[ad_1]

Bitcoin and cryptocurrency buying and selling have gained immense recognition lately. However what about crypto margin buying and selling? Is it authorized within the US? Margin buying and selling permits merchants to borrow funds to extend their buying and selling energy, probably resulting in greater income. Nonetheless, it additionally includes greater dangers. The legality of margin buying and selling, particularly altcoin and Bitcoin margin buying and selling within the US, is a fancy difficulty, so, should you’re contemplating partaking in the sort of exercise, it’s essential to grasp the authorized panorama and potential dangers.

On this article, we’ll discover the legality of margin buying and selling and crypto leverage buying and selling within the USA, together with the rules and restrictions in place, and supply some suggestions that will help you navigate this complicated terrain.

Crypto Leverage Buying and selling within the US: Key Takeaways

Margin buying and selling permits you to commerce extra funds than you personal by borrowing a standard or a crypto asset out of your dealer.

Crypto leverage buying and selling is authorized within the US, however regulation varies from state to state.

The transaction charges related to crypto margin buying and selling usually contain platform charges, community and transaction prices, and potential liquidation charges.

One of the best crypto leverage buying and selling platforms within the US are Kraken, Coinbase Professional, and Poloniex.

A few of the dangers concerned in margin buying and selling embody margin calls and liquidation, each of which may trigger monumental losses.

What Is Margin Buying and selling?

Margin buying and selling is a sophisticated buying and selling technique that permits cryptocurrency merchants to open positions with extra funds than they really have. It really works by borrowing funds from a dealer or an trade. Primarily, a dealer deposits a certain quantity of funds as collateral, and the platform lends the dealer further funds to extend their shopping for energy, permitting them to take bigger positions than they might be capable to in any other case.

One of many primary advantages of margin buying and selling is the power to extend revenue potential. With leverage, merchants can amplify their features by taking bigger positions out there. That is notably helpful within the extremely risky world of cryptocurrencies, the place costs can fluctuate quickly, and merchants can earn greater income by well-timed trades.

How Does Crypto Margin Buying and selling Work?

Let’s break it down with Bitcoin for instance. You have got $300 and consider Bitcoin’s worth will rise. With out borrowing, you should buy $300 value of Bitcoin, primarily betting in your prediction with a 1x leverage—like enjoying a recreation with your individual cash.

Now, should you’re feeling extra adventurous and need to improve your potential winnings, you may go for 2x leverage. This implies you’re borrowing one other $300 on high of your individual, which supplies you $600 to guess on Bitcoin. This borrowed quantity, alongside together with your preliminary $300, acts as a security internet or “margin” for the deal.

Nonetheless, there’s a catch. If Bitcoin’s worth drops, your $300 margin may very well be in jeopardy. With 2x leverage, Bitcoin would want to lose a major worth earlier than the platform steps in, but when it does, they could ask you for extra money to maintain the commerce open, generally known as a “margin name.” If issues transfer too rapidly or you may’t high up your account, the platform may shut your place to recuperate the mortgage and any curiosity, leaving you with a loss.

Utilizing low leverage is like strolling a tightrope with a security internet. It’s riskier than conserving your toes on the bottom however safer than flying and not using a parachute. And for the thrill-seekers, some platforms provide as much as 200x leverage, the place even a tiny drop in Bitcoin’s worth may imply recreation over on your commerce.

Dangers Related to Margin Buying and selling

Margin buying and selling might be an efficient software for skilled merchants to amplify their income within the extremely risky cryptocurrency market. Nonetheless, using leverage additionally exposes merchants to potential dangers and losses. On this part, we are going to define numerous dangers related to margin buying and selling within the US and supply insights on how merchants can mitigate these dangers to enhance their probabilities of success.

The Horrendous Margin Calls

Margin buying and selling might be an efficient technique for skilled merchants seeking to amplify their features within the crypto market. Nonetheless, it comes with a major stage of threat and duty. Some of the feared elements of margin buying and selling is the margin name.

