[ad_1]

Bitcoin not too long ago climbed to $52,000, sparking pleasure about surpassing its all-time excessive. The approval of Bitcoin spot ETFs by the SEC has fueled this optimism, suggesting a big development section for the cryptocurrency. However what about extra bold value predictions?

Hello there, I’m Zifa. With over three years overlaying crypto and having witnessed two halvings, I’ve seen the ups and downs of the market. At the moment, I’m exploring a sizzling matter: When will Bitcoin hit $100k?

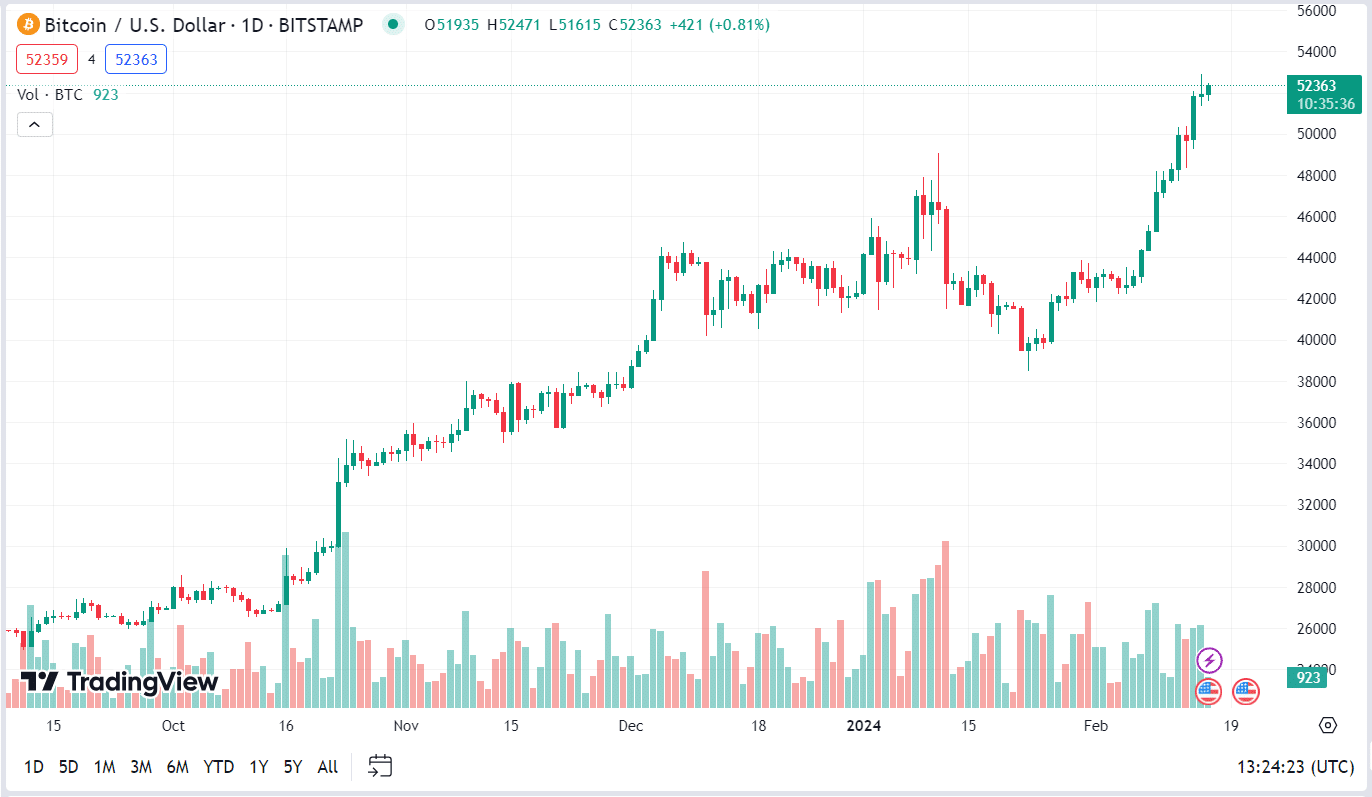

Bitcoin Hits 52,000 in February 2024

Because the market exhibits indicators of restoration from the crypto winter, the main focus intensifies on Bitcoin, the pioneer cryptocurrency. The anticipation builds with the upcoming halving, stirring professional predictions and market speculations. Latest information underscores this rising curiosity:

A notable surge in Bitcoin Futures Open Curiosity, reaching ranges not seen since November 2021.

The general cryptocurrency market cap has breached the $2 trillion mark.

Bitcoin itself has achieved a two-year peak, nearly touching $53,000.

This momentum is partly attributed to important investments from high-profile figures like Peter Thiel, signaling a sturdy confidence in Bitcoin’s future. Thiel’s name for main monetary gamers to put money into Bitcoin, coupled with the launch of U.S. spot Bitcoin ETFs, has catalyzed this optimistic sentiment.

