[ad_1]

Market Outlook #245 (thirteenth November 2023)

Hi there, and welcome to the 245th instalment of my Market Outlook.

On this week’s publish, I will probably be protecting Bitcoin, Ethereum, Chainlink, Polkadot, ImmutableX, Perpetual Protocol, DIA, Saito and Cellframe.

As ever, you probably have any requests for subsequent week, let me know.

Bitcoin:

Weekly:

Every day:

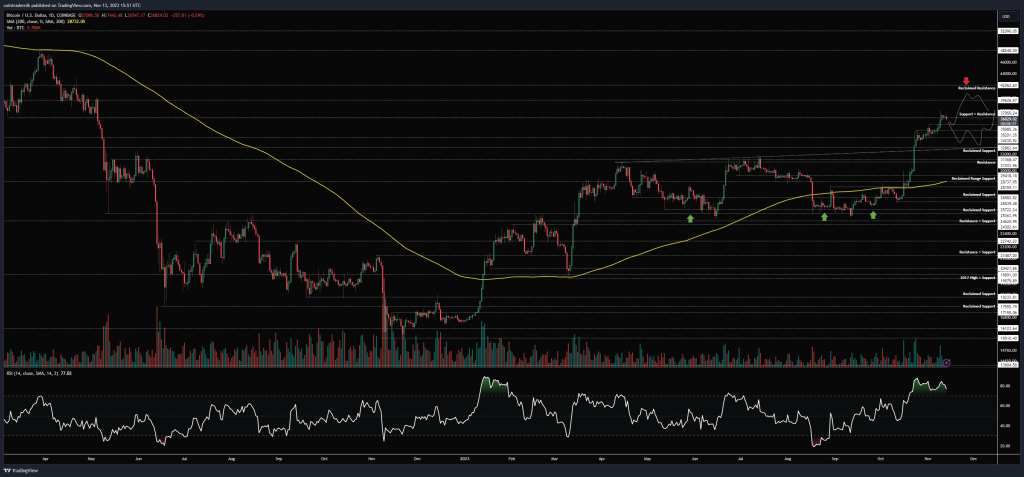

Value: $36,982

Market Cap: $721.671bn

Ideas: If we start by BTC/USD on the weekly chart, we are able to see that worth rallied once more final week off the weekly open, on increased quantity than the earlier week, pushing via the 38.2% fib retracement of the bear market at $36k into $37.1k, poking marginally above that however closing on the stage. We see no indicators nonetheless of momentum exhaustion on this timeframe, and given the shut I’m leaning in direction of continuation of this squeeze increased to fill in the remainder of the hole into $39.6k this week. There may be, in fact, additionally the chance that a number of ETFs are accepted this week (although a slim likelihood), and in that case it’s possible we push all the best way into the 50% fib retracement and reclaimed resistance at $42k. Both means, there’s nothing on the weekly timeframe that implies a longer-term high is in, and if we do dip early this week I’d count on it to be shallow.

Nonetheless, if we drop into the day by day, I’ve marked out two attainable trajectories I’m contemplating from right here. The primary is as above: we get a shallow pull-back in direction of resistance from final week at $36k, discover assist and proceed increased into the resistance ranges between $39.6k and $42k; the second trajectory is that if this divergence in momentum is validated and we shut again inside $35.2k and switch it into resistance, the place I’d then count on the remainder of the lows of that week to be swept into $32.9k and worth to then mark out a backside round there. Thrilling occasions forward, regardless.

Ethereum:

ETH/USD

Weekly:

Every day:

ETH/BTC

Weekly:

Every day:

Value: $2110.58 (0.0571 BTC)

Market Cap: $254.658bn

Ideas: If we start by ETH/USD, we are able to see from the weekly that the pair rallied onerous final week, turning trendline resistance into assist on the weekly open after which pushing into resistance at $2037, wicking above that simply shy of the yearly excessive however closing again marginally above $2037. If this stage now turns assist, I’d count on ETH to start out enjoying catch up, with recent yearly highs above $2172 lastly opening up the transfer into the 38.2% fib retracement at $2425, which I’ve had marked out for a good whereas. That’s the extent I count on the pair to squeeze into over the subsequent couple of weeks if we are able to now maintain above $2037. If we shut the weekly again under $2037, I’d count on a bit extra of a pull-back in direction of $1850 to mark out a higher-low earlier than one other run at yearly highs. Dropping into the day by day, we are able to see that in contrast to BTC there isn’t any momentum divergence right here, and on this timeframe the pair is discovering assist at $2037 early this week, pushing off that stage again in direction of final week’s excessive. Shut the day by day above $2172 and there’s fairly actually no resistance for an additional $250 transfer…