A margin name happens when the worth of a dealer’s belongings falls under the minimal margin requirement set by the trade. This minimal requirement is the bottom quantity of fairness {that a} dealer wants to take care of of their account relative to their leveraged place. If the worth of the underlying asset decreases considerably, the fairness within the dealer’s account might now not meet the minimal margin necessities.

When a margin name is triggered, the dealer will obtain a notification from the trade so as to add extra funds to their account to take care of the minimal margin requirement. If the dealer fails to high up their account, the trade might liquidate their place, promoting off their belongings to cowl the margin necessities.

This is usually a devastating blow, leading to important losses that may wipe out a dealer’s total account. To keep away from being caught in a margin name, it’s important for merchants to have a strong understanding of the margin necessities and to implement threat administration methods.

One of many threat administration methods is to at all times set stop-loss orders to forestall important losses. Moreover, merchants can think about using decrease ranges of leverage and buying and selling solely with funds that they’ll afford to lose in case of a margin name.

It’s value noting that margin calls usually are not unique to crypto buying and selling. They happen in conventional markets as nicely, and the results might be simply as extreme. Due to this fact, merchants should at all times follow warning and make use of methods that decrease threat whereas maximizing features.

Liquidation of Collateral

When partaking in common and crypto margin buying and selling, it’s necessary to grasp the idea of collateral and the way it elements into the liquidation course of. When a dealer opens a leveraged place, they have to deposit collateral. This collateral serves as a assure that the dealer can cowl their potential losses.

If the worth of the dealer’s belongings begins to say no and falls under the minimal margin requirement set by the trade, they might obtain a margin name. Which means that they’re required so as to add extra collateral. In any other case, they threat having their place liquidated.

Liquidation happens when a dealer’s collateral can now not cowl their losses, and the trade or brokerage closes their place and sells their collateral to repay the borrowed funds. In easier phrases, which means the dealer’s belongings are bought off to assist offset their losses.

The method of liquidation is usually influenced by trade insurance policies and the dealer’s actions. The trade may have particular insurance policies and procedures to find out when a dealer’s place must be liquidated. These insurance policies will normally rely upon elements equivalent to minimal margin necessities, the volatility of the belongings in query, and the quantity of leverage used.

Talking of a dealer’s actions, they’ll additionally contribute to the chance of their place being liquidated. For instance, if a dealer makes use of important leverage or in the event that they fail to take care of satisfactory collateral of their account, they’re at a better threat of getting their place liquidated.

Is Cryptocurrency Margin Buying and selling Authorized within the USA?

Margin buying and selling has turn into more and more in style throughout the cryptocurrency market. Nonetheless, being a high-risk monetary product, the sort of buying and selling is topic to strict rules, particularly within the US.

US residents who want to take part in margin buying and selling of cryptocurrencies should accomplish that on regulated exchanges that adjust to the rules set forth by supervisory authorities such because the Commodity Futures Buying and selling Fee (CFTC) and Nationwide Futures Affiliation (NFA). These embody licensed futures fee retailers (FCMs) and registered introducing brokers (IBs) who provide leverage buying and selling.

The CFTC has categorized cryptocurrencies, together with Bitcoin and Ethereum, as commodities, therefore guaranteeing that they fall underneath the jurisdiction of their regulatory mandate. This regulatory physique has enacted a number of rules that exchanges should observe to function as official margin buying and selling service suppliers for US residents.

Moreover, regulated exchanges should present clear steerage on particular margin necessities and most leverage limits for every buying and selling pair. This data helps crypto merchants make knowledgeable selections concerning the dangers of margin buying and selling and their potential losses when taking part within the cryptocurrency market.

What about different international locations?

Within the UK, the oversight of economic derivatives, together with futures, falls underneath the jurisdiction of the Monetary Conduct Authority (FCA). In a transfer to guard retail customers from the excessive dangers related to crypto derivatives, the FCA applied a ban on their sale in 2020. Nonetheless, margin buying and selling for different forms of buying and selling devices stays permissible, albeit with restrictions on the quantity of leverage accessible to merchants.

