[ad_1]

Quarterly Report for Synthetix, Quarter 1 of 2024: January — March.

👉Q1 Highlights

⭐ Spartan Council/CCs: Andromeda Scaling & L1 Perps⭐ Grants Council: sUSD Bridge UI⭐ Ambassador Council: OP Grants

The primary quarter of 2024 was a interval of intense progress and improvement for Synthetix, marked by vital technical developments and a bolstered dedication to community-driven governance. Let’s take a minute to overview a number of the highlights and challenges from the final three months.

The Andromeda invite-only Alpha went dwell proper originally of the yr. You’ll keep in mind, again in 2023, Kain proposed a collection of experiments to check the viability of the flagship Synthetix product exterior of the quick neighborhood. Out of an abundance of warning, the deployment remained comparatively constrained for a lot of the quarter with very restricted LP and OI caps, but it surely was unleashed proper on the finish of March and has since seen almost $500 million in quantity. In simply 5 days, the goal milestone of $10 million in LP collateral was reached.

The following main milestone is $100 million in every day quantity. At the moment, the 7-day common every day quantity hovers between $10–20 million. This couldn’t have come at a greater time, because the scaling of Perps V3 has coincided with a renewed curiosity in Base. Since its launch in 2023, TVL on Base has hovered between $300–500 million. Throughout the month of March that determine doubled, and transaction quantity has elevated considerably as properly.