Turning to ETH/BTC, we are able to see that worth depraved into 0.051 final week and located sturdy assist, bouncing off that stage all the best way into prior assist turned resistance at 0.0577 earlier than rejecting and shutting the week marginally under the 200wMA and the Could 2021 lows at 0.0551. Nonetheless, that was fairly the present of energy from bulls off that low and if we see continuation increased this week and worth closes above the 200wMA and prior vary assist at 0.0551, for my part the cyclical backside is prone to be in, with worth then prone to push in direction of the trendline resistance. If we drop into the day by day, we are able to see how we now have bullish construction with higher-highs and lows, and early this week worth is discovering assist above 0.0551, pushing again into 0.0577 as we communicate. Given how sturdy the push was final week off the underside, I’d count on to see 0.0577 give means if retested this week, and worth to squeeze into 0.0594 earlier than discovering resistance. Bears have to see 0.0577 act as resistance as soon as once more right here, with any shut again under 0.0551 now trying like continuation of the longer-term downtrend. Let’s see how the week performs out.

Chainlink:

LINK/USD

Weekly:

Every day:

LINK/BTC

Weekly:

Every day:

Value: $15.33 (41,455 satoshis)

Market Cap: $8.495bn

Ideas: If we start by LINK/USD, we are able to see that the pair continued its ascent final week and exhibits little signal of slowing, pushing via the 200wMA for the primary time since April 2022 and shutting proper on the 23.6% fib retracement of the bear market at ~$16. While quantity nonetheless appears to be like good and there’s no momentum exhaustion on the upper timeframes but, I’d be cautious to leap in proper right here round resistance. If we drop into the day by day, once more we are able to see no indicators of divergence up right here however I’d be on the lookout for a pull-back into $13.30 – or near it – earlier than on the lookout for leveraged longs. That additionally aligns with a 200wMA retest, if we get it. Nonetheless, if we don’t get that, we are able to look to play the squeeze into $21 by shopping for the primary shallow pull-back after a day by day shut above $16.60 with invalidation under at present’s low.

Turning to LINK/BTC, we are able to see extra motive why we shouldn’t be fast to leap in with leverage right here if you’re sidelined, because the pair is urgent up in opposition to the 2022 highs and the 200wMA at 45k-47k satoshis. Weekly shut above this is able to open up one other 15% of upside into the subsequent resistance, however would additionally sign a longer-term reversal and continuation into the 38.2% fib retracement at 76k satoshis, round which there are a number of ranges of resistance. If we briefly have a look at the day by day, we are able to see how there’s some minor divergence up right here however worth is discovering assist at current above prior resistance at 40k satoshis. Except we now shut under that, it’s possible we at the least retest 45k right here. Break and shut above that stage and clearly issues look much more promising for LINK, with solely air between there at 57k satoshis. Nonetheless, both deviate above 45k and shut again inside it, or simply discover resistance under it on a retest this week and break under 40k and I believe we’re prone to transfer 15% decrease into 35.4k satoshis. The development, nevertheless, remains to be very a lot pointing up shifting into 2024.

Polkadot:

DOT/USD

Weekly:

Every day:

DOT/BTC

Weekly:

Every day:

Value: $5.61 (15,156 satoshis)

Market Cap: $7.268bn

Ideas: Starting with DOT/USD, we are able to see from the weekly that after two years of bear market the pair appears to be like to have bottomed, breaking above 2023’s trendline resistance a few weeks in the past and turning it into assist final week, from which worth rallied into the weekly shut at $5.70, reclaiming a number of assist ranges. We are actually consolidating between reclaimed assist at $5.34 and resistance at $6, and if we pull again from right here I’d be on the lookout for the formation of a higher-low above $4.42. If we don’t pull again right here, I’d count on to see any acceptance above $6 result in one other rally into $7.08, the place there’s historic resistance, with a weekly shut above $6 additionally turning construction bullish on this timeframe. Above $7, the cyclical reversal is on and we are able to have a look at that $10-11 space subsequent.