Canada presents a considerably difficult regulatory panorama for crypto margin buying and selling. In 2022, the Canadian Securities Directors (CSA) launched a ban on margin buying and selling on crypto platforms, signaling a cautious strategy in direction of the volatility and threat inherent within the crypto market.

Australia’s strategy to margin buying and selling strikes a stability, permitting it solely inside regulated limits. The Australian Securities and Investments Fee (ASIC) is answerable for setting these limits, together with most leverage ratios. A notable enforcement motion occurred in 2023 when ASIC introduced civil prices towards Kraken’s Australian trade supplier, Bit Commerce Pty Ltd, highlighting the regulatory scrutiny within the area.

The tightening of rules worldwide has led to important shifts within the operations of crypto exchanges. As an illustration, Binance withdrew from the Canadian market in 2023, reflecting the challenges posed by new regulatory measures. Moreover, many exchanges have resorted to geofencing strategies. This expertise restricts entry to the trade’s companies primarily based on the consumer’s geographical location, successfully stopping people from areas with stringent rules from taking part in margin buying and selling on their platforms.

What Are the Charges Associated to Crypto Margin Buying and selling within the USA?

One of many primary charges related to margin buying and selling is platform charges. These charges cowl the price of utilizing the platform and the margin buying and selling service offered by the trade. Some exchanges cost a proportion of the commerce quantity as a price, whereas others cost a set fee. Merchants ought to analysis the platform charges and take them into consideration when making margin trades.

Along with platform charges, merchants may incur liquidation charges. Liquidation charges are charged if a margin place is closed as a consequence of an absence of funds or margin upkeep. These charges can differ relying on the trade and the dimensions of the place.

Merchants must also think about the corresponding community and transaction prices related to the underlying blockchain. These prices usually are not straight associated to margin buying and selling charges, however they’ll impression the general price of margin buying and selling. Blockchain community charges are charged for transacting on the blockchain and are sometimes dynamic and rely upon community congestion.

How To Begin Leverage Buying and selling Crypto within the USA

Folks usually ask if they’ll leverage commerce crypto within the US. The reply is sure, however it’s not as simple as in different international locations as a consequence of strict rules. Just a few exchanges with a FinCEN Cash Service Enterprise license, equivalent to BitMart, can provide margin derivatives merchandise. Acquiring this license topics service suppliers to intense regulatory scrutiny, which many platform homeowners discover not well worth the trouble. Some decide to open off-shore exchanges with fewer hurdles to go. To commerce leveraged tokens and cash in the US, you must know which trade affords the suitable product underneath the suitable regulation. Listed here are a few of the greatest crypto leverage buying and selling platforms accessible to US residents.