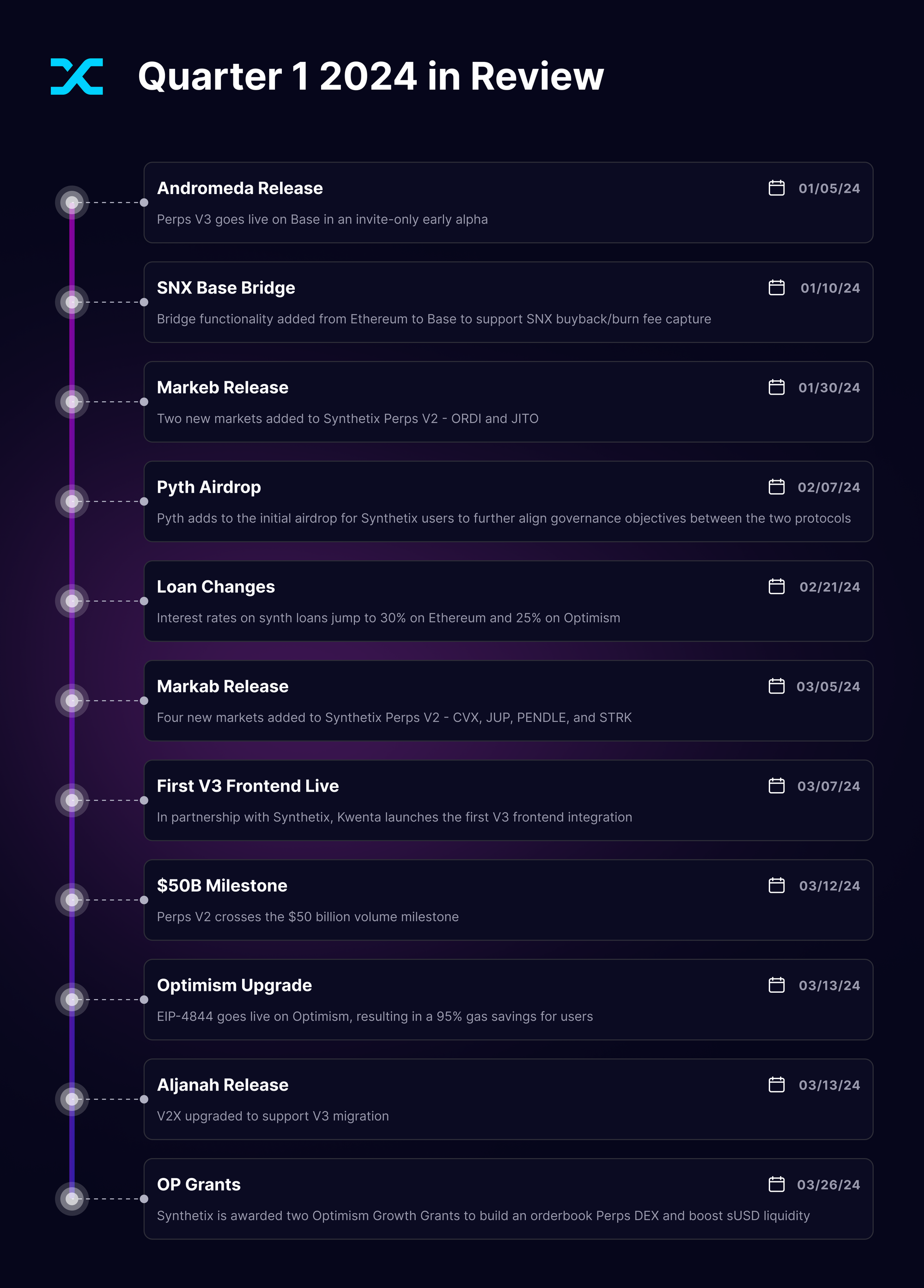

In one other main occasion this quarter, Perps quantity on Optimism surpassed $50 billion! This can be a monumental milestone that underscores the protocol’s strong progress during the last couple of years. This achievement not solely highlights Synthetix’s robust market presence, however is a testomony to the demand for decentralized perps markets. The protocol continues to exhibit a powerful dedication to offering a scalable and environment friendly buying and selling expertise to customers and we are able to’t wait to see what V3 brings!

This quarter, a V3 use case for SNX LPs was additionally added in a strategic partnership with Ethena. Ethena is the creator of the yield bearing, decentralized stablecoin USDe. On the finish of final yr, they approached Synthetix requesting an L1 Perp to execute a portion of their yield technology technique (capturing the funding price on by-product positions). Synthetix agreed to be the infrastructure supplier on this initiative and the product is anticipated to go dwell subsequent month.

The Ambassadors efficiently secured two Optimism Grants this previous quarter. One grant targeted on enhancing sUSD liquidity, a strategic initiative geared toward bolstering the soundness and value of the Perps V2 buying and selling stablecoin. The second grant gives funding to create a best-in-class orderbook Perps DEX — an innovation that continues to revolutionize the DeFi buying and selling expertise. These grants not solely exhibit the Ambassadors’ efficient illustration and advocacy for the protocol, but in addition spotlight Synthetix’s dedication to steady evolution and always increasing choices that can serve to attract new customers to the protocol sooner or later.

👉Challenges

The most important problem this previous quarter, and one which may be sticky the remainder of the yr, is the problem of the legacy debt pool skew. It has been a long-standing situation that tends to get exacerbated throughout bull runs as customers pile into one facet of a specific commerce. Earlier than the protocol launched delta impartial Perps markets, the preferred product was spot synth publicity to cryptocurrency property — most notably, sBTC and sETH. A lot of the opposite spot choices have been unwound, however the unbalanced positions that customers soak up these spot markets require a better c-ratio for LPs and require stakers to take a extra lively position in hedging.

A number of options have been proposed to handle this situation and a few of them started to take form this quarter. The difficulty price price on loans was raised from 0% to 40%, ETH Wrapper parameters had been up to date, and legacy V2 loans had been finally deprecated to use some reverse strain to the market dynamics that generate the skew. The final word objective is to unwind the spot choices fully, as they generate threat for the protocol with nearly no charges.

One other problem this quarter got here simply after the brand new yr when there was suspicious buying and selling exercise on a number of centralized exchanges. These exchanges, together with Synthetix, depend on wholesome arbitrage exercise to assist market making. Because of the uncommon buying and selling exercise, a variety of arbitragers stopped taking part in particular markets. Fortunately, and this was deliberate as a threat administration measure, the open curiosity for these markets was fairly small. It did, nevertheless, immediate the addition of a brand new threat administration module that will grant the proprietor emergency authority to scale back OI caps to zero for a predetermined listing of property. This proprietor will finally be the danger committee, however till the committee is shaped, the Spartan Council would appoint an interim threat council to serve on this capability underneath their path.

The protocol noticed a little bit of a meta-governance shakeup this quarter as properly. After 4 years serving Synthetix, the present Grants Council would be the ultimate one. The choice to sundown the Grants Council is available in mild of the evolving wants of the protocol and a noticeable decline in quantity and high quality of inbound grant requests. The introduction of a single, technical lead will serve to streamline choice making and be sure that the trajectory of the grants course of extra intently aligns with the long-term, strategic targets of the protocol. The place will serve on the pleasure of the Spartan Council and could be voted in or terminated at any time with a easy majority.

