[ad_1]

A number of weeks have handed for the reason that Bitcoin ETFs have gone reside on buying and selling. Right here’s how a lot of the asset’s circulating provide these funds maintain now.

Bitcoin Spot ETFs Now Carry This A lot Of The Cryptocurrency’s Provide

On January 10, the much-anticipated spot ETFs gained approval for Bitcoin from the US Securities and Change Fee (SEC). The following day, January eleventh, these ETFs went reside on buying and selling, marking a historic day for the cryptocurrency.

Change-traded funds (ETFs) consult with monetary devices that permit traders to realize publicity to a commodity with out truly proudly owning stated asset. Within the case of BTC, ETFs is usually a extra interesting strategy to put money into the coin for merchants who aren’t well-versed in how cryptocurrencies work.

The spot ETFs commerce on conventional exchanges, so such traders, who might already be acquainted with the standard mode of buying and selling, gained’t need to learn to navigate digital asset exchanges and wallets.

In an effort to present this oblique publicity to the traders, the funds themselves purchase and maintain Bitcoin. CryptoQuant Netherlands neighborhood supervisor Maartunn has shared some fast numbers associated to the present holdings of the spot ETFs in a brand new publish on X.

First, here’s a chart that exhibits the holdings of the older BTC funds, together with the Grayscale Bitcoin Belief (GBTC):

The worth of the metric seems to have taken a plunge in current days | Supply: @JA_Maartun on X

From the graph, it’s seen that the holdings of those funds have plunged lately. That is because of the large outflows that GBTC has noticed following its conversion to a spot ETF. In complete, these funds now carry 564,402 BTC.

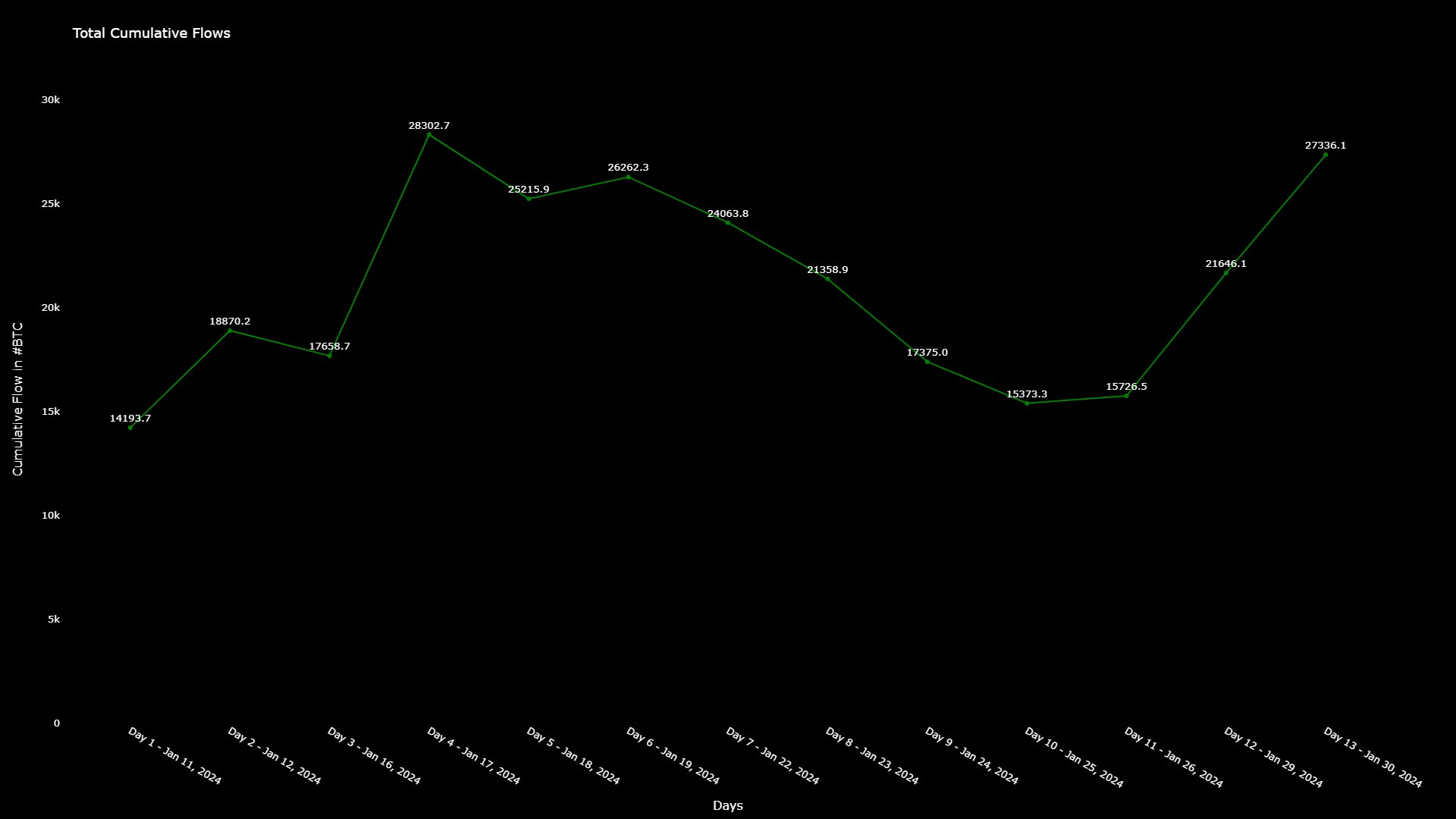

Now, under is a chart that shows the cumulative flows that the brand new spot ETFs as a complete have witnessed since they’ve gone reside.

The pattern within the cumulative flows for the ETFs | Supply: @JA_Maartun on X

As is obvious from the graph, the brand new spot ETFs have seen internet inflows of 27,336 BTC. Including this quantity to the opposite metric, these funds maintain a complete of 591,738 BTC. By way of the US Greenback, that is equal to a whopping $25.5 billion on the present change fee of the asset.

The present complete circulating provide of the cryptocurrency is the same as 19,615,950 BTC, which implies that the overall quantity held by these funds corresponds to about 3% of this determine.

One thing to notice, although, is that the cumulative flows would additionally embody the GBTC outflows, so this proportion isn’t completely right. When accounting for this correction, the determine rises to about 3.3%.

BTC Value

Though the approval of the Bitcoin spot ETFs was one thing appeared ahead to among the many traders within the cryptocurrency sector as a complete, the occasion turned out to be a sell-the-news one ultimately.

This occasion began an prolonged downtrend for the asset, from which the worth has solely simply begun to make some restoration. The under chart exhibits how the cryptocurrency has carried out over the previous month.

Bitcoin is buying and selling round $43,000 proper now, which means that the cryptocurrency is but to make a restoration to the degrees it was at through the days surrounding the spot ETF approval.

Seems like the worth of the coin has gone down a internet quantity on this interval | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link