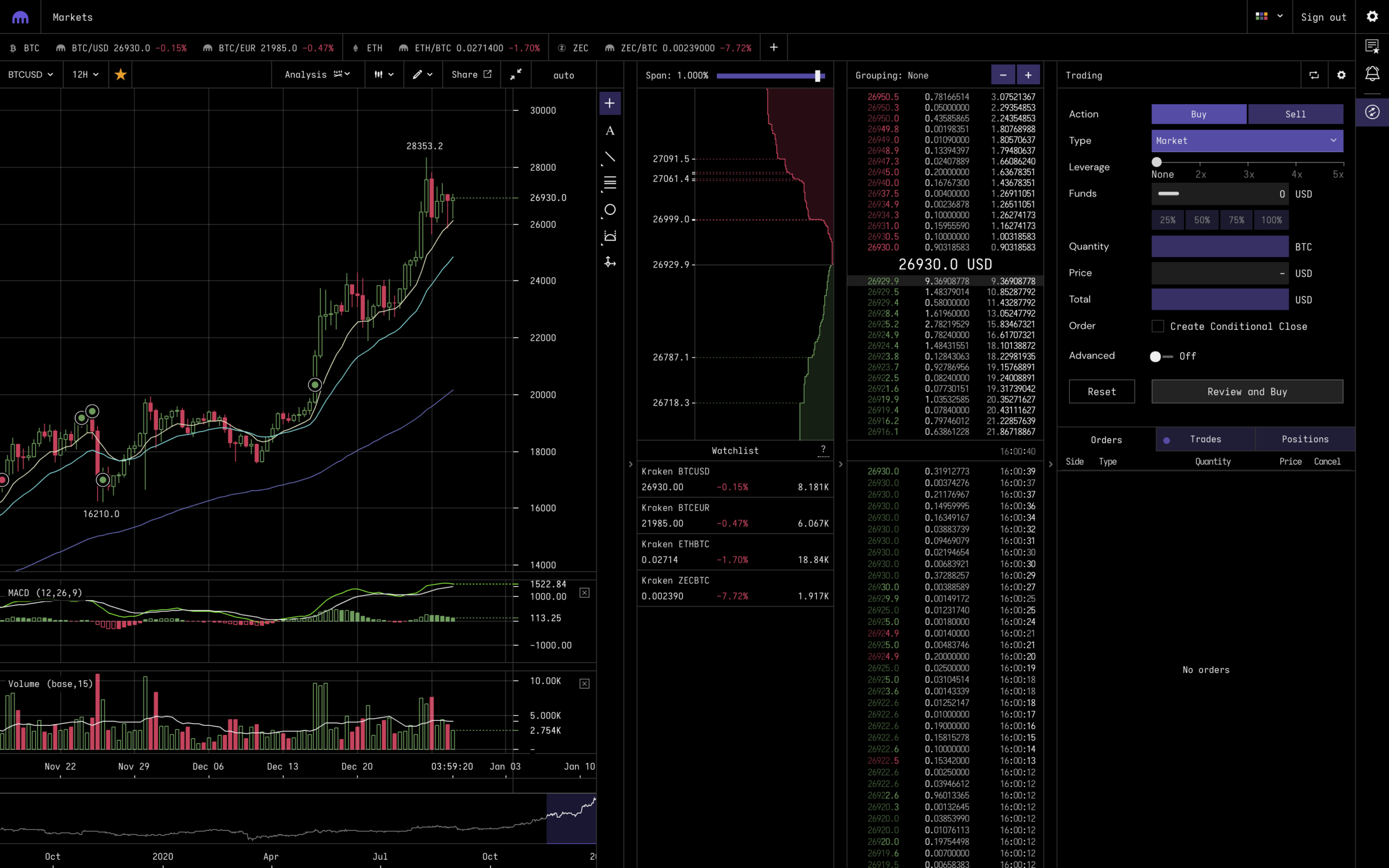

Kraken.com – General Greatest Crypto Leverage Buying and selling Platform

In case you are a US citizen desirous about margin buying and selling cryptocurrencies, Kraken.com is the platform for you. Kraken is a number one crypto trade and margin dealer that gives customers with a excessive stage of safety, a user-friendly interface, quite a lot of buying and selling pairs, and low buying and selling charges.

Safety is a high precedence for Kraken, which is why they make use of numerous measures to maintain consumer funds and private data protected. Kraken makes use of two-factor authentication, SSL encryption, and chilly storage to guard consumer accounts and make sure the integrity of knowledge.

Kraken’s buying and selling interface is straightforward to make use of and navigate, making it preferrred for each skilled merchants and newbies. The platform affords a variety of buying and selling pairs with fiat currencies and cryptocurrencies, permitting merchants to diversify their portfolios and reap the benefits of market alternatives.

By way of charges, Kraken prices a few of the lowest buying and selling charges within the business. Moreover, Kraken affords many margin buying and selling choices, together with small leverage, which supplies a stage of safety towards potential losses, in addition to bigger commerce positions with as much as 5x leverage. This permits merchants to decide on the leverage best suited for his or her buying and selling technique and threat profile.