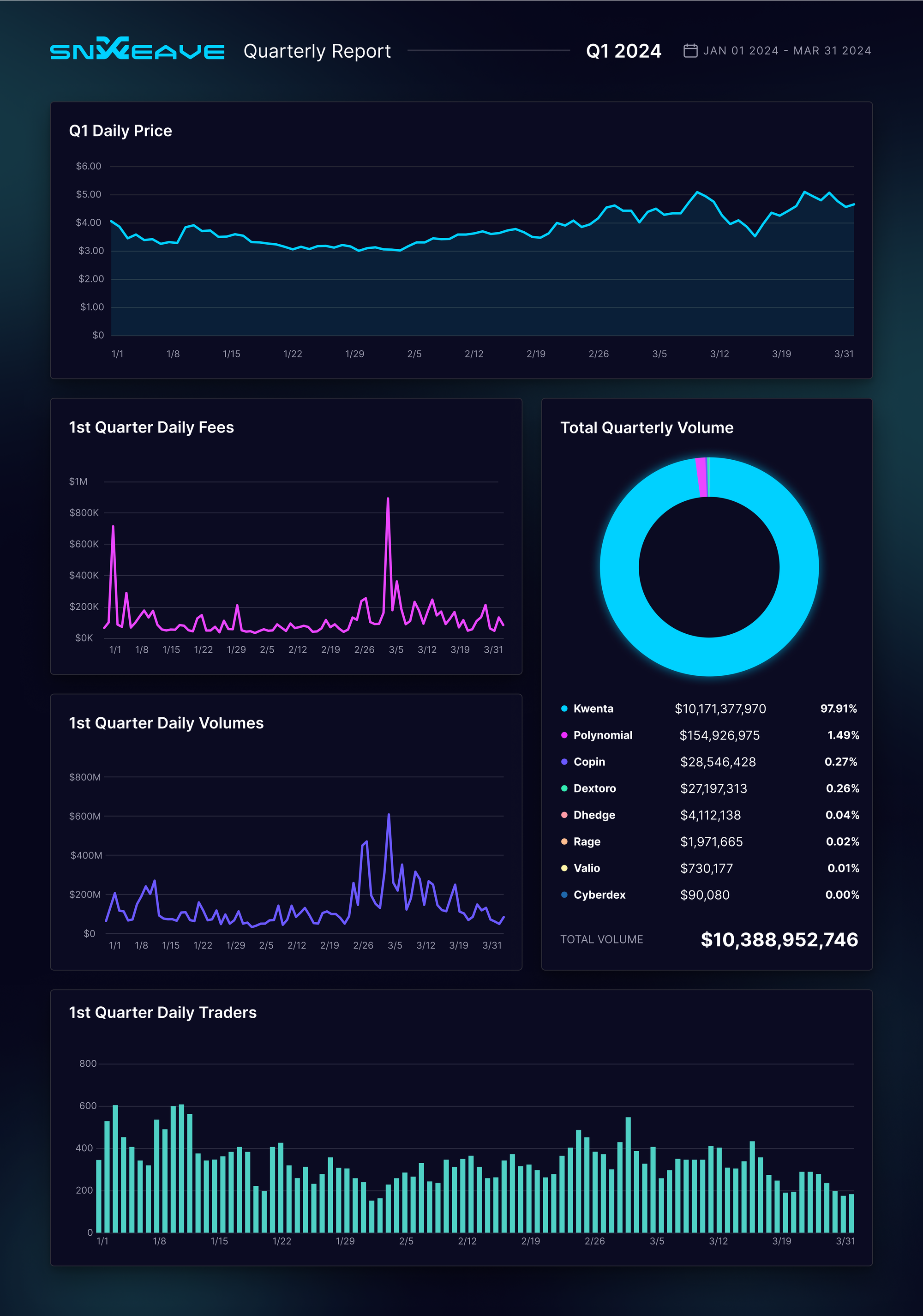

👉Protocol Stats

Overview of Synthetix Q1 Stats: January 2024 — March 2024.

👉Spartan Council

Q1 2024 Spartan Councilors: Adam, Bilby, Cyberduck, Jackson, Kain, Millie, ml_sudo, and Snax Frens

Together with their contribution to the achievement of main Synthetix milestones this epoch, let’s take a minute to overview every little thing else that the Spartan Council was in a position to obtain in simply the final 3 months.

