[ad_1]

💡

This report was supplied by a group member. Whereas Synthetix has reviewed the content material for veracity, these views are usually not essentially endorsed by the Synthetix DAO and/or group.

Lyra protocol gives decentralized choices infrastructure using Synthethix infrastructure to help margining and hedging for LPs. Choices are sometimes tough for the typical person to wrap their head round in comparison with perpetual futures, so on this article we’ll cowl all you’ll want to find out about choices + how Lyra gives infrastructure to commerce them.

Choices Primer

There’s one million completely different guides to choices on the market proper now – in case you’ve by no means heard of them earlier than there’s fairly a deep rabbit gap to go down. On the threat of sounding like a damaged report, I’ll restate a few of that primer materials right here to assist set the scene for Lyra. You possibly can skip this part in case you’re already accustomed to what choices contracts are.

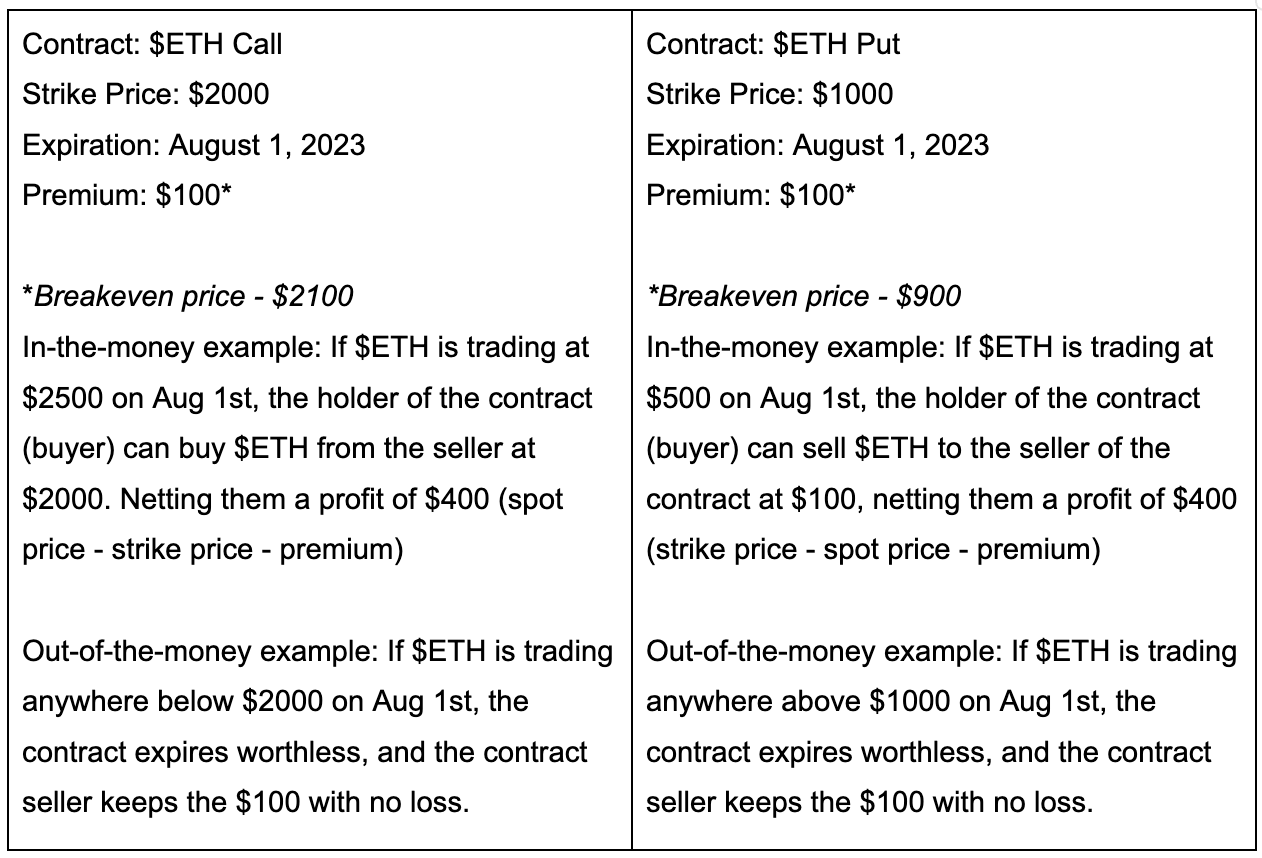

An choice contract is an settlement between a purchaser and a vendor to purchase or promote a particular asset on a specified expiration date sooner or later (expiry date) at a particular worth (strike worth). We’ve got name choices and put choices – Name choices characterize the contract purchaser’s proper to buy the asset sooner or later, whereas put choices characterize the contract purchaser’s proper to promote the asset sooner or later.