Turning to DOT/BTC, the pair has been in a downtrend for 910 days, dropping 88% of its worth from the all-time excessive throughout that interval. Value fell inside touching distance of the all-time low at 11.8k satoshis a number of weeks in the past and bounced, reversing sharply final week to shut marginally under prior assist at 15k satoshis. We nonetheless have bearish weekly construction and a agency downtrend right here, however momentum is trying extra promising after this rally. Bulls now wish to see a higher-low type above the all-time low and worth to then shut again above 17.8k satoshis from there to start trying like a longer-term backside is in. If we drop into the day by day, we are able to see that we’re additionally sat marginally under the 200dMA, which as capped the pair since early 2022 – acceptance above that and turning it into assist could be a promising signal for a sustained reversal, with 25.6k satoshis the subsequent main resistance above that.

ImmutableX:

IMX/USD

Every day:

IMX/BTC

Every day:

Value: $1.22 (3286 satoshis)

Market Cap: $1.516bn

Ideas: As IMX has solely been buying and selling for round 18 months, each pairs look just about similar and so I’ll focus right here on the Greenback pair.

IMX/USD, we are able to see that worth shaped a backside in September under the $0.52 assist stage, deviating into $0.48 earlier than rallying sharply on excessive quantity into the 200dMA and rejecting. Value then shaped the next low in October above $0.52 and has since been rallying continuous, breaking via the 200dMA at $0.70 and reclaiming that stage as assist, then persevering with increased so far as assist turned resistance at $1.31, which capped the pair earlier this 12 months. This led to a pointy rejection and swift pullback into $0.80, which held agency as assist, and the pair has v-reversed again above $1.10 since. We’ve got the makings of some momentum exhaustion up right here as we come into this 2023 resistance zone, however given the sharp reversal off that preliminary rejection, I’d count on to see $1.31 give means on the subsequent try. If that happens and we flip that stage as assist, no matter momentum indicators I believe it’s possible we take out the 2023 excessive at $1.60 and run into $1.80 resistance. Past that, the remainder of IMX’s first bull cycle awaits in 2024…

Perpetual Protocol:

PERP/USD

Weekly:

Every day:

PERP/BTC

Weekly:

Every day:

Value: $0.70 (1889 satoshis)

Market Cap: $50.764mn

Ideas: Starting with PERP/USD, we are able to see that worth has been held inside this broader vary between all-time lows and resistance at $1.37 for over 500 days, extra lately forming a higher-low above reclaimed assist at $0.51 and pushing into resistance at $0.75. This $0.50-0.75 vary has held for one of the best a part of three months now and given the quantity on the impulse candle off the underside I’m now on the lookout for a weekly shut above $0.75 to verify continuation to the highest finish of the vary later this 12 months. Longer-term, a weekly shut above $1.37 is what we’re for the subsequent part of the cycle to start, however for now so long as we’re above $0.50 the pair appears to be like bullish.

Turning to PERP/BTC, we are able to see that worth had shaped a spread above the all-time low at 1516 satoshis and under prior assist turned resistance at 1942 for months earlier this 12 months earlier than that top quantity breakout candle in September. The pair then retraced all of that candle again into the all-time low final week, bouncing above it however remaining capped by 1942 satoshis. The primary signal, subsequently, {that a} reversal is underway could be a weekly shut again above 1942. If we see that, I’d count on worth to push up into 2600 satoshis, retesting that space as resistance – and above that we come into a very powerful stage on the chart to show again into assist at 3600 satoshis. Bullish above that all-time low, in fact. Briefly dropping into the day by day, we are able to see that worth is now contending with the 200dMA, the trendline and horizontal resistance, so clearing this cluster with some power could be promising certainly. Settle for above 1950 and I believe we’re prepared for the subsequent wave.