Getting Andromeda over the road was the BIG achievement of This fall of final yr, however that’s the place all of the work actually started in the direction of the trouble of scaling the deployment. In January, we noticed Andromeda formally launch with a restricted alpha launch to permit for additional, dwell testing. SNX buyback and burn was additionally launched and the Base SNX bridge was launched, permitting SNX to be transferred from L1 to Base to be purchased and burned. As a reminder, this resolution was initially chosen by the Spartan Council as essentially the most elegant, least overhead resolution for sharing charges with SNX LPs whereas permitting for USDC LPing on Base. The Council wrapped up the month with the Markeb launch, which launched JTO and ORDI markets on Perps V2.

In February, Pyth Retrospective awards had been introduced, reflecting a dedication to neighborhood stakeholder worth. There have been additionally some modifications made to mortgage parameters, which included will increase within the issuance price and the rate of interest. The objective right here was to encourage mortgage reimbursement and additional strengthen the sUSD $1 peg, which is important for the wholesome perform of Perps V2.

In March, Synthetix introduced one other enlargement of Perps choices including STRK, CVX, PENDLE, and JUP which went out on the Markab launch. Moreover, and in partnership with Synthetix, Kwenta launched the primary V3 integration beta constructed on the brand new Synthetix V3 structure. This integration introduces new options resembling native cross-margin and higher pricing mechanisms which search to enhance consumer expertise.

👉Grants Council

Q1 2024 Grants Councilors: ALEXANDER, Egor, Mike, MoneyManDoug, synthquest

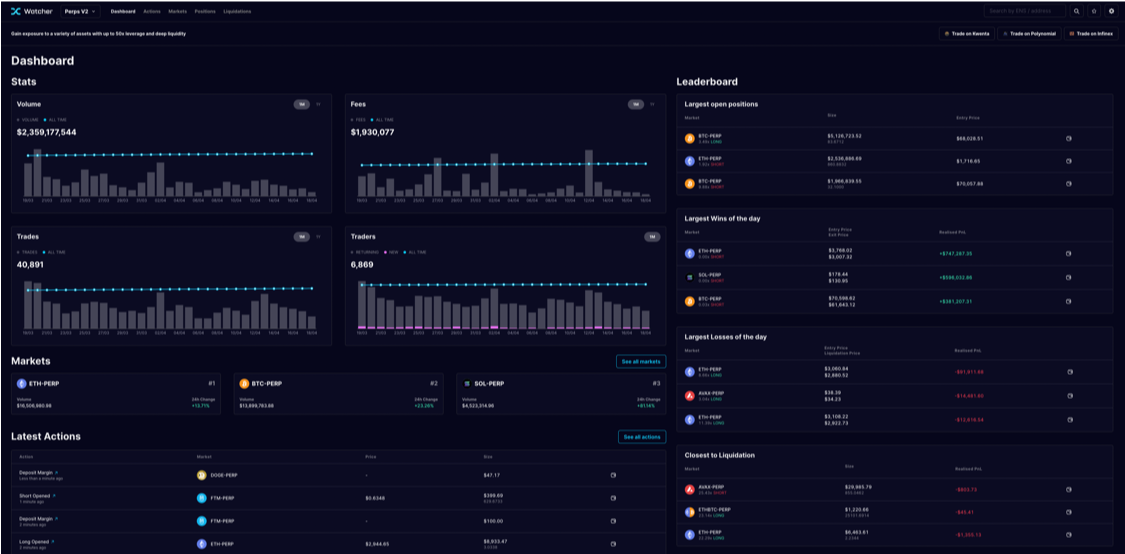

Watcher Web page

Everyone knows the Grants Council has been behind a lot of the success of the Watcher web page prior to now, however in current months they’ve additionally been working to enhance and replace this web site in preparation for V3. This included a rework of the UX/UI with additions resembling: totals for open positions, filter tabs for closed and liquidation positions, and historic account complete buying and selling historical past.

Bots

Along with their common Synthetix Discord bot upkeep and funds (recurring bots such because the ETH/BTC ratio and anti-scam Discord bots), the Council additionally labored on an Arbitrage bot and Discord bots for V3. These V3 bots embody ones for quantity, burn (which changed the inflation bot and was up to date in February to incorporate all-time SNX burns , along with weekly), and shortly charges and OI bots.

