[ad_1]

Market Outlook #246 (twentieth November 2023)

Hey, and welcome to the 246th instalment of my Market Outlook.

On this week’s put up, I shall be overlaying Bitcoin, Ethereum, Polygon, Avalanche, Uniswap, Beam, Sushi and LayerAI.

Most of those have been reader requests this week – as ever, ship these throughout to me for subsequent week’s inclusion if there’s one thing particular you need taking a look at.

Bitcoin:

Weekly:

Every day:

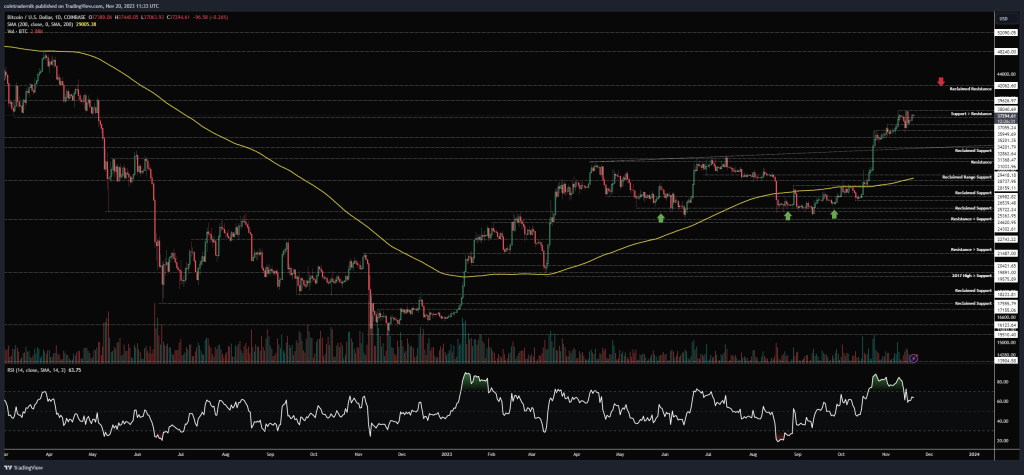

Worth: $37.263

Market Cap: $728.411bn

Ideas: If we start by taking a look at BTC/USD, on the weekly timeframe we are able to see that worth closed final week at marginal new yearly highs, having depraved decrease in direction of the prior weekly low earlier than bouncing again above the $36k space and shutting shy of $38k resistance. While this was an excellent present of power from bulls and there are nonetheless no indicators but that we’ve got topped on this timeframe, the actual fact we now have three consecutive weekly lows unswept because the breakout candle is one thing to bear in mind for once we inevitably do mark out a neighborhood prime. We’re sat proper round prior assist right here and above $38k we’ve got no resistance into $39.6k, which I feel can be a pit cease earlier than the inevitable run into that main confluence of resistance at $42k: that is the place we’ve got an necessary historic degree in addition to the 50% fib retracement of the whole bear market. Little question, if we are able to settle for above final week’s excessive this week, then that’s the extent we’re headed for earlier than marking out any prime. If, nonetheless, we wick above $38k and shut the weekly again beneath it, I feel it appears to be like extra possible we want some type of sweep of draw back liquidity earlier than continuation.

Turning to the day by day, we are able to see that worth is making greater lows on the day by day having reset RSI after the momentum divergence, and prior resistance has develop into assist at $36k. Holding above that early this week is vital – break beneath it and I feel we’re taking a look at a transfer again in direction of $34.2k in any case. Above it, nonetheless, I feel we proceed to push, with day by day closes above $38k opening up the following leg greater after this consolidation in direction of $39.6k after which $42k. Nothing else so as to add right here actually besides that, if we do get a dip after this enormous rally, I might be wanting on the vary between $31k-34k as a first-rate shopping for alternative for 2024.

Ethereum:

ETH/USD

Weekly:

Every day:

ETH/BTC

Weekly:

Every day:

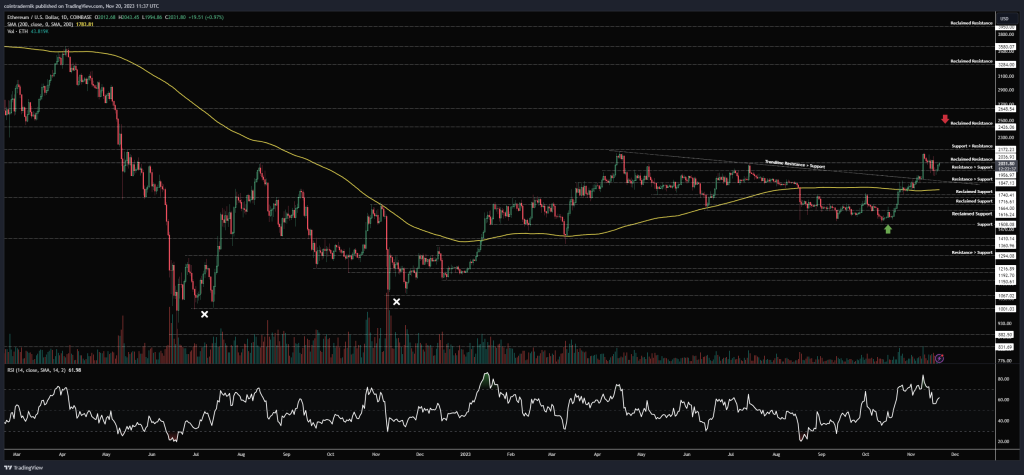

Worth: $2029 (0.05447 BTC)

Market Cap: $244.205bn

Ideas: If we start by taking a look at ETH/USD, we are able to see from the weekly that worth moved decrease to retest the trendline as assist, bouncing and shutting proper again close to the weekly open, just under reclaimed resistance at $2037. There may be nothing about this that at the moment appears to be like bearish to me: we’ve got a robust trendline breakout, with that trendline appearing as assist, and consolidation proper at an necessary resistance degree. Above $1850, this stays the case, for my part. If we shut the weekly again beneath $1850, it’s possible we transfer to retest that $1717-1740 vary as assist, the place bulls would search to kind a higher-low. However for now, I anticipate to see any acceptance above $2037 this week result in $2172 giving means after which a squeeze to fill within the hole into $2425. Dropping into the day by day, we are able to see that RSI has reset as worth retraced into resistance turned assist, failing to shut beneath $1957 on a number of makes an attempt. From there, worth has pushed up into $2036, which is vital resistance. Bulls wish to see a day by day shut above this adopted by that degree appearing as assist. If we see that, lengthy your longs in direction of $2425. On this timeframe, indicators of weak point can be rejection right here adopted by a day by day shut beneath $1957.

Turning to ETH/BTC, we are able to see that worth rejected above the 200wMA once more final week, with 0.0577 appearing as resistance and sending the pair again beneath 0.055, with it closing at 0.0538. We’re at the moment sat between reclaimed assist at 0.053 and the 200wMA as resistance. Clearly, the bullish state of affairs right here can be a weekly reclaim of 0.055 as assist – in that state of affairs, I feel we see ETH outperform for a number of weeks, pushing up into that trendline. Nevertheless, if we now reject the 200wMA once more and begin closing beneath 0.053, I feel the yearly lows at 0.051 get taken out and worth runs into 0.0487. Trying on the day by day, we are able to see how 0.0533 is appearing nearly as good assist at current however day by day construction is bearish following the break again beneath 0.055; bulls really want to see that degree flipped as assist as soon as once more after which we are able to anticipate to see one other check of 0.0577. Very clear construction right here.

Polygon:

MATIC/USD

Weekly:

Every day:

MATIC/BTC

Weekly:

Every day:

Worth: $0.858 (2303 satoshis)

Market Cap: $7.972bn

Ideas: If we start by taking a look at MATIC/USD, on the weekly we are able to see from the weekly that worth has rallied for a number of weeks after forming a backside above reclaimed assist at $0.47, pushing by means of the 200wMA a few weeks in the past after which rejecting simply shy of $1 resistance final week, with worth now sat above reclaimed assist at $0.75 and beneath $0.93 as resistance. From right here, I might anticipate to see the 200wMA act as assist if that is to stay short-term bullish, with any weekly shut again beneath $0.75 opening up a deeper retracement in direction of $0.62 to kind a higher-low above the September-October backside there. If $0.75 holds this week, I might anticipate one other crack at $1 to observe with nothing above that for an additional 30% into $1.31. Dropping into the day by day, we are able to see how worth rejected proper across the 38.2% retracement of the bear market, with the 50% confluent with that $1 space. Clearly, for bulls, $0.92 can’t now act as resistance on a retest from beneath, else we’ve got a decrease excessive and one would think about a deeper pull-back would observe, with the 200dMA aligned with reclaimed assist at $0.68 as a primary space of curiosity. Settle for again above $0.92 and that is gonna squeeze a lot greater, in my view.

