[ad_1]

All of us have Nvidia (NVDA) to thank for the S&P 500 (SPY) lastly breaking above 5,000. Actually some of the spectacular earnings bulletins in years. But the valuation for NVDA, and the remainder of the mega cap tech house is getting lofty calling into query whether or not a bubble is forming. Study what investing knowledgeable Steve Reitmeister thinks concerning the present state of the market alongside together with his a preview of this prime 12 shares to purchase now. Learn on beneath for extra.

Synthetic Intelligence is all the fashion. And no person is doing higher than Nvidia (NVDA). This was on FULL show of their super Wednesday after market earnings beat that lit a fireplace beneath shares on Thursday…particularly any tech shares tied to AI.

This led to a formidable breakout above 5,000 for the S&P 500 (SPY) to shut the session at 5,087. However ought to traders be fearful that not all shares are taking part on this rally. Like how the small caps within the Russell 2000 are nonetheless within the purple this 12 months???

We’ll talk about that and extra in in the present day’s market commentary.

Market Commentary

February has been marked by an ongoing take a look at of the 5,000 degree for the S&P 500.

Twice earlier than shares closed above 5,000 for a brief stretch solely to fall again beneath. However there’s a sense that this third time is the allure with an additional breakout seemingly on the best way.

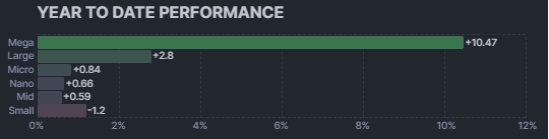

But identical to 2023 the beneficial properties appear far too remoted within the mega cap tech shares as may be seen by this 12 months to this point chart targeted on beneficial properties my market cap:

With historical past as our information, a wholesome bull market has small caps main the best way. That’s as a result of these smaller firms sometimes have superior progress prospects which propels their shares above the pack.

That’s the reason the returns for small caps going again 100 years are sometimes 20% higher than massive caps. For readability which means if massive caps common a ten% return that small caps can be round 20% higher at 12% return (not a 30% return).

One principle is to say “the development is your pal”. And thus traders are greatest served taking part in the big cap tech recreation till the celebration is over.

Going again to the late 1990’s that was an ideal thought so long as you bought in early 2000 on the first indicators the bubble was bursting. Sadly, traders hardly ever make these prudent strikes. As an alternative, they inform themselves seemingly sound logic like promoting when shares get again to earlier ranges. This flawed pondering results in disastrous outcomes on the finish of bubble as shares can so simply fall 50-80% in pretty quick order.

To be clear, I’m not saying Mega Caps or AI shares are as a lot of a mania as we noticed in 1999 for web shares. Nvidia and others are worthwhile firms rising at an outstanding tempo. However their PE nearing 40X earnings is a premium that historical past factors to having very low odds of future success.

Which means these shares are priced for perfection. Doubtless they’ll keep aloft so long as that perfection continues to unfold with every subsequent earnings report. However as soon as there may be the primary blemish in that earnings outlook, then “be careful beneath!”.

Be aware that again in my days at Zacks Funding Analysis we ran a collection of research trying on the PE and projected progress charges of firms. Most would assume that the upper the anticipated progress…the upper the returns. And but it was the precise reverse with the very best progress firms providing the bottom future returns.

That’s exactly due to the upper PE and priced for perfection downside famous above. Progress by no means holds up over time. Whether or not its business situations or stiff competitors, in some unspecified time in the future the expansion celebration ends. And when it does the shares implode and PE comes all the way down to dimension.

My assumption is that almost all everybody has an allocation to those Magnificent 7 shares to learn so long as this AI celebration lasts. That possession is both straight within the particular person firms or by way of possession in SPY or QQQ which is dominated by these shares.

The query is what are you going to do with the remainder of your cash as a result of it’s unwise to have too many eggs on this turning into extra fragile basket?

For me it’s to lean into my greatest investing benefit. That being a give attention to the confirmed outperformance from shares uncovered by our POWR Scores system.

Analyzing each inventory by 118 components that time to future outperformance is why the coveted A rated shares have generated a median return of +28.56% per 12 months since 1999. And that outperformance is displaying up in spades as soon as once more this 12 months.

What prime POWR Scores shares am I recommending in the present day?

Learn on beneath for the reply…

What To Do Subsequent?

Uncover my present portfolio of 12 shares packed to the brim with the outperforming advantages present in our unique POWR Scores mannequin. (Practically 4X higher than the S&P 500 going again to 1999)

This consists of 5 beneath the radar small caps lately added with super upside potential.

Plus I’ve 1 particular ETF that’s extremely properly positioned to outpace the market within the weeks and months forward.

That is all based mostly on my 43 years of investing expertise seeing bull markets…bear markets…and all the pieces between.

In case you are curious to be taught extra, and wish to see these fortunate 13 hand chosen trades, then please click on the hyperlink beneath to get began now.

Steve Reitmeister’s Buying and selling Plan & Prime Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)CEO, StockNews.com and Editor, Reitmeister Whole Return

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares have been buying and selling at $507.66 per share on Friday morning, up $0.16 (+0.03%). 12 months-to-date, SPY has gained 6.81%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is best identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

Extra…

The publish Is a Inventory Bubble Forming? appeared first on StockNews.com

[ad_2]

Source link