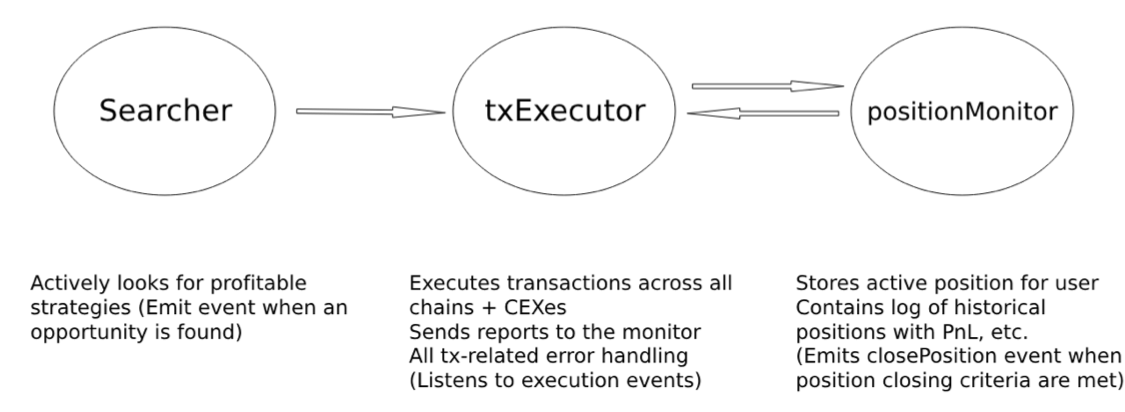

For the ARB bot initiative, the GC funded an enlargement on the present Synthetix V3 SDK to launch the Funding Charge Arbitrage Bot Template, a cutting-edge device tailor-made for capturing funding price arbitrage alternatives between Synthetix and different buying and selling venues. They acknowledged a rising want for arbs on V3 and had been excited to construct easy tooling that enables anybody to arrange an arbitrage bot by working just a few traces of code. This may empower customers to mechanically search, open, and shut arbitrage trades between Synthetix V3 markets and Binance.

This challenge serves as a template to assist newer builders/merchants begin benefiting from delta-neutral arbitrage alternatives between CEX/DEX perps platforms. The present model focuses on Synthetix vs Binance pairs, opening funding-accruing positions on Synthetix, and hedging on Binance.

On condition that the repo is underneath lively improvement, it is strongly recommended that you just run the bot on testnet for some time first to make sure that the configuration is appropriate earlier than placing any capital at stake.

Additional work shall be executed to showcase present and historic arbitrage returns, and this bot will dwell on the Watcher Web page. 📈Completely satisfied Arbing!📉

