[ad_1]

Nearly each Bitcoin investor is anticipating a continued value surge because the crypto continues to commerce across the $70,000 value mark. On-chain knowledge has proven a big a part of this surge may be attributed to the accumulation by giant whales.

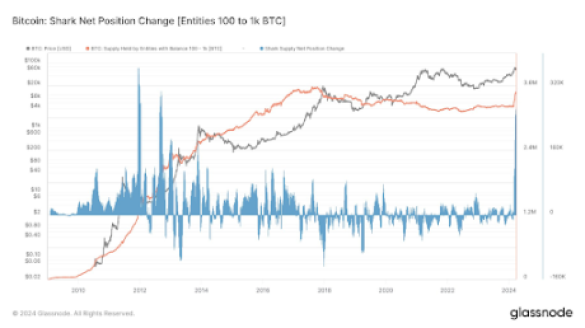

Bitcoin is undoubtedly house to plenty of these whale addresses holding a whole bunch of thousands and thousands of {dollars} and with transactions that may transfer the market. Nonetheless, on-chain knowledge has additional revealed that the buildup pattern has additionally flowed into the following cohort of merchants. These merchants, also called “Sharks,” are addresses that maintain between 100 BTC and 1,000 BTC. In accordance with Glassnode knowledge, shark pockets addresses have accrued 268,441 BTC up to now 30 days, which is the most important internet place change since 2012.

Elevated Accumulation Of BTC

In accordance with a Glassnode chart shared on social media by crypto analyst James Van Straten, Bitcoin accumulation by shark buyers shot up in 2024 to reverse a multi-year consolidation since 2020. In consequence, these addresses elevated their holdings by 268,441 in 30 days, roughly changing to $18 billion.

Whereas these sharks shouldn’t have as a lot particular person energy over value motion as very giant whales, their collective conduct remains to be value monitoring as in addition they relate to the sentiment amongst buyers. Consequently, this massive accumulation pattern might result in extra shopping for which might sign a continued value surge for Bitcoin.

Supply: Glassnode

The surge in accumulation just isn’t actually stunning, because the launch of Spot Bitcoin ETFs within the US has ushered in an even bigger wave of accumulation sentiment from all cohorts of Bitcoin buyers. As one other analyst identified on social media, this shark accumulation might’ve been because of ETFs buying huge quantities of Bitcoins from Coinbase OTC desks.

Bitcoin whales (addresses holding greater than 1,000 BTC) have additionally upped their exercise up to now few days, signaling strategic positioning available in the market. Numerous transaction alerts from Whale Alerts have proven strategic motion from whale addresses.

Notably, the crypto whale transaction tracker has revealed $1.3 billion value of BTC exchanged between whale addresses up to now 24 hours. Amongst these giant BTC actions was a notable switch of three,599 BTC value $252 million between two unknown wallets. One other notable transaction was the switch of three,118 BTC from an unknown pockets to Coinbase Institutional.

Bitcoin To $100,000?

Knowledge from IntoTheBlock has additionally reiterated this accumulation pattern with its internet switch pattern from exchanges. Knowledge from ITB’s platform reveals a $16.18 billion outflow from exchanges as in opposition to a $15.76 billion influx up to now seven days. Bitcoin is now buying and selling at $67,931 and has didn’t stabilize above the $70,000 mark once more.

Nonetheless, the buildup by whales and sharks, rising mainstream curiosity from institutional buyers via Spot Bitcoin ETFs, and the approaching halving all level to the potential for substantial value appreciation to $100,000.

BTC value at $70,000 | Supply: BTCUSDT on Tradingview.com

Featured picture from BBC, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site solely at your personal danger.

[ad_2]

Source link