The vendor of the contract is then obligated to promote the person that asset (or buy it from then, for put contracts) ought to the contract expire “in-the-money.” The vendor collects a premium from the client when the commerce is opened (this premium is usually priced by an advanced pricing mannequin, extra on that later) – and if the contract expires “out-of-the-money,” the vendor will get to maintain the premium and has no obligation to settle the contract. Let’s check out two fast examples.

So, with these two fundamental contracts we now have 4 completely different trades. Shopping for a name (bullish), promoting a name (bearish), Shopping for a put (bearish), and promoting a put (bullish). With these 4 we will create an entire host of difficult methods. Right here you’ll find some extra complicated methods, tips on how to execute them, and what sort of biases they match.

When placing contracts like this onchain, we’re confronted with a few key hurdles. One among them being pricing. Present choices pricing fashions in tradfi aren’t precisely excellent for tokens – they’re made to cost choices towards equities. One of many key variables they take a look at is implied volatility, which is the market’s opinion of the underlying asset’s probability to vary in worth. Tokens are clearly orders of magnitude extra risky than equities, so if we use a typical choices pricing mannequin we’ll find yourself with mispriced premiums and low curiosity from consumers/sellers

The second hurdle is a well-known one all through all of defi – liquidity. The well-known chicken-and-egg downside of needing to draw liquidity whereas concurrently attracting demand for that liquidity is a comparatively unified one for any defi protocol with a liquidity provisioning element. With choices particularly – not having sufficient liquidity can imply much less strike costs/expiries and decrease open curiosity (OI, the sum complete of all open trades in a given market) caps for merchants.

Lyra

Lyra provides choices buying and selling towards $ETH and $WBTC on Arbitrum and towards $ETH, $WBTC, $ARB, and $OP on Optimism. Lyra choices are European-style, that means they’ll solely be exercised on the expiration date (versus American-style, which could be exercised on or earlier than the expiration date). Lyra segments liquidity suppliers from choices consumers/sellers, permitting any arbitrary commerce to be crammed even with out a direct counterparty, so long as the asset + strike worth is supported.

Offering Liquidity on Lyra

Lyra employs a peer-to-protocol strategy the place LPs deposit stablecoins into market maker vaults (MMVs) for particular property to gather buying and selling charges and hedged dealer PnL by serving as a counterparty for all merchants. With a purpose to defend LPs from a very one-sided buying and selling atmosphere, Lyra additionally hedges for LPs through GMX (for merchants on Arbitrum) or Synthetix (for merchants on Optimism). On Optimism, for instance, LPs would deposit $USDC (this will get swapped to $sUSD if wanted to hedge) or $sUSD in an MMV. If Lyra merchants have a heavy lengthy bias unprotected MMV vaults could be pressured to have a heavy brief bias to fill these trades.

With a purpose to deposit/withdraw liquidity on Lyra, LPs must first sign the intention to take action – a three-day cooldown is then initiated the place the funds are locked after which deposited after the cooldown interval. The protocol has circuit breakers in place to keep up payouts for LPs + liquidity for merchants in case of insolvency. On this state of affairs, withdrawals/deposits could also be blocked (though, extra deposits could be manually accredited ought to they be blocked for lengthy sufficient).

Synthetix’s Function

Synthetix performs a vital position for Lyra on Optimism. Lyra makes use of Synthetix Perps to hedge their choices AMM utilizing perps positions on Synthetix with the intention to preserve a delta-neutral place in MMVs, thus defending their LPs from pointless directional threat ought to choices merchants have a heavy lengthy or brief bias.

Tangentially, Kwenta additionally provides a frontend for buying and selling choices utilizing Lyra – making it a one-stop store for buying and selling Synthetix perps and Synthetix-margined choices.

APYs for LPs can vary between 8% – 40%, relying on market circumstances and which market you select to offer liquidity for.

Pricing

Precisely pricing choices is an important element of a profitable choices protocol. Value too low, and choices sellers received’t have an interest. Value too excessive, and choices consumers received’t have an interest. Choices pricing is historically carried out utilizing the Black-Scholes mannequin, an equation that takes in 5 inputs – the one one which requires any tweaking to make the mannequin match for onchain choices is implied volatility, or IV (the opposite inputs are asset worth, strike worth, time-to-expiry, and the danger free charge. Every of those could be utilized as they’d in some other choices trade). IV is a quantity that represents the market’s opinion of an underlying asset’s probability to vary in worth and is completely different throughout every strike worth + expiry based mostly on provide/demand. Lyra IV calculation facilities round growing IV when demand for an choice with a particular strike + expiry is excessive and reducing IV when provide is excessive.

