[ad_1]

Because the countdown to the much-anticipated 2024 bitcoin halving occasion nears its climax, the cryptocurrency world finds itself amidst a whirlwind of pleasure and hypothesis.

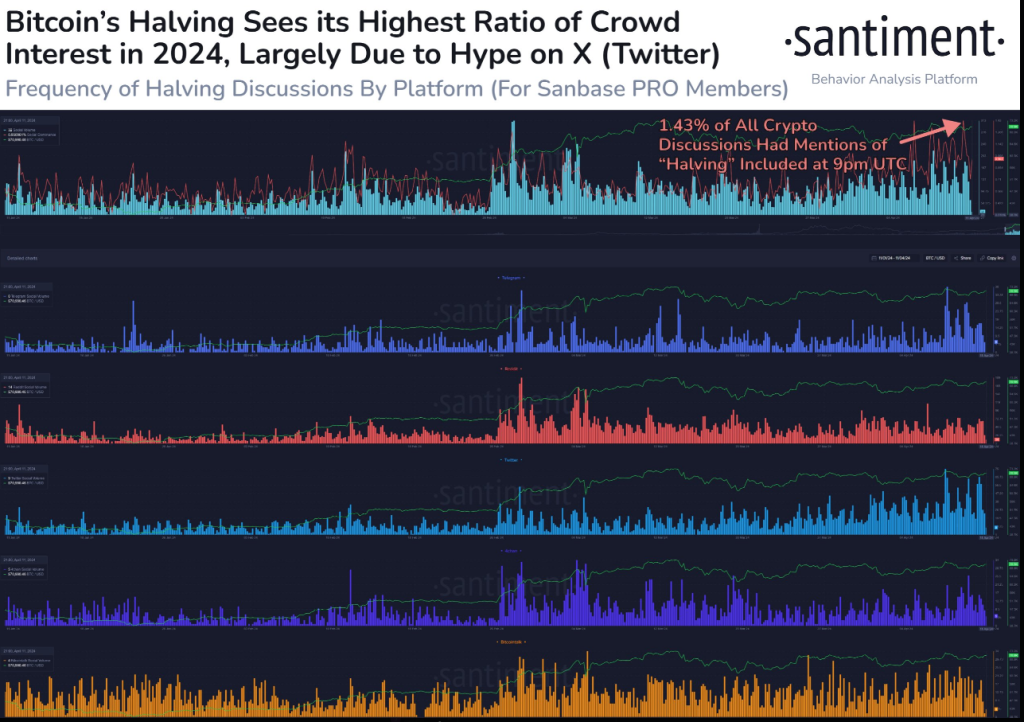

Social media platforms have turn into abuzz with discussions surrounding the upcoming halving, in keeping with information from Santiment. This enhance in social media chatter signifies a possible for vital value actions within the unstable crypto market, sparking each FOMO (Worry of Lacking Out) and FUD (Worry, Uncertainty, Doubt) amongst buyers.

Social Media Surge Fuels Hypothesis On Bitcoin’s Destiny

The surge in social media chatter across the halving occasion has not gone unnoticed by analysts, who recommend that such peaks in exercise usually coincide with notable shifts in market sentiment and value motion.

Whereas some consider that the heightened discussions might sign a possible value rally, others stay cautious, mentioning the current flat market situations that will dampen the occasion’s impression.

⌛️🗣️ As #Bitcoin has now drawn to its closing week earlier than the #halving, social dominance towards the subject has peaked at its highest degree of the yr at 9pm UTC. The spikes on this subject must be obtained as excessive confidence value reversals for #crypto markets. Markets have been… pic.twitter.com/U2dOujjhLj

— Santiment (@santimentfeed) April 12, 2024

Distinctive Dynamics Surrounding Bitcoin 2024 Halving

This forthcoming halving occasion carries a singular set of circumstances, setting it other than its predecessors. Bitcoin’s present buying and selling place above its earlier cycle’s excessive provides a component of unpredictability to the equation, making it difficult to forecast the period and depth of the upcoming bull run.

Consultants weigh in on the confluence of diminished provide and rising ETF demand as potential catalysts driving Bitcoin into uncharted territory.

Supply: Santiment

Antoni Trenchev, co-founder of Nexo, highlights the significance of understanding the demand dynamics out there, significantly as regards to whale demand for BTC, involving veteran Bitcoiners, newcomers, and ETF holders.

Associated Studying: XRP To Blast Off? Analyst Predicts ‘Sensible’ 5x Surge To $3

Trenchev means that this heightened demand might amplify the impression of the upcoming provide shock, paving the way in which for a shorter however extra intense bull market.

Complete crypto market cap is presently at $2.38 trillion. Chart: TradingView

Skilled Views: Optimism Vs. Warning

Whereas some specialists stay cautiously optimistic in regards to the potential outcomes of the halving occasion, others warn in opposition to overestimating its impression.

Steven Lubka, Head of Personal Purchasers at Swan Bitcoin, emphasizes the significance of sustaining a level-headed method amidst the frenzy surrounding the halving. Lubka means that whereas the occasion might spark short-term value fluctuations, its long-term results are prone to be extra subdued.

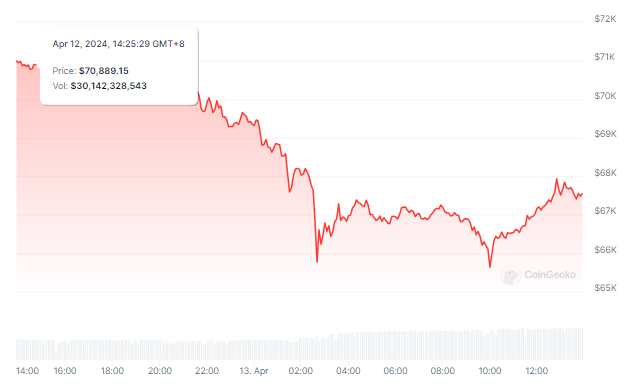

Bitcoin value motion within the final day. Supply: Coingecko

Bitcoin value motion within the final day. Supply: Coingecko

Because the countdown to the bitcoin halving occasion reaches its crescendo, the crypto neighborhood finds itself grappling with a combination of hope and warning. Whereas some anticipate vital adjustments out there panorama, others brace themselves for a extra tempered response.

Featured picture from ZebPay, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site fully at your personal threat.

[ad_2]

Source link