[ad_1]

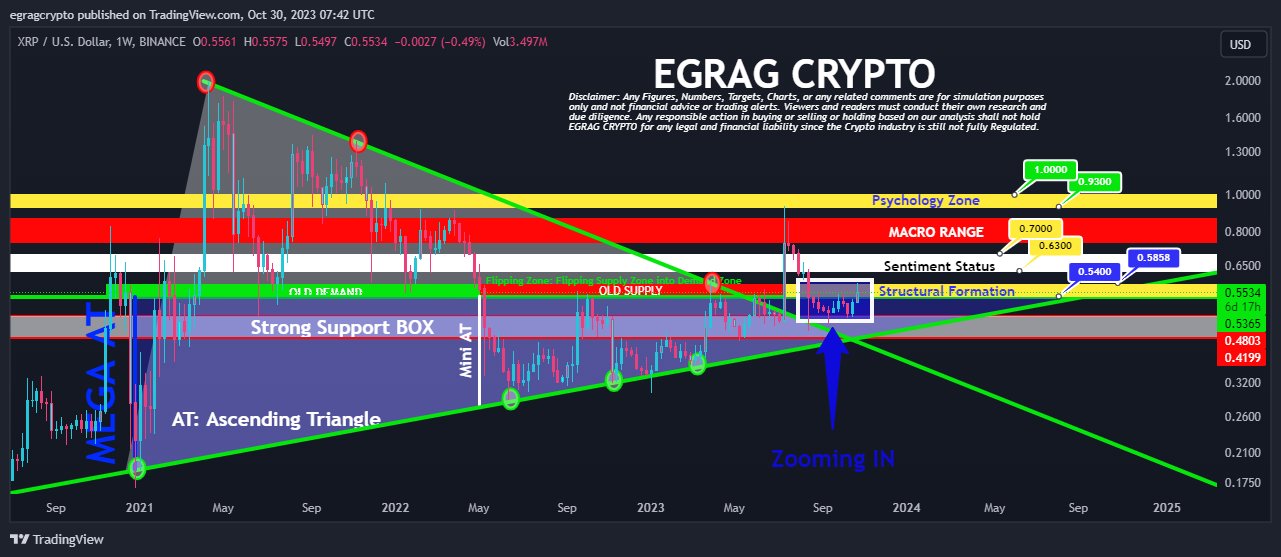

In an in depth evaluation shared on social media as we speak, famend crypto analyst Egrag factors to a number of bullish indicators within the XRP value construction, suggesting the potential for an imminent breakout. Egrag evaluated varied timeframes, figuring out a sequence of technical patterns and formations that bolster the bullish outlook.

XRP Reveals Robust Bullish Structural Indicators

“Final week’s candle closed inside the confines of the Yellow structural formation,” Egrag tweeted with regard to the weekly XRP/USD chart, emphasizing the importance of latest actions inside the timeframe. This remark is instrumental in understanding the underlying market buildings influencing the upcoming value motion.

The implication? If one other weekly candle had been to affirm its place inside this formation, the percentages of a bullish pattern continuation might considerably enhance. “To substantiate a bullish pattern continuation, we have to see one other weekly candle shut with a full physique inside this construction,” Egrag added.

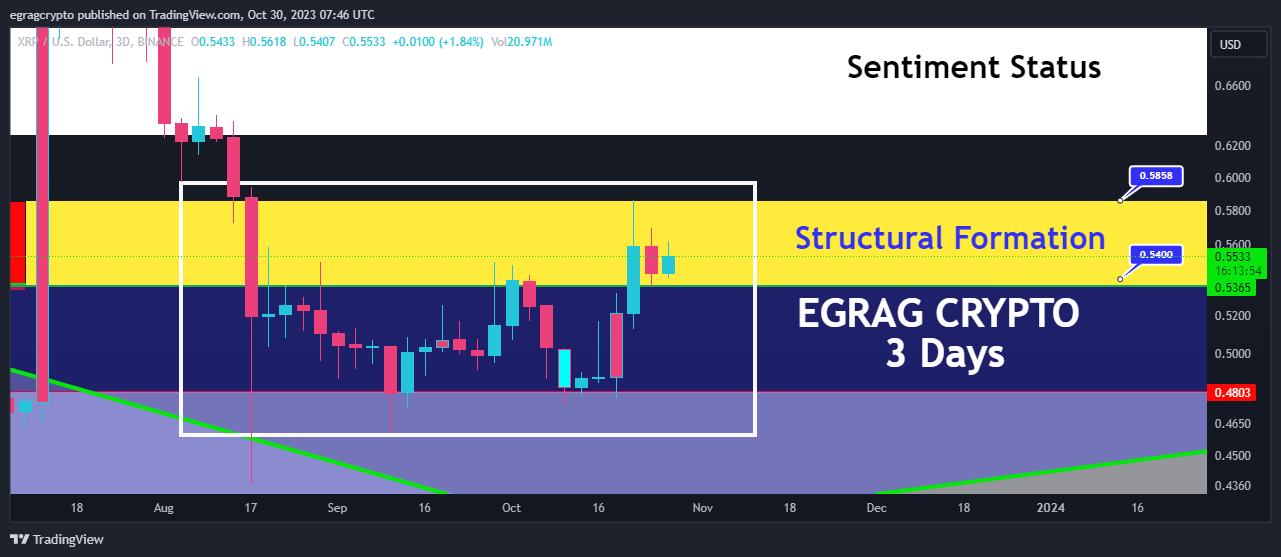

Subsequent, his insights lengthen additional to the three-day chart, the place he keenly observes, “In simply 16 hours, XRP is poised to finish the second full physique candle inside the structural formation, signaling a robust bullish sentiment.” This near-term projection underscores a way of momentum that seems to be constructing inside the XRP market.

The 1-day chart, too, garnered Egrag’s scrutiny. He highlighted the upcoming completion of the seventh full-body candle inside the present construction, stating this means an “extraordinarily bullish pattern.” This remark means that XRP’s bullish habits isn’t only a fleeting phenomenon however has consistency throughout various timeframes.

For merchants with a penchant for shorter timeframes, Egrag’s insights into the 12-hour chart are significantly salient. Whereas there have been a number of closures inside the structural formation, he singled out the significance of the continuing momentum: “The present candle and the subsequent one are pivotal as they kind a symmetrical triangle.”

He elaborated on the implications of this sample, saying, “Sometimes, symmetrical triangle breakouts have a 50/50 likelihood, making this a choice level for XRP.”

XRP Worth Targets

Circling again to a tweet from October 27, Egrag had demarcated important value zones, highlighting the “$0.54 to $0.58” vary as a make-or-break threshold. Past this, he indicated the “$0.63-$0.70” vary as a pivotal indicator of market sentiment shifts.

For these with an eye fixed on the psychological dimensions of buying and selling, Egrag’s point out of the “0.93-$1” bracket is noteworthy. He cautioned merchants about this zone, advising them to “Keep on with your plan and resist the temptation to let feelings or impatience dictate your actions.”

In sum, Egrag’s complete evaluation blends technical information with dealer sentiment and psychology, offering a nuanced and detailed perspective for these invested in XRP. The approaching days are more likely to be watched with bated breath as merchants anticipate the subsequent large transfer.

At press time, XRP traded at $0.5595.

Featured picture from Shutterstock, chart from TradingView.com

[ad_2]

Source link