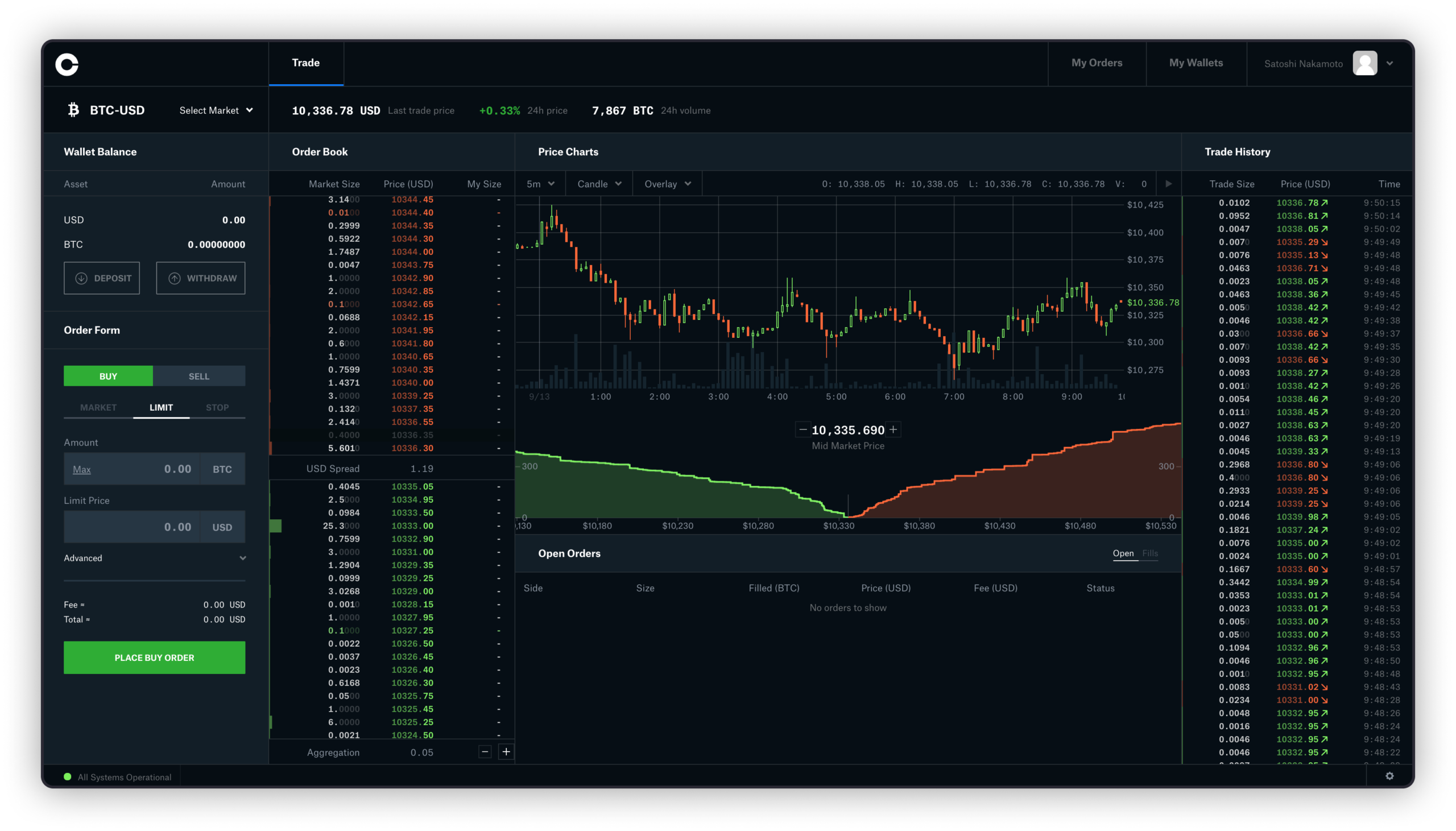

Coinbase Professional – The Coinbase Margin Dealer Platform

Coinbase Professional is a margin buying and selling platform by Coinbase, some of the in style crypto exchanges in the US. As a margin dealer, Coinbase allows customers to amplify their buying and selling energy by borrowing funds from the platform.