Such endorsements and the continual development of Bitcoin replicate each institutional and retail buyers’ eager curiosity, setting the stage for what many hope to be the following section of explosive development. As we delve into professional analyses and predictions, the query stays: When will Bitcoin hit $100k? This exploration goals to unravel the insights and forecasts shaping the discourse round Bitcoin’s potential ascent.

When Will BTC Hit 100K?

Timothy Peterson, a notable funding supervisor, has made a big prediction primarily based on Bitcoin’s historic efficiency.

He famous that Bitcoin has beforehand seen a 100% achieve inside 180 days, a sample that has emerged quite a few occasions since 2015. Based on Peterson, such tendencies counsel a robust probability of Bitcoin reaching and even surpassing $100,000 by August. His evaluation, grounded in historic knowledge, factors to a 50% probability of attaining this milestone.

Concurrently, developments corresponding to Bitcoin crossing the $50,000 threshold, the affect of Bitcoin ETFs, and anticipations surrounding the Federal Reserve’s rate of interest choices have bolstered market optimism. Moreover, the upcoming halving occasion, anticipated to scale back the each day mining provide considerably, introduces a possible provide shock state of affairs.

Learn additionally: What if I make investments 100$ in BTC at the moment?

Is a Bitcoin Correction on the Horizon?

With the following Bitcoin halving occasion on the horizon, hypothesis is mounting a few potential market correction, echoing patterns noticed in earlier cycles. Famous crypto analyst Rekt Capital means that we would see a big downturn within the weeks main as much as the halving, a phenomenon that has marked earlier cycles and represents a pivotal second for buyers.

Furthermore, the resistance degree at $52,000 emerges as a key battleground. Overcoming this barrier might unleash a wave of shopping for, pushed by the worry of lacking out amongst buyers. But, latest market exercise has seen Bitcoin’s worth oscillating round this important degree.

On February 15, Bitcoin briefly dipped under $52,800 however has since proven resilience, sustaining an upward trajectory. Ought to this development persist, the rapid resistance to look at is close to $52,700, adopted by extra formidable ranges at $53,250 and $53,860. A decisive push above these factors might set the stage for a rally towards $54,000, with potential additional climbs to $55,000.

Conversely, if Bitcoin can not breach the $52,800 resistance zone, we would witness a correction. The primary line of help lies round $51,700, with a extra important degree at $51,500. Ought to costs fall under $51,300, it might sign a bearish flip, probably driving Bitcoin all the way down to the $50,200 and $49,450 help zones.

This nuanced view by Glassnode’s founders underscores the important junctures Bitcoin faces, highlighting the intricate dance between bullish optimism and the warning warranted by potential corrections. As we navigate these pivotal moments, Bitcoin’s path might very properly set the tone for its subsequent important section of development.

Bitcoin Worth Predictions By Business Consultants

Learn additionally: BTC value prediction.

Throughout the realm of Bitcoin forecasts, a broad spectrum of business specialists share their optimism for its long-term valuation. This optimistic sentiment is basically influenced by the four-year market cycle principle and anticipated provide shifts following Bitcoin halvings. Highlighted under are key projections from notable figures, every grounded in a mixture of analytical rigor and market sentiment, showcasing the wide-ranging expectations for Bitcoin’s monetary trajectory within the coming years.

ARK Make investments, led by Cathie Wooden, envisions a staggering potential of $600,000 to $1,500,000 by 2030, reflecting an ultra-bullish stance.

Markus Thielen of Matrixport predicts a extra conservative, but optimistic, $125,000 by the tip of 2024.

BitQuant sees a variety of $80,000 to $250,000 by the identical timeline, indicating various confidence ranges.

Matiu Rudolph from Layer One X initiatives Bitcoin reaching $340,000 by 2025, whereas Mike McGlone of Bloomberg Intelligence suggests a $100,000 mark by 2026.

Lastly, Bernstein’s Gautam Chhugani estimates it might hit $150,000 by 2025, showcasing a spectrum of expectations inside the business.

Closing Ideas

As we method the Bitcoin halving, expectations are hovering. I’m inclined to imagine that reaching the $100,000 mark will not be as distant a aim as some assume. However what about you? Do you share this optimistic view on Bitcoin’s future value? I’d love to listen to your ideas and predictions. Be happy to share your insights within the remark part under.

Sources and References

https://fortune.com/crypto/2024/02/13/how-high-can-bitcoin-go/

https://www.newsbtc.com/bitcoin-news/bitcoin-all-time-high-ahead-historical-pattern-signals-50-chance-of-reaching-100k-by-august/

https://thenewscrypto.com/bitcoin-stays-at-52k-is-a-btc-correction-coming-soon/

https://www.forbes.com/websites/digital-assets/2024/02/14/bitcoin-price-suddenly-surges-to-fresh-2024-high-after-paypal-billionaires-huge-secret-bitcoin-and-ethereum-bet-revealed/

https://www.reuters.com/know-how/peter-thiels-founders-fund-made-200-million-crypto-investment-before-bull-run-2024-02-13/

Disclaimer: Please notice that the contents of this text should not monetary or investing recommendation. The data offered on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native rules earlier than committing to an funding.

[ad_2]

Source link