of 2024.

Supply: Santiment

Supply: Santiment

In a associated improvement, analysis exhibits there was a major improve in Ethereum whale accumulation. On-chain information signifies that the most important Ethereum wallets, in keeping with Santiment, are displaying a constructive sample that means a giant change.

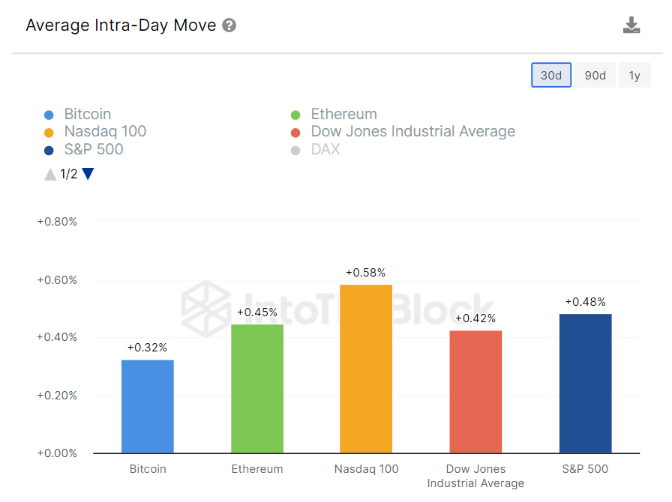

ETH Worth Volatility Traits vs. Bitcoin. Supply: IntoTheBlock

In the meantime, Ethereum has an incredible 30-day Common Intra-Day Volatility rating of 0.45%, surpassing Bitcoin’s 0.32%, a latest analysis by IntoTheBlock exhibits.

Funding methods might have to alter because of this alteration in volatility dynamics, which might spotlight the Ethereum market’s dynamic prospects.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes threat. If you make investments, your capital is topic to threat).

Featured picture from Freepik

[ad_2]

Source link