DIA:

DIA/USD

Weekly:

Every day:

DIA/BTC

Weekly:

Every day:

Value: $0.30 (811 satoshis)

Market Cap: $33.26mn

Ideas: If we start by DIA/USD, we are able to see from the weekly that the pair has been in a downtrend since April 2021 however that the volatility has drastically diminished on the newest strikes decrease, with some momentum exhaustion coming into play. Value shaped a double backside on the all-time low at $0.215 in Could and September, marginally sweeping that low earlier than pushing off it to show weekly construction bullish as worth closed again above reclaimed assist at $0.26. Since then, the pair has continued to push up, final week closing above $0.296. We are actually sat proper under assist turned resistance at $0.33, however that is the final stage of main resistance earlier than an enormous vary opens up into the subsequent areas of resistance up close to $0.50. If we see that weekly shut via $0.33, I’ll look to purchase spot on a retest if I can get it and search for $0.49 as a primary goal, adopted by $0.58 and $0.78 as the ultimate goal, given how important that stage is traditionally. Longer-term, above that stage, I believe we’re within the midst of a bull cycle for DIA and may simply look to purchase pull-backs, however that’s possible months away but.

Turning to DIA/BTC, the pair remains to be capped by trendline resistance from that April 2021 excessive. A few weeks in the past, the pair shaped a recent all-time low at 704 satoshis however now we have clear development exhaustion down right here, and the pair has since reclaimed assist at 788 satoshis which had beforehand held for a number of months. While we may look to purchase spot right here for a cyclical (12-18 month) place with invalidation on an in depth under 704, I would like to be somewhat extra affected person right here and watch for the trendline breakout and acceptance above 1000 satoshis for that. DIA has by no means skilled a bull cycle regardless of having traded for 3 years, so that is undoubtedly one to control. The cyclical place additionally differs from the short-term commerce outlined within the Greenback pair, so relying in your preferences there are two methods to play this.

Saito:

SAITO/USD

Every day:

SAITO/BTC

Every day:

Value: $0.0085 (23 satoshis)

Market Cap: $18.063mn

Ideas: As each pairs for SAITO look very related, I’ll focus right here on the Greenback pair.

SAITO/USD, we are able to see that worth lately shaped a low at $0.0065 and has rallied off that low above trendline resistance that has capped the pair all 12 months. While this breakout is promising for bulls, the pair stays under the 200dMA and is now sat round assist turned resistance at $0.0086. This space is especially important traditionally for SAITO, having additionally been the Could-June 2022 backside and the unique assist stage when buying and selling started, so a powerful reclaim of this stage as assist would, for my part, make it possible that the underside is in right here. Affirmation of this is able to be a weekly shut above $0.01. In that state of affairs, I believe the pair pushes up into the 360dMA and prior assist round $0.0125 earlier than discovering any additional resistance after which makes a run for the 2023 excessive at $0.023, starting its subsequent bull cycle. Clearly, if we see the pair reject right here and shut again under that trendline, this has been a deviation / failed breakout and we are able to count on the underside to be retested on the very least…

Cellframe:

CELL/USD

Weekly:

Every day:

CELL/BTC

Weekly:

Every day:

Value: $0.225 (610 satoshis)

Market Cap: $6.493mn

Ideas: Starting with CELL/USD, we are able to see from the weekly that the pair stays capped by trendline resistance from the all-time highs and the earliest buying and selling days, having spent most of its price-history in a downtrend but in addition having consolidated for over 500 days above the all-time lows. Value has lately turned weekly market construction bullish by closing above $0.185 and is now consolidating under $0.245 as resistance, with any acceptance above this stage opening up one other retest of that trendline overhead, in addition to prior assist at $0.37. I’m very a lot nonetheless in my spot place right here and am on the lookout for a weekly shut above the trendline and above $0.37 to verify that the primary part of CELL’s first bull cycle is starting. Contemporary all-time lows stay my invalidation right here and I’m seeking to maintain this for the majority of the cycle.

If we flip to CELL/BTC, we are able to see that the pair has been flat for the previous 168 days above the all-time low however under prior assist turned resistance at 770 satoshis. Extra necessary than that, nevertheless, is the extent above it at 1150 satoshis. That can also be the August 2021 backside and so a weekly shut above 1150 would flip weekly construction bullish and reclaim that historic stage as assist. If you’re on the sidelines on the lookout for an entry, you could possibly look to enter both above that stage or incrementally between right here and there. I’m personally centered right here on the Greenback pair for my general positioning.

And that concludes this week’s Market Outlook.

I hope you’ve discovered worth within the learn and thanks for supporting my work!

As ever, be happy to depart any feedback or questions under, or e mail me instantly at nik@altcointradershandbook.com.

You have to be logged in to view this content material.

You possibly can register for entry to the Premium Content material through the sign-up type under or right here.

[ad_2]

Source link