Turning to MATIC/BTC, we are able to see right here that worth rejected beneath the 200wMA, confirming it as resistance at 2450 satoshis and is now sandwiched between reclaimed assist at 2100 and that 200wMA and prior assist. Closing the weekly again above this could be a vastly promising signal for bulls, and I might anticipate a niche fill to observe again in direction of 3200 satoshis from there. If we shut the weekly again beneath 2100, that invalidates numerous this construction and bulls are again at sq. one, with the multi-year lows at 1700 satoshis in plain sight…

Avalanche:

AVAX/USD

Weekly:

Every day:

AVAX/BTC

Weekly:

Every day:

Worth: $22.17 (59,514 satoshis)

Market Cap: $7.926bn

Ideas: Starting with AVAX/USD, we are able to see from the weekly that worth has been on a tear this previous few months, rallying from the multi-year lows at $8.60 all the best way into $24.77 final week, closing marginally above assist turned resistance at $21.70 that had capped the highs all yr. Quantity continues to develop but when we now see worth break again beneath $21.70, I might be on the lookout for $18 to carry as a higher-low given the power of the rally. Trying on the day by day for extra readability, we are able to see how above this degree there’s little or no resistance in any respect again into $30, so any alternative to get lengthy on a pull-back right here can be golden; there’s some momentum exhaustion creeping in and if we do see worth retrace into $18, I shall be on the lookout for indicators to get lengthy on the decrease timeframes, with a view to carry for that $30 degree. Beneath $18, a deeper pull-back would have us wanting on the vary between $12-15 for entries. In fact, if we aren’t gifted a pull-back in any respect and $21 acts as assist this week, a day by day shut above $25 will possible result in the remainder of that vary getting crammed in fairly rapidly.

Turning to AVAX/BTC, we are able to see that worth has rallied proper into a significant degree of prior assist turned resistance, proper on the Could 2022 backside round 60k satoshis. Final week, worth depraved above this degree however closed again on the degree, and we now have a very sturdy vary of reclaimed assist beneath at 48.5-41k satoshis the place a higher-low could look to kind. If we do see that higher-low formation, and that aligns with an entry primarily based on the Greenback pair, the following space of resistance above 60k is that trendline and the 23.6% fib retracement at 84k satoshis…

Uniswap:

UNI/USD

Weekly:

Every day:

UNI/BTC

Weekly:

Every day:

Worth: $5.26 (14,109 satoshis)

Market Cap: $3.969bn

Ideas: Starting with UNI/USD, we are able to see that worth has lastly turned market construction bullish once more on the weekly after deviation beneath assist at $4.21 led to a bounce off trendline resistance turned assist and subsequent rally again above the extent, with worth closing firmly above $4.75 and persevering with greater. We at the moment are sat with $4.75 having acted as assist final week and $5.68 as resistance above; if we are able to maintain above $4.75, I might anticipate this minor resistance to present means with $6.30 the main degree above to observe for. Nevertheless, if we see worth break beneath that reclaimed assist ultimately week’s low, I’m on the lookout for a return to $4.21 for a possibility at a leveraged lengthy. I do have a spot place however I wish to get levered publicity as near $4.21 as I can get it if potential. Dropping into the day by day, we are able to see how worth reclaimed the 200dMA which is now appearing as assist, however given how that performed out final time (August) it supplies confluence for the significance of holding above $4.75 right here for bulls. Above $5.68, there’s air into $6.30 after which into $7.50. Let’s see if we get the golden alternative for a leveraged lengthy…

Turning to UNI/BTC, we are able to see that worth broke beneath the double backside at 14.4k satoshis a number of weeks in the past, capitulating into multi-year assist at 12k satoshis after which reclaiming 14k satoshis as assist since. Worth is now sandwiched in between prior assist turned resistance at 15.3k satoshis and assist at 14k. If this degree provides means once more, I feel 12k is getting taken out and worth runs the all-time low at 9.9k satoshis, which might be an unbelievable long-term shopping for alternative if we’re to anticipate UNI to stay necessary subsequent cycle. Till that is again above 17k satoshis, nonetheless, I don’t assume it appears to be like notably sturdy.

Beam / Advantage Circle:

BEAMX/USD

Every day:

Worth: $0.0092 (25 satoshis)

Market Cap: $400.281mn

Ideas: While I’m conscious MC is now BEAM or BEAMX, for the needs of study I’ve shared the MC/USD chart right here in order that we are able to see all of price-history.

this, we are able to see how sturdy the reversal has been since turning the 200dMA into assist, with worth now pushing up once more $0.93 as resistance, with that degree additionally being the final main resistance degree between right here and the following degree – 100% greater at $1.88. We’re seeing some momentum exhaustion right here as we come into this resistance, so if we’re to mark out a neighborhood prime it will possible be round right here, however I might anticipate any pull-back into $0.60 to be wolfed up given the power proven up to now. For these on the lookout for an entry, I might search for $0.60-0.65 as a primary space of curiosity for spot, adopted by $0.44 if you’re fortunate sufficient to get it. For these already on the prepare, benefit from the trip, as I’m anticipating a minimum of $4 to be hit in 2024.