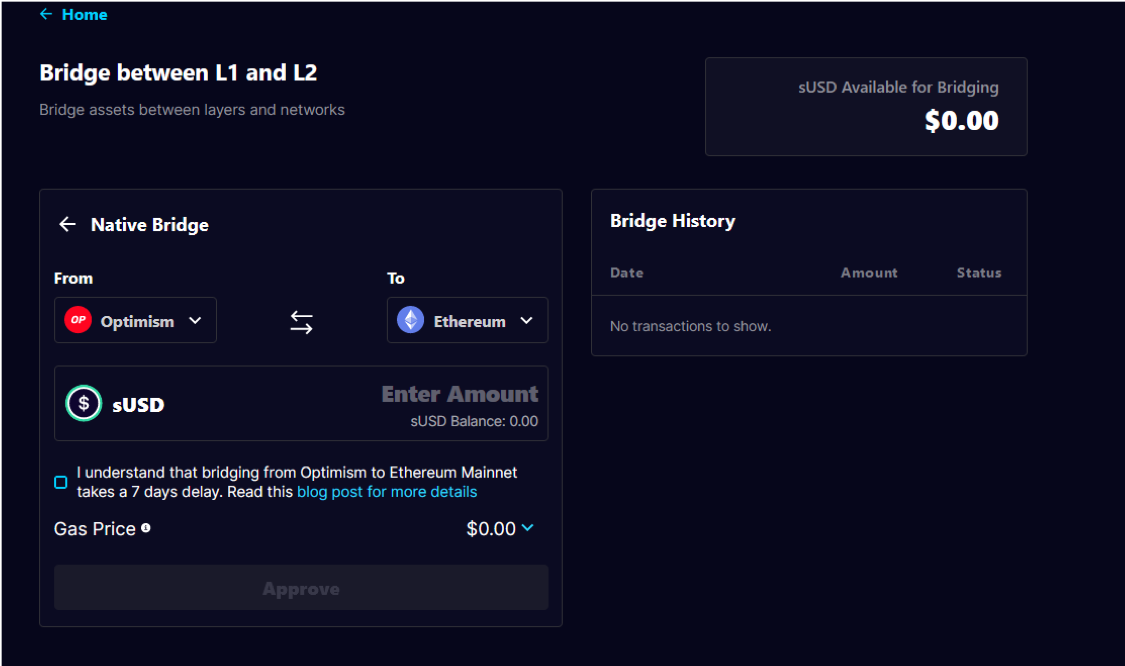

sUSD Bridge

This was an enormous one this quarter — the Grants Council helped convey the sUSD Bridge to Synthetix! After a number of weeks of labor, the sUSD bridge UI (native and on the spot) went dwell in March. This now permits transfers between Ethereum Mainnet and Optimistic Ethereum at a assured 1:1 synth switch, and is accessible by way of the Synthetix Staking web site. This UI leverages a local bridge that the Grants Council created with the Socket bridge aggregator integration. To make use of this device, go to the Synthetix Staking UI Bridge.

How one can switch sUSD:

1. Go to the Synthetix Staking UI Bridge web site

2. Choose both the native bridge or the moment bridge choice:

The native bridge permits for sUSD transfers between Optimism and Ethereum Mainnet with out slippage. Word: transfers by way of the native bridge can have a 7-day ready interval.The moment bridge, using Socket Tech, helps bridging any asset to any chain with a price.

3. Provoke the withdrawal

4. Show the withdrawal (might have to attend a couple of minutes after initiating)

5. For native, wait 7 days

6. Declare the withdrawal

Notifi integration

In the event you recall from final quarter, the Grants Council funded this initiative to convey Notifi to the Synthetix ecosystem and assist enhance staking expertise. Kinds of alerts embody: Synthetix Bulletins, Liquidation Warning, Liquidation Affirmation, Account Snapshots, Declare Reward Reminders, Governance Updates, and C-Ratio Well being Alerts. The GC continues to fund Notifi to permit customers to realize direct entry to real-time alerts on Discord, Telegram, and electronic mail for these reminders. Click on right here to see how you can arrange Notifi in case you haven’t already!

Integrator Charge Report

Lastly, the GC accredited a grant from ML_sudo for an Integrator Charge Report, which is a analysis effort to find out an appropriate price of price sharing by the protocol with integrators. Paying too little or an excessive amount of may lead to incentives which can be misaligned with Synthetix stakeholders (stakers and token holders). At the moment, there isn’t any quantifiable strategy to find out a good and motivating price cut up for integrators, so there’s a want for higher data to assist the Spartan Council make this choice for the long run (proper now a easy flat 20% price share is in place on Andromeda/Base).

The targets, due to this fact, that ML_sudo laid out for this challenge are to realize readability on the revenues earned by integrators and suggest extra nuanced fee constructions (e.g. tiered charges).

This report remains to be in progress, however ML_sudo has held preliminary interviews with 3 frontends already: Kwenta, Polynomial, and Cyberdex.

What’s subsequent for the Grants Council?

Beginning within the new governance epoch, the Grants Council shall be reconfigured right into a single Grants Lead place to make it extra environment friendly and efficient for the present and future state of the protocol. This comes from SIP-364, which specifies that the Grants Lead shall be appointed moderately than voted on by SNX debt share weighting. The SIP additionally redefines the mandate of the grants initiative to offer better focus shifting ahead.

This new Grants Lead shall be somebody with expertise as a technical challenge supervisor, and shall be appointed by the Spartan Council with a majority 5/8 vote in favor for an ongoing time period that may be terminated with the identical vote construction. They may coordinate with varied governance our bodies, in addition to the neighborhood, to handle and ship initiatives inside the new Grants scope.

The Grants Lead shall be liable for:

Sustaining and setting an acceptable finances for ongoing and one-off projectsCoordinating and publishing a abstract of open grant requests required by the CCs, SC, TC, and/or neighborhood and defining the outputs for these requestsProposing a finances to the Treasury Council to cowl ongoing and new Grant requestsConducting due diligence on grant proposals and the work of contractorsEstablishing standards for retroactive grant funding throughout varied classes and sharing these standards usually to make sure broad visibility by potential recipientsProactively figuring out acceptable alternatives that may be addressed by grantsProduct managing the scoping, improvement and supply of priceless initiativesEstablishing common communication with the Spartan Council, together with briefs, memos, studies, and voice calls

If that is one thing that you’re concerned with, and suppose you’d make a great candidate for, click on right here to use by the top of the week! This place will begin with the brand new epoch, as quickly as Could 1st.