One of many key options of the Coinbase margin buying and selling platform is the vary of buying and selling pairs accessible to customers. This contains cryptocurrency pairs equivalent to BTC/USD and ETH/BTC, in addition to fiat forex pairs like USD/EUR and USD/GBP.

To start margin buying and selling on the Coinbase Professional platform, customers should meet sure margin necessities relying on the buying and selling pair they choose and the extent of leverage the dealer needs to make use of.

On Coinbase, merchants can select from a plethora of leverage choices, with the utmost leverage being 3x. This can be decrease compared to different margin buying and selling platforms, but these circumstances can nonetheless be sufficient for merchants to extend their returns.

In terms of buying and selling charges, Coinbase Professional prices a maker-taker price of as much as 0.5% for margin trades. There’s additionally a minimal deposit quantity of $10, which is comparatively low in comparison with different margin buying and selling platforms.

One distinctive facet of the Coinbase margin buying and selling platform is the supply of instructional assets and instruments for margin merchants. These assets embody articles, movies, and webinars that cowl a number of matters, together with buying and selling methods and threat administration.

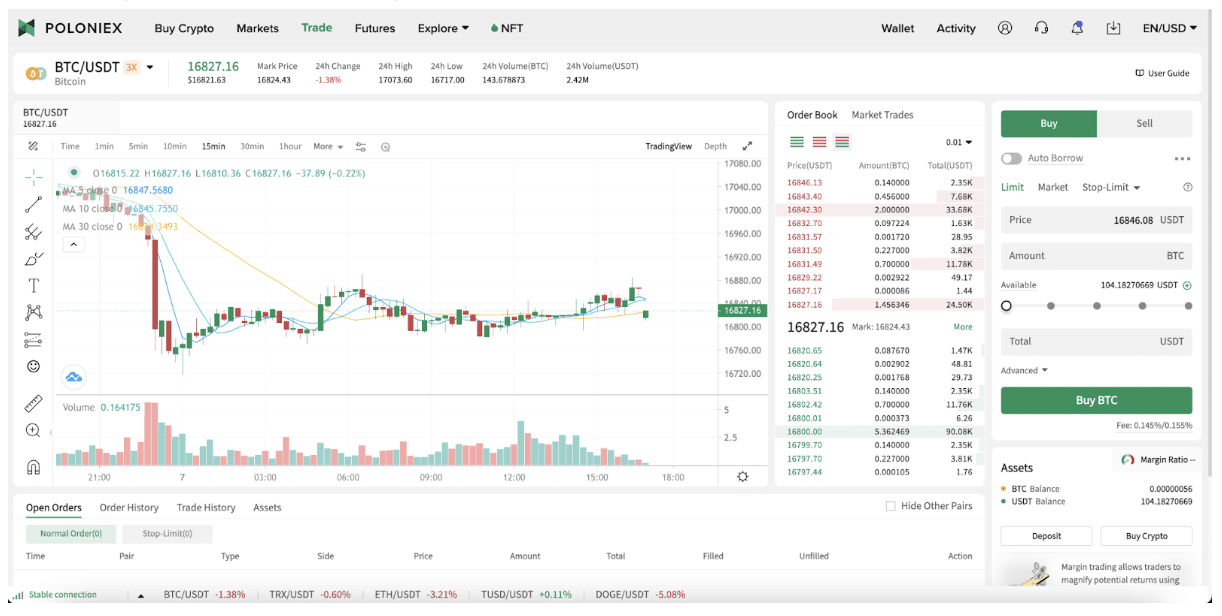

Poloniex – One-Cease Store for Crypto Margin Buying and selling

Poloniex Margin Buying and selling is a well-liked characteristic of the Poloniex cryptocurrency trade that permits customers to commerce with borrowed funds, giving them an opportunity to probably improve their returns on investments. The platform is filled with options and advantages but in addition has some drawbacks that customers ought to concentrate on.