The above sentence is a fairly large oversimplification, so let’s dig a bit deeper. Lyra initializes a baseline IV for the ATM (the place strike worth = spot worth) choice at a given expiry utilizing present market information. This may be extrapolated to different strikes throughout the similar expiry by growing/reducing baseline IV per every trades inside that expiry (relative to complete variety of trades). This new baseline IV is then divided by the unique to find out skew ratio – which in flip tells us that skew ratio occasions unique IV may give us an equation for figuring out IV for any strike with the identical expiry.

There’s one different bit about pricing value mentioning – Lyra’s administration of Vega threat. Vega is a measure of a contract’s sensitivity in worth to modifications within the IV. Since there’s a restricted quantity of liquidity within the MMVs at any given time – there’s a specific amount of Vega the system can safely tackle with out placing LPs vulnerable to insolvency ought to IV transfer an excessive amount of. To stop this – Lyra costs a charge (or provides a reduction) to assist the system preserve net-zero Vega for MMVs.

So in summation – IV is the main unknown consider figuring out an choices worth (you possibly can consider buying and selling an choice as buying and selling IV). Lyra protocol determines IV by initializing a baseline worth for the ATM strike, then has that dynamically change based mostly on demand + extrapolates it to different strikes throughout the similar expiry (+ repeats the method for different expiries). As well as – there’s a flat charge/low cost on prime of the choices worth to keep up the system having impartial publicity to Vega (i.e, much less uncovered to large volatility swings).

Buying and selling

Lyra and Kwenta each supply (comparable) interfaces for buying and selling choices utilizing the Lyra Protocol. Presently, they provide expiries as much as about 2 months prematurely, with wherever from 1-10+ strikes per expiry. The buying and selling rewards program was additionally overhauled in April 2023 – presently, merchants earn rewards in proportion to their charges in $OP and $LYRA (they had been additionally paying out $ARB to Arbritrum merchants up till just lately – now paying $LYRA). They’ll additionally earn better rewards by buying and selling shorted dated contracts and/or holding contracts till expiry. These rewards could be boosted by as much as 2.5x by having the next dealer rating (resets day by day), staking $LYRA, or referrals (as much as 1.2x, referrals additionally supply buying and selling charge reductions like most derivatives platforms).

Lyra’s interface

Should you keep in mind from our two examples above – promoting (both a name or a put) would require exercising the consumers contract at expiry. Because of this promoting choices requires some degree of collateralization to make sure correct settlement. The current Newport improve allowed for partial collateralization of promoting choices on Lyra – carried out so in both or the quote ($USDC/$sUSD) or the bottom asset ($ETH/$BTC/and many others.). There are a few notable limitations to buying and selling, specifically:

Merchants can not open positions for choices expiring in below 12 hoursTraders can not open trades which have deltas (delta is a measure of how a lot the worth of an choices contract will transfer given a $1 transfer within the underlying asset) exterior a specified cutoff rangeFor closing trades which can be exterior these two parameters – they need to accomplish that utilizing the ForceClose mechanism, incurring a penalty

Keep in mind additionally that charges dynamically replicate the online complete IV within the AMM – so they’re additionally topic to extra charges ought to trades exacerbate the Vega.

Tokenomics

$LYRA is the governing token of Lyra protocol. Staking permits for participation in governance (or delegation of governance) in addition to boosted yield to MMV positions, $LYRA emissions, and a multiplier for buying and selling rewards.

The method of unstaking is a bit completely different than what you is perhaps used to. You first must sign your intent to unstake, at which level a 14-day cooldown is initiated – throughout which the rewards are disabled. After this cooldown, a two-day window opens the place the staker wants to substantiate their motion with the intention to unstake. If this window passes with out unstaking, their tokens can be staked once more and topic to a different 14-day cooldown ought to they attempt to unstake once more.

The Way forward for Lyra

Lyra just lately introduced their v2, consisting of an OP-stack based mostly rollup providing spot, perpetuals, and choices buying and selling. This appchain comes with an entire host of upgrades to Lyra, together with however not restricted to:

Portfolio margin, cross-margin, and multi-asset collateralCapital environment friendly spreads for optionsGas charges from the Lyra Chain accruing to Lyra DAOAn offchain matching engineAccount abstractionPartial liquidationsA model new UI

Learn extra about Lyra v2 right here. The early entry program can also be accepting signal ups presently, you possibly can join right here. Lyra has carried out over $500m of notional quantity to this point, making them the most important onchain choices dex by a big margin. To place that into perspective within the bigger market – Deribit, the most important centralized crypto choices trade, clears 4 billion USD in quantity weekly. It’s clear decentralized choices nonetheless have a protracted technique to go, however with names like Lyra main the cost there’s clearly heaps to be excited for.

[ad_2]

Source link