👉Ambassador Council

Q1 2024 Ambassador Councilors: GUNBOATs, Kevin, mastermojo, Matt, Westie

Because the governing arm of Synthetix, the Ambassadors stay a relentless voice for the protocol. In Q1 they continued to earn governance assist and recognition all through the ecosystem and better DeFi area. The Council had three primary focuses throughout Q1:

DeFi Governance: Optimism Governance (which concerned Token Home and Citizen Home), in addition to different DeFi DAOs (resembling Arbitrum, Gearbox, Protected, Lyra, Aave, and so forth.)Integrator Help: Present & future — Guiding core contributors, integrators, and extra by way of the processes of grants, retroactive funding, and different methods to safe priceless fundsMarketing Help: Spartan Areas & Integrator Spotlights by way of Twitter

An enormous spotlight for the Ambassadors this Quarter was their help and assist towards ecosystem companions within the current Optimism Grants Spherical (second spherical is at the moment over at finish of April 2024). Detailed breakdown is listed under the place 900,000 OP was secured for Synthetix/Ecosystem Companions.

Now let’s get right into a extra detailed listing of what else the Ambassador Council achieved this previous quarter:

✅ Governance

1. Basic Governance

The Ambassadors at all times wish to ensure they’re staying clear with their voting. As at all times, their exercise could be adopted by way of their wallets on Snapshot and Tally.

Voting Exercise could be adopted utilizing these hyperlinks:

2. Optimism Governance Discussion board Exercise:

The Synthetix Ambassadors stay a serious voice in Optimism Governance, and their respective OP Governance Discussion board Actions could be discovered utilizing these hyperlinks:

3. X/Twitter Engagement

The Council has elevated their on-line engagement much more from final quarter, doubling their variety of Governance Replace posts on X.

Synthetix Ambassadors Governance Updates:

Synthetix Ambassadors Mission Highlight:

4. Accomplice Help

Present Companions

The Ambassadors have continued to examine in on companions and work with them on any suggestions, assist requests, DeFi grant help/steering, and so forth.

Future Companions

The Council plans to concentrate on Perps V3 and Synthetix V3 within the subsequent epoch relating to future partnerships. They’re at the moment in talks with future companions to construct on high of Synthetix Perps both as a frontend or in any other case, and they are going to be persevering with these efforts into the brand new quarter.They’re additionally monitoring modifications to retroactive public items funding (RPGF), which seems to be fruitful for Synthetix on Base & OP as onchain builders and ecosystem companions.