Sushi:

SUSHI/USD

Weekly:

Every day:

SUSHI/BTC

Weekly:

Every day:

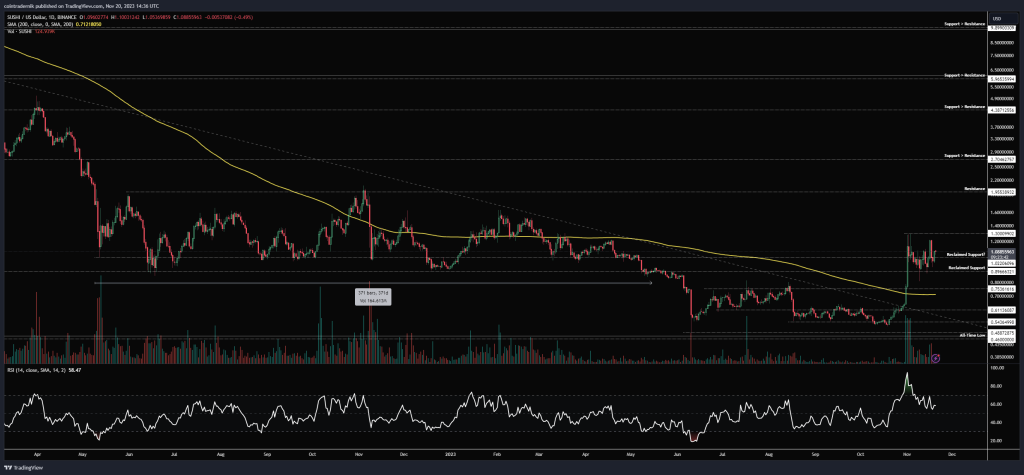

Worth: $1.08 (2892 satoshis)

Market Cap: $208.653mn

Ideas: Starting with SUSHI/USD, we are able to see from the weekly that worth has performed out its bear market in a textbook trend, capitulating into $0.48 (simply above the all-time lows) in Could earlier than forming a multi-month vary above this degree. Worth then ripped greater, rallying by means of $0.75 to show weekly construction bullish and persevering with by means of the year-long assist for, 2022 at $0.90. Worth has since been consolidating above that degree as reclaimed assist, and persevering with to carry above this degree can be very promising certainly for SUSHI bulls. If we do get a pull-back, look ahead to a pointy wick beneath $0.90 in direction of $0.75 and fast reclaim of the extent as assist. That may be a sign to get lengthy if we see it. If we drop into the day by day for readability, we are able to see how a swift transfer into $0.75 would additionally mark out a retest of prior resistance and the 200dMA as assist, however I don’t know if we’re going to be granted such a possibility. If not, I might be on the lookout for a day by day shut above $1.30 after which look to lengthy the following pull-back for the vary play again into $2.

Turning to SUSHI/BTC, we are able to see that not like the Greenback pair that is nonetheless capped by trendline resistance from the 2021 highs, however weekly construction is now bullish and worth is consolidating above prior resistance at 2700 satoshis. Clearly, the important thing right here for bulls is to carry this degree as assist after which see a excessive quantity breakout above the trendline, reclaiming the Could 2022 lows at 3900 satoshis as assist within the course of. If and once we see that, little doubt the start of SUSHI’s subsequent bull cycle is underway, for my part. If this trendline caps worth right here nonetheless and we transfer again beneath 2700, I feel we see the all-time lows retested, with a deviation and reclaim of 1830 being the golden alternative and certain the spring for the following cycle to start. Let’s see how issues unfold…

LayerAI:

LAI/USD

Every day:

Worth: $0.0124 (33 satoshis)

Market Cap: $3.951mn

Ideas: Lastly, let’s check out LayerAI – a microcap that has began wanting very promising, notably given the AI narrative that’s certain to develop in 2024.

If we take a look at LAI/USD, we cam see that worth misplaced 97% of its worth from the all-time excessive again in March into an all-time low at $0.005 in October, then rallying off that low to reclaim the June assist at $0.0082 a number of weeks in the past on rising quantity. Worth additionally closed above trendline resistance, turning it into assist, and has since been consolidating between $0.0082 as assist and resistance at $0.012, the place the 200dMA can also be sat. We’ve day by day bullish construction right here additionally, and I’ve been shopping for inside this vary the previous week, wanting so as to add on acceptance above $0.014, with a view to carry for a full cycle (new all-time highs possible, in my view). Invalidation is an in depth again beneath $0.0082.

And that concludes this week’s Market Outlook.

I hope you’ve discovered worth within the learn and thanks for supporting my work!

As ever, be at liberty to depart any feedback or questions beneath, or e-mail me immediately at nik@altcointradershandbook.com.

[ad_2]

Source link