[ad_1]

Binance, the world’s main digital asset alternate, has exhibited resilience and progress following its current settlement with the US regulatory our bodies. The settlement, which addressed allegations of cash laundering and sanctions evasion, marked a pivotal second for Binance.

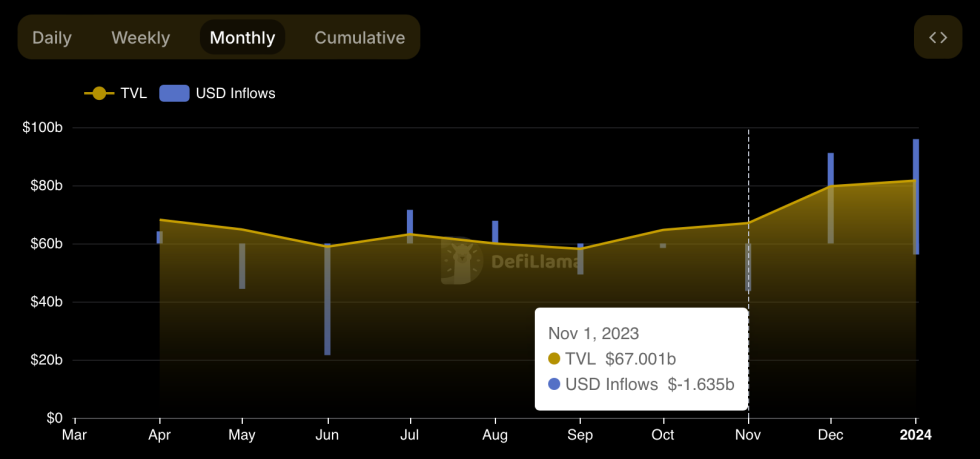

Since November 21, when the settlement was reached, Binance has skilled a surge in web inflows, amounting to roughly $4.6 billion. This knowledge, revealed in a put up by Satoshi Membership on X, reveals the platform’s resilience amid these challenges.

📊 Regardless of current authorized challenges and management adjustments, @binance has seen web inflows of $4.6 billion since its November settlement with US companies.

In January alone, it attracted $3.5 billion, marking its strongest month since November 2022. pic.twitter.com/hMZZB3kK3U

— Satoshi Membership (@esatoshiclub) January 18, 2024

Binance Influx Resurgence Put up-Settlement

January 2023 emerged as a very affluent month for Binance, witnessing web inflows of $3.5 billion. This determine surpasses any full month’s influx since November 2022 and signifies a considerable rebound from the alternate’s myriad challenges in the direction of the tip of final yr.

These challenges weren’t insignificant; they included notable fines imposed by a US courtroom on Binance and its CEO, Changpeng Zhao (CZ), for costs associated to alleged cash laundering operations initiated by the US Commodity Futures Buying and selling Fee (CFTC).

To place into perspective how a lot Binance has recovered following a tumultuous interval final yr: After former CEO Changpeng Zhao stepped down and the alternate agreed to a considerable $4 billion nice with US regulators, the alternate skilled a major outflow of over $1 billion in a single day.

Subsequently, weekly inflows struggled to exceed $800 million, culminating in a web outflow of $-1.63 billion in November, in keeping with knowledge from DeFillama.

Nevertheless, a turnaround started in December, and the alternate’s weekly inflows persistently surpassed $1 billion weekly, totaling over $3 billion month-to-month. This upward pattern has continued into the present month, with inflows nearing $4 billion, signaling a sturdy restoration for the main crypto alternate.

International Growth And BNB’s Resilience

Regardless of Binance’s hurdles final yr, the alternate has continued to make its presence recognized. The alternate has lately prolonged its world footprint by launching Gulf Binance in Thailand, a three way partnership with Gulf Innova. This transfer goals to cater to the Thai market by providing a platform for buying and selling digital belongings with native foreign money pairs.

The alternate’s native token, BNB, has additionally demonstrated resilience. After a dip under $230 in November, BNB has steadily climbed, buying and selling above $300 on the time of writing. This upward trajectory of BNB, with its buying and selling quantity exceeding $1 billion, mirrors the alternate’s restoration and progress trajectory.

Moreover, Binance continues to guide the crypto alternate market, as evidenced by knowledge from Coinmarketcap. With a 24-hour buying and selling quantity surpassing $14 billion, Binance comfortably outperforms rivals comparable to Coinbase and Kraken, which recorded $2.7 billion and $999 million in buying and selling quantity up to now day.

Featured picture from Unsplash, Chart from TradingView

[ad_2]

Source link