5. Delegation

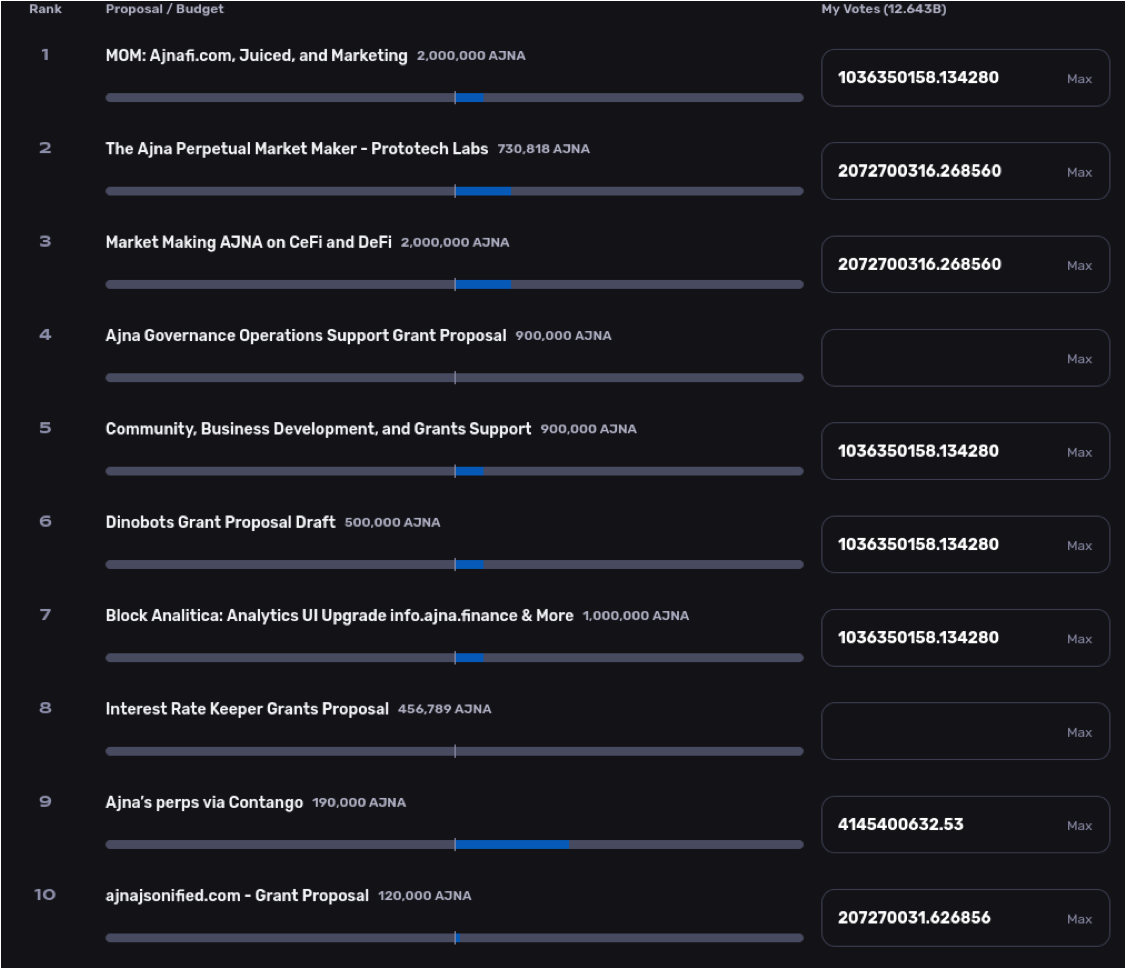

This quarter the Ambassadors accepted AJNA delegations and used their voting energy to vote for Ajna grants!

✅ OP Grants

A very BIG WIN for the Ambassadors this quarter was the outcomes from Spherical 1 of Optimism Grants Cycle 19. The notable winners from the Synthetix Ecosystem embody:

1. Synthetix for a Mission Request for Finest in Class Perps DEX — 400,000 OP: This grant will assist the constructing of an orderbook Perps DEX on Synthetix Perps, that includes a sophisticated orderbook, a number of order varieties (e.g., take revenue, cease loss), an open-source relayer, and the infrastructure to implement these buying and selling guidelines.

2. Thales for a Progress Grant — 200,000 OP

3. Synthetix for a Progress Grant — 200,000 OP: Enhance sUSD liquidity and assist Perps buying and selling competitions.

4. ERC-7412 Tooling + Training for a Builders Grant — 50,000 OP

5. Synthetix IPFS Node — 50,000 OP

Along with supporting ecosystem companions within the newest spherical of Optimism Grants, the Ambassadors expect to proceed to assist most of the similar companions within the upcoming spherical as properly. This listing consists of:

Rage TradePolynomialCoPinSponglyThalesOP Indexer (from Polynomial)TorosdHedgeValioTLXStrandsAmmalgam

At the moment, OP grants can’t be used on Base, however the Council is working with delegates and the OP basis to make this doable.

✅ Spartan Areas

Spartan Areas continued to function vital neighborhood advertising instruments this quarter, with the Ambassadors internet hosting a few different DAOs on behalf of Synthetix.

1. Polynomial (Size: 45 minutes)

2. Pyth (Size: 1 hour)

✅ Synthetix Governance Proposals

The Ambassadors solely had one Synthetix Enchancment Proposal (SIP) that they authored this quarter, but it surely was a rapidly accredited one:

1. SIP-2054: Checklist PENDLE on SNX Perps V2 (creator: GUNBOATs)

What’s subsequent for the Ambassadors?

Within the subsequent quarter, the Ambassador Council shall be specializing in the next:

Acquiring extra Arbitrum delegations and increasing into Arbitrum governanceOther DeFi DAOs (Lyra, Gearbox, Protected, and so forth.)Integrator assist: serving to CCs and integrators with grants, retroactive funding, and so forth.Persevering with advertising supportPursuing additional progress methods for Perps and Synthetix V3Exploring alternatives to scale synth supplyIncreasing presence in Optimism governance (Optimism Token Home, Citizen Home, Grants, RPGF)Increasing affect in DeFi & DeFi Governance

👉Finest Memes from Q1

The quarter of COURSE wasn’t with out humor, so listed here are our favourite memes from the quarter:

[ad_2]

Source link