Some of the engaging options of Poloniex Margin Buying and selling is the vary of cryptocurrency pairs accessible for buying and selling (e.g., Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and different in style cryptocurrencies).

Margin necessities on Poloniex differ relying on the buying and selling pair and leverage. The platform has leverage choices from 2.5x to 5x. Aside from inherent dangers, customers must also concentrate on the potential drawbacks of margin buying and selling on Poloniex. The platform doesn’t provide fiat forex pairs, which means that customers should already possess crypto to provoke a margin commerce.

By way of buying and selling charges, Poloniex prices a maker-taker price of as much as 0.125% for margin trades.

As we mentioned beforehand, margin buying and selling is regulated by the related supervisory authority within the US, guaranteeing that merchants have entry to a safe and clear buying and selling setting. Nonetheless, merchants have to do their very own analysis and select respected platforms that provide truthful margin necessities, aggressive buying and selling charges, and an array of complicated order varieties and superior buying and selling interfaces.

One other nice crypto buying and selling platform is eToro. They assist crypto, derivatives buying and selling, margin spot buying and selling, and extra. Nonetheless, eToro doesn’t provide leverage buying and selling choices within the US.

Greatest Cryptocurrency/Bitcoin Margin Buying and selling Ideas

Margin buying and selling amplifies each income and dangers. On this part, we are going to present a few of the greatest cryptocurrency and Bitcoin margin buying and selling suggestions to assist merchants navigate the complexities of leveraged buying and selling and maximize their returns whereas minimizing dangers.

1. At all times Begin with Small Quantities

In terms of buying and selling cryptocurrencies on margin within the US, it’s at all times necessary to keep in mind that it is a high-risk, high-reward endeavor. One key method to mitigate potential losses and decrease threat is to at all times begin with small quantities.

Beginning with small quantities will help inexperienced merchants get a really feel of the market and perceive the mechanics of leverage buying and selling with out risking an excessive amount of capital upfront.

2. Don’t Go All-In at As soon as

One frequent mistake that newbies make when coming into the world of margin buying and selling is placing all their investments into one place. Whereas this could look like a logical choice, because it will increase the potential rewards of a profitable commerce, it additionally introduces important dangers that may result in substantial losses if the commerce goes south.

The implications of such a choice might be extreme, as a result of a failed place can lead to the liquidation of collateral, additional compounding monetary losses. In excessive circumstances, merchants can lose all the pieces they’ve in a single catastrophic commerce, unable to recuperate the funds they initially invested.

Beginning with small quantities and creating a disciplined strategy to cryptocurrency margin buying and selling will help keep away from this situation. Merchants ought to think about diversifying their holdings throughout a number of currencies and belongings, increase positions over time. Not solely does this scale back total threat but in addition will increase the probabilities of success in the long term.

A number of profitable merchants have espoused the significance of persistence and self-discipline in margin buying and selling. For instance, legendary investor Warren Buffet famously mentioned,

“Rule No. 1: By no means lose cash. Rule No. 2: Always remember rule No.1.”

Within the crypto sphere, dealer Nick Leeson, who made hundreds of thousands within the early days of Bitcoin, advises merchants to “management their feelings and commerce with self-discipline” to achieve the high-risk world of crypto margin buying and selling.

3. Don’t Disregard Volatility

Cryptocurrencies are inherently risky belongings, with their costs fluctuating dramatically over quick intervals of time. When mixed with leverage, this volatility might be amplified, leading to higher potential rewards and better dangers.

In margin buying and selling, merchants borrow funds from the trade to amplify their returns on a specific commerce. Nonetheless, this additionally signifies that losses might be equally amplified, and speedy decreases out there can result in margin calls and the liquidation of positions.

To handle this threat, it will be significant for merchants to determine clear threat administration methods. One strategy is to set stop-loss orders, which mechanically shut a place if the worth of an asset falls under a sure threshold.

One other technique is to diversify investments throughout a number of currencies and buying and selling pairs, decreasing total publicity to at least one asset. That is notably necessary within the extremely dynamic crypto market, the place new belongings and developments can emerge quickly and impression costs unpredictably.

4. Study the ABCs of Margin Buying and selling

In crypto margin buying and selling, it’s important to know just a few key ideas to handle your trades successfully. Right here’s a simplified breakdown:

Preliminary Margin: That is the preliminary deposit you place all the way down to open a buying and selling place. It acts as collateral in your margin buying and selling account.

Margin Stage: This represents the minimal sum of money you should maintain in your margin account to assist your open positions.

Upkeep Margin: That is further collateral required to maintain your positions open. As an illustration, should you’re in a brief place and the market worth rises, your margin stage can be affected, probably resulting in a margin name.

Margin Name: That is an alert out of your trade or buying and selling platform indicating that your margin stage has dropped too low. To keep away from liquidation, you’ll want so as to add extra funds to your account.

Liquidation: In case your account can’t maintain the minimal margin stage, the platform might mechanically dump your collateral to cowl the losses, a course of generally known as pressured liquidation.

Crypto Margin Buying and selling: FAQ

Is margin buying and selling crypto dangerous?

Sure, margin buying and selling in crypto is dangerous. It’s like betting extra money than you could have on a race. In case your prediction is flawed, you possibly can lose your cash rapidly.

What’s 10x leverage in crypto?

10x leverage in crypto means you’re betting ten occasions the sum of money you even have. When you’ve got $100 and use 10x leverage, you’re buying and selling with $1,000, aiming for larger wins but in addition dealing with the chance of bigger losses.

Does Binance US assist margin buying and selling?

No, as of March 2024, Binance doesn’t provide margin buying and selling companies.

Can US merchants use leverage?

Sure, US merchants have entry to leverage when buying and selling sure monetary devices, equivalent to futures contracts, choices, and margin accounts supplied by regulated brokers. Nonetheless, the supply and particular rules surrounding leverage might differ relying on the monetary product and the dealer/platform getting used.

Can US residents commerce crypto on margin?

Sure, US residents can commerce cryptocurrencies on margin. Some cryptocurrency exchanges and buying and selling platforms, each inside and outdoors the US, provide margin buying and selling companies to eligible customers, together with US residents. It’s important to adjust to the rules imposed by particular exchanges and to fulfill their necessities, equivalent to minimal fairness thresholds or verification processes.

Can US residents margin commerce on Kraken?

Sure, US residents can interact in margin buying and selling on Kraken. Kraken is a well known and respected cryptocurrency trade that gives margin buying and selling companies to eligible customers, together with these from the US.

Are you able to quick crypto within the USA?

Sure, shorting cryptocurrency is feasible within the USA. Quick promoting permits merchants to revenue from a decline within the worth of a cryptocurrency by borrowing and promoting it with the intention of shopping for it again at a lower cost sooner or later to cowl the borrowed quantity. Nonetheless, it’s important to conduct quick promoting by platforms or brokers that adjust to rules and necessities set by related monetary authorities in the US.

Are you able to commerce crypto on 100x leverage?

You’ll be able to commerce crypto futures on 100x leverage on the BitMart Futures buying and selling platform. Nonetheless, please take into account that that is extremely dangerous, and also you shouldn’t enter trades like that until you might be completely assured you already know what you’re doing. Whereas the potential income you may earn from buying and selling digital belongings on 100 or 50x leverage are excessive, so are the potential losses.

Disclaimer: Please word that the contents of this text usually are not monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native rules earlier than committing to an funding.

[